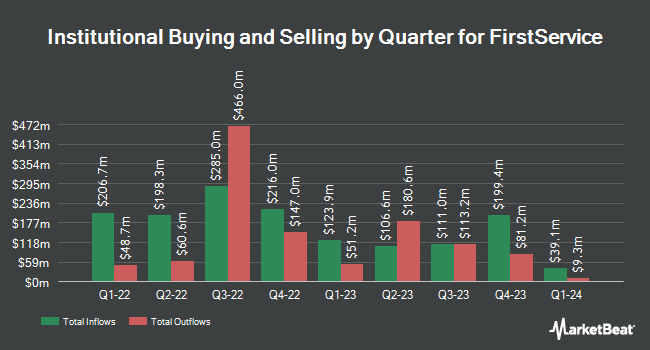

Harbor Capital Advisors Inc. lifted its stake in shares of FirstService Co. (NASDAQ:FSV - Free Report) TSE: FSV by 218.1% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 5,475 shares of the financial services provider's stock after buying an additional 3,754 shares during the quarter. Harbor Capital Advisors Inc.'s holdings in FirstService were worth $999,000 at the end of the most recent reporting period.

A number of other hedge funds have also recently modified their holdings of the stock. Millennium Management LLC lifted its stake in FirstService by 2,136.1% in the second quarter. Millennium Management LLC now owns 209,297 shares of the financial services provider's stock valued at $31,853,000 after buying an additional 199,937 shares during the last quarter. The Manufacturers Life Insurance Company raised its position in FirstService by 6.8% in the 2nd quarter. The Manufacturers Life Insurance Company now owns 2,733,694 shares of the financial services provider's stock valued at $415,427,000 after purchasing an additional 174,970 shares during the last quarter. Vanguard Group Inc. boosted its stake in FirstService by 4.8% during the 1st quarter. Vanguard Group Inc. now owns 1,654,783 shares of the financial services provider's stock worth $274,363,000 after purchasing an additional 76,503 shares during the period. Summit Creek Advisors LLC acquired a new stake in FirstService during the 1st quarter worth $11,710,000. Finally, Boston Financial Mangement LLC grew its position in FirstService by 25.3% during the 3rd quarter. Boston Financial Mangement LLC now owns 246,673 shares of the financial services provider's stock worth $45,008,000 after purchasing an additional 49,790 shares during the last quarter. 69.35% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several brokerages have recently weighed in on FSV. TD Securities increased their target price on shares of FirstService from $179.00 to $182.00 and gave the stock a "hold" rating in a research note on Thursday, October 17th. StockNews.com upgraded FirstService from a "hold" rating to a "buy" rating in a research note on Friday, October 25th. Scotiabank upped their price target on FirstService from $190.00 to $200.00 and gave the stock a "sector perform" rating in a research note on Tuesday, October 15th. Stifel Nicolaus lifted their price objective on shares of FirstService from $200.00 to $215.00 and gave the company a "buy" rating in a research report on Monday, October 21st. Finally, Royal Bank of Canada boosted their price objective on shares of FirstService from $187.00 to $192.00 and gave the company an "outperform" rating in a research note on Friday, July 26th. Two research analysts have rated the stock with a hold rating and five have assigned a buy rating to the stock. According to MarketBeat, FirstService has a consensus rating of "Moderate Buy" and a consensus target price of $198.33.

Read Our Latest Research Report on FSV

FirstService Price Performance

Shares of NASDAQ FSV traded up $1.25 during midday trading on Thursday, hitting $187.64. The company had a trading volume of 74,987 shares, compared to its average volume of 83,061. The firm has a market capitalization of $8.46 billion, a price-to-earnings ratio of 78.18 and a beta of 1.05. FirstService Co. has a twelve month low of $141.26 and a twelve month high of $192.71. The business has a 50-day simple moving average of $182.99 and a two-hundred day simple moving average of $166.68. The company has a quick ratio of 1.84, a current ratio of 1.79 and a debt-to-equity ratio of 1.13.

FirstService (NASDAQ:FSV - Get Free Report) TSE: FSV last announced its earnings results on Thursday, October 24th. The financial services provider reported $1.63 EPS for the quarter, beating analysts' consensus estimates of $1.42 by $0.21. The firm had revenue of $1.40 billion for the quarter, compared to analysts' expectations of $1.32 billion. FirstService had a return on equity of 16.68% and a net margin of 2.19%. FirstService's quarterly revenue was up 25.0% on a year-over-year basis. During the same quarter in the prior year, the firm earned $1.18 EPS. Equities research analysts anticipate that FirstService Co. will post 4.58 earnings per share for the current year.

FirstService Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Monday, October 7th. Shareholders of record on Monday, September 30th were paid a dividend of $0.25 per share. The ex-dividend date of this dividend was Monday, September 30th. This represents a $1.00 annualized dividend and a yield of 0.53%. FirstService's dividend payout ratio is presently 41.67%.

FirstService Company Profile

(

Free Report)

FirstService Corporation, together with its subsidiaries, provides residential property management and other essential property services to residential and commercial customers in the United States and Canada. It operates through two segments: FirstService Residential and FirstService Brands. The FirstService Residential segment offers services for private residential communities, such as condominiums, co-operatives, homeowner associations, master-planned communities, active adult and lifestyle communities, and various other residential developments.

Read More

Before you consider FirstService, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FirstService wasn't on the list.

While FirstService currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.