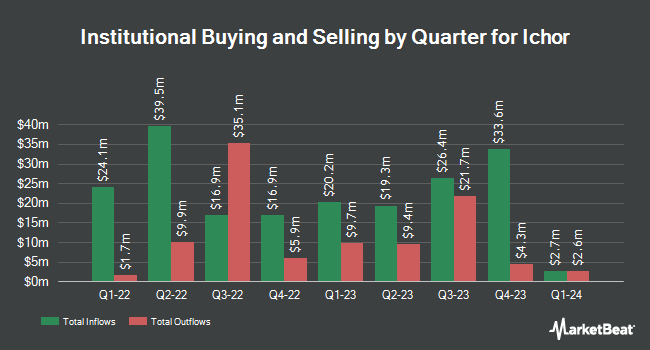

Harbor Capital Advisors Inc. boosted its position in Ichor Holdings, Ltd. (NASDAQ:ICHR - Free Report) by 105.5% in the third quarter, according to its most recent filing with the SEC. The institutional investor owned 39,642 shares of the technology company's stock after purchasing an additional 20,351 shares during the period. Harbor Capital Advisors Inc. owned about 0.12% of Ichor worth $1,261,000 as of its most recent SEC filing.

A number of other institutional investors have also added to or reduced their stakes in the company. Vanguard Group Inc. lifted its stake in shares of Ichor by 6.6% during the 1st quarter. Vanguard Group Inc. now owns 2,841,622 shares of the technology company's stock valued at $109,743,000 after buying an additional 176,970 shares in the last quarter. Mutual of America Capital Management LLC purchased a new stake in Ichor in the 1st quarter worth approximately $1,353,000. Epoch Investment Partners Inc. lifted its stake in Ichor by 33.0% in the 1st quarter. Epoch Investment Partners Inc. now owns 265,246 shares of the technology company's stock worth $10,244,000 after purchasing an additional 65,862 shares in the last quarter. Swedbank AB purchased a new stake in Ichor in the 1st quarter worth approximately $67,106,000. Finally, Westfield Capital Management Co. LP lifted its stake in Ichor by 162.9% in the 1st quarter. Westfield Capital Management Co. LP now owns 335,867 shares of the technology company's stock worth $12,971,000 after purchasing an additional 208,117 shares in the last quarter. 94.81% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Several analysts have issued reports on the stock. Oppenheimer assumed coverage on shares of Ichor in a research note on Wednesday, September 25th. They issued a "market perform" rating and a $35.00 target price on the stock. B. Riley reissued a "buy" rating and issued a $38.00 price target (up previously from $36.00) on shares of Ichor in a report on Tuesday. TD Cowen increased their price target on shares of Ichor from $35.00 to $40.00 and gave the stock a "buy" rating in a report on Tuesday. Needham & Company LLC decreased their price target on shares of Ichor from $44.00 to $40.00 and set a "buy" rating on the stock in a report on Wednesday, August 7th. Finally, DA Davidson began coverage on shares of Ichor in a report on Thursday, September 26th. They issued a "buy" rating and a $50.00 price target on the stock. Two research analysts have rated the stock with a hold rating, five have assigned a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat.com, Ichor presently has a consensus rating of "Moderate Buy" and a consensus price target of $42.57.

Read Our Latest Stock Analysis on Ichor

Ichor Trading Up 3.2 %

Ichor stock traded up $1.02 during mid-day trading on Wednesday, hitting $32.52. The company's stock had a trading volume of 346,566 shares, compared to its average volume of 306,290. The company has a debt-to-equity ratio of 0.18, a current ratio of 4.27 and a quick ratio of 1.91. The stock has a market cap of $1.10 billion, a price-to-earnings ratio of -34.97 and a beta of 1.91. The business has a 50 day moving average price of $28.94 and a 200-day moving average price of $33.75. Ichor Holdings, Ltd. has a 12 month low of $22.26 and a 12 month high of $46.43.

Ichor (NASDAQ:ICHR - Get Free Report) last posted its earnings results on Monday, November 4th. The technology company reported $0.12 earnings per share for the quarter, topping analysts' consensus estimates of $0.11 by $0.01. The company had revenue of $211.14 million during the quarter, compared to analyst estimates of $203.24 million. Ichor had a negative net margin of 4.53% and a negative return on equity of 2.56%. Ichor's revenue for the quarter was up 7.3% on a year-over-year basis. During the same period in the prior year, the business posted ($0.09) earnings per share. As a group, analysts forecast that Ichor Holdings, Ltd. will post -0.17 EPS for the current year.

About Ichor

(

Free Report)

Ichor Holdings, Ltd. engages in the design, engineering, and manufacture of fluid delivery subsystems and components for semiconductor capital equipment in the United States and internationally. It primarily offers gas and chemical delivery systems and subsystems that are used in the manufacturing of semiconductor devices.

Featured Stories

Before you consider Ichor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ichor wasn't on the list.

While Ichor currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.