Harbor Capital Advisors Inc. bought a new position in shares of Applied Optoelectronics, Inc. (NASDAQ:AAOI - Free Report) during the 3rd quarter, according to its most recent filing with the SEC. The institutional investor bought 92,202 shares of the semiconductor company's stock, valued at approximately $1,319,000. Harbor Capital Advisors Inc. owned approximately 0.24% of Applied Optoelectronics at the end of the most recent reporting period.

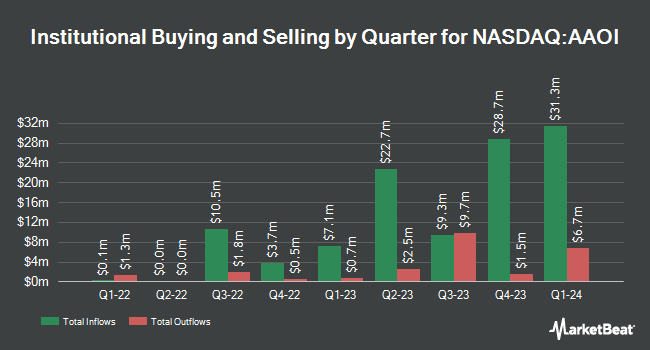

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in the business. CANADA LIFE ASSURANCE Co bought a new position in Applied Optoelectronics during the 1st quarter worth about $46,000. Zurcher Kantonalbank Zurich Cantonalbank boosted its holdings in shares of Applied Optoelectronics by 272.1% in the 2nd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 9,281 shares of the semiconductor company's stock valued at $77,000 after buying an additional 6,787 shares in the last quarter. Point72 Hong Kong Ltd bought a new stake in shares of Applied Optoelectronics in the 2nd quarter valued at about $89,000. Emerald Mutual Fund Advisers Trust boosted its holdings in shares of Applied Optoelectronics by 2.8% in the 3rd quarter. Emerald Mutual Fund Advisers Trust now owns 410,154 shares of the semiconductor company's stock valued at $5,869,000 after buying an additional 11,037 shares in the last quarter. Finally, Truvestments Capital LLC bought a new stake in shares of Applied Optoelectronics in the 1st quarter valued at about $161,000. 61.72% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In other Applied Optoelectronics news, insider David C. Kuo sold 10,000 shares of Applied Optoelectronics stock in a transaction on Tuesday, September 24th. The shares were sold at an average price of $15.02, for a total transaction of $150,200.00. Following the sale, the insider now owns 132,921 shares of the company's stock, valued at $1,996,473.42. The trade was a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. 5.40% of the stock is currently owned by corporate insiders.

Applied Optoelectronics Stock Performance

Shares of NASDAQ:AAOI traded down $0.33 during trading on Wednesday, hitting $16.21. 4,272,608 shares of the stock traded hands, compared to its average volume of 2,454,260. The company has a fifty day moving average price of $14.97 and a two-hundred day moving average price of $11.59. Applied Optoelectronics, Inc. has a 52-week low of $6.70 and a 52-week high of $24.75. The company has a market cap of $662.99 million, a price-to-earnings ratio of -8.66 and a beta of 1.96. The company has a quick ratio of 0.97, a current ratio of 1.64 and a debt-to-equity ratio of 0.41.

Applied Optoelectronics (NASDAQ:AAOI - Get Free Report) last announced its earnings results on Tuesday, August 6th. The semiconductor company reported ($0.28) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.29) by $0.01. Applied Optoelectronics had a negative net margin of 34.84% and a negative return on equity of 19.82%. The company had revenue of $43.27 million for the quarter, compared to analysts' expectations of $44.14 million. During the same quarter in the previous year, the company posted ($0.31) EPS. The firm's quarterly revenue was up 4.0% on a year-over-year basis. As a group, equities analysts predict that Applied Optoelectronics, Inc. will post -1.08 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of analysts have recently weighed in on AAOI shares. B. Riley lowered their price target on shares of Applied Optoelectronics from $12.00 to $9.00 and set a "neutral" rating on the stock in a report on Wednesday, August 7th. Rosenblatt Securities reissued a "buy" rating and set a $20.00 price target on shares of Applied Optoelectronics in a research report on Wednesday, October 9th. B. Riley Financial reaffirmed a "neutral" rating and set a $9.00 target price on shares of Applied Optoelectronics in a report on Thursday, August 8th. Raymond James raised shares of Applied Optoelectronics from a "market perform" rating to an "outperform" rating and set a $17.00 target price for the company in a report on Tuesday, September 3rd. Finally, StockNews.com raised shares of Applied Optoelectronics to a "sell" rating in a report on Friday, October 25th. One equities research analyst has rated the stock with a sell rating, two have issued a hold rating and two have assigned a buy rating to the company's stock. According to MarketBeat.com, the stock presently has an average rating of "Hold" and an average price target of $13.75.

Check Out Our Latest Stock Report on AAOI

Applied Optoelectronics Profile

(

Free Report)

Applied Optoelectronics, Inc designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China. It offers optical modules, optical filters, lasers, laser components, subassemblies, transmitters and transceivers, turn-key equipment, headend, node, distribution equipment, and amplifiers.

Read More

Before you consider Applied Optoelectronics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Applied Optoelectronics wasn't on the list.

While Applied Optoelectronics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.