Harbor Capital Advisors Inc. raised its stake in shares of UniFirst Co. (NYSE:UNF - Free Report) by 164.2% during the 3rd quarter, according to the company in its most recent filing with the SEC. The firm owned 8,387 shares of the textile maker's stock after purchasing an additional 5,213 shares during the quarter. Harbor Capital Advisors Inc.'s holdings in UniFirst were worth $1,666,000 as of its most recent filing with the SEC.

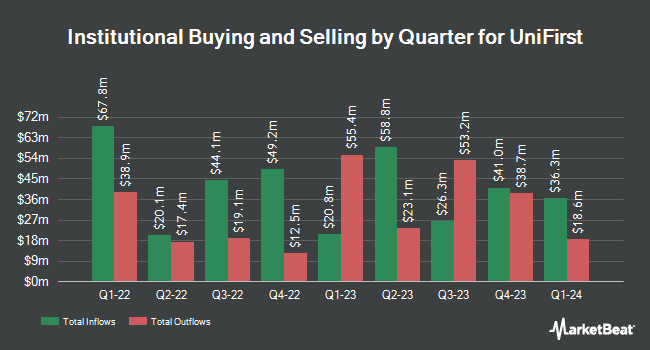

Other institutional investors and hedge funds also recently made changes to their positions in the company. M&G Plc acquired a new stake in shares of UniFirst during the 1st quarter valued at about $19,842,000. Victory Capital Management Inc. boosted its position in shares of UniFirst by 8.9% during the 2nd quarter. Victory Capital Management Inc. now owns 622,048 shares of the textile maker's stock valued at $106,700,000 after acquiring an additional 51,088 shares in the last quarter. Copeland Capital Management LLC boosted its position in shares of UniFirst by 12.4% during the 3rd quarter. Copeland Capital Management LLC now owns 332,187 shares of the textile maker's stock valued at $65,989,000 after acquiring an additional 36,651 shares in the last quarter. American Century Companies Inc. boosted its position in shares of UniFirst by 25.9% during the 2nd quarter. American Century Companies Inc. now owns 173,315 shares of the textile maker's stock valued at $29,729,000 after acquiring an additional 35,604 shares in the last quarter. Finally, Cubist Systematic Strategies LLC boosted its position in UniFirst by 305.1% in the second quarter. Cubist Systematic Strategies LLC now owns 41,936 shares of the textile maker's stock valued at $7,193,000 after buying an additional 31,583 shares in the last quarter. Institutional investors own 78.17% of the company's stock.

UniFirst Price Performance

Shares of UNF stock traded up $16.99 during trading hours on Wednesday, reaching $198.75. 116,658 shares of the company were exchanged, compared to its average volume of 64,632. UniFirst Co. has a fifty-two week low of $149.58 and a fifty-two week high of $200.07. The stock's fifty day moving average is $188.34 and its two-hundred day moving average is $176.76. The company has a market cap of $3.70 billion, a price-to-earnings ratio of 25.58 and a beta of 0.82.

UniFirst Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, January 3rd. Stockholders of record on Friday, December 6th will be given a dividend of $0.35 per share. This represents a $1.40 dividend on an annualized basis and a dividend yield of 0.70%. This is a positive change from UniFirst's previous quarterly dividend of $0.33. The ex-dividend date of this dividend is Friday, December 6th. UniFirst's dividend payout ratio is presently 16.99%.

Analyst Upgrades and Downgrades

UNF has been the topic of a number of recent analyst reports. Robert W. Baird boosted their price target on shares of UniFirst from $199.00 to $200.00 and gave the company a "neutral" rating in a research report on Thursday, October 24th. StockNews.com upgraded shares of UniFirst from a "hold" rating to a "buy" rating in a research report on Monday, August 12th. One analyst has rated the stock with a sell rating, three have given a hold rating and one has issued a buy rating to the stock. Based on data from MarketBeat.com, UniFirst has a consensus rating of "Hold" and an average target price of $186.25.

Check Out Our Latest Analysis on UNF

UniFirst Profile

(

Free Report)

UniFirst Corporation provides workplace uniforms and protective work wear clothing in the United States, Europe, and Canada. The company operates through U.S. and Canadian Rental and Cleaning, Manufacturing, Specialty Garments Rental and Cleaning, and First Aid segments. It designs, manufactures, personalizes, rents, cleans, delivers, and sells a range of uniforms and protective clothing, including shirts, pants, jackets, coveralls, lab coats, smocks, and aprons; and specialized protective wear, such as flame resistant and high visibility garments.

Featured Articles

Before you consider UniFirst, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UniFirst wasn't on the list.

While UniFirst currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.