Hardman Johnston Global Advisors LLC cut its holdings in shares of FMC Co. (NYSE:FMC - Free Report) by 5.2% during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 210,747 shares of the basic materials company's stock after selling 11,525 shares during the period. Hardman Johnston Global Advisors LLC owned 0.17% of FMC worth $13,897,000 at the end of the most recent reporting period.

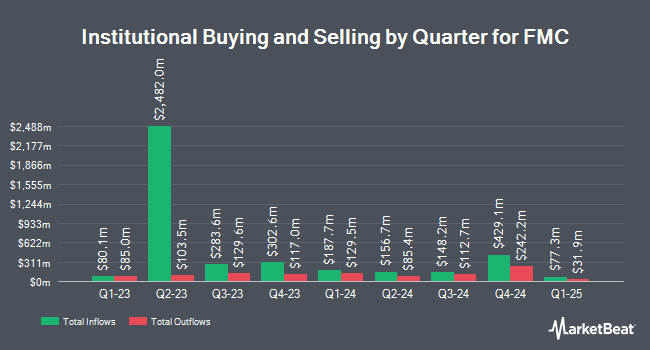

A number of other hedge funds have also modified their holdings of FMC. Vanguard Group Inc. grew its position in FMC by 5.3% in the 1st quarter. Vanguard Group Inc. now owns 15,290,219 shares of the basic materials company's stock valued at $973,987,000 after buying an additional 768,432 shares during the last quarter. Price T Rowe Associates Inc. MD grew its position in FMC by 35.1% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 5,061,828 shares of the basic materials company's stock valued at $322,439,000 after buying an additional 1,316,133 shares during the last quarter. AQR Capital Management LLC grew its position in FMC by 317.7% in the 2nd quarter. AQR Capital Management LLC now owns 1,099,389 shares of the basic materials company's stock valued at $63,160,000 after buying an additional 836,179 shares during the last quarter. Russell Investments Group Ltd. grew its position in FMC by 11.6% in the 1st quarter. Russell Investments Group Ltd. now owns 903,274 shares of the basic materials company's stock valued at $57,538,000 after buying an additional 93,892 shares during the last quarter. Finally, Bank of New York Mellon Corp grew its position in FMC by 2.1% in the 2nd quarter. Bank of New York Mellon Corp now owns 858,129 shares of the basic materials company's stock valued at $49,385,000 after buying an additional 17,381 shares during the last quarter. 91.86% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of equities analysts recently weighed in on FMC shares. Mizuho lifted their price objective on shares of FMC from $64.00 to $70.00 and gave the company a "neutral" rating in a research report on Friday, November 1st. Royal Bank of Canada boosted their target price on shares of FMC from $78.00 to $81.00 and gave the stock an "outperform" rating in a research report on Friday, November 1st. Wells Fargo & Company decreased their target price on shares of FMC from $68.00 to $62.00 and set an "equal weight" rating on the stock in a research report on Tuesday, July 16th. Redburn Atlantic upgraded shares of FMC from a "hold" rating to a "strong-buy" rating in a research report on Friday, July 19th. Finally, Citigroup began coverage on shares of FMC in a research report on Wednesday, October 23rd. They set a "neutral" rating and a $67.00 target price on the stock. One equities research analyst has rated the stock with a sell rating, ten have given a hold rating, four have given a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat.com, FMC has an average rating of "Hold" and an average price target of $68.00.

Get Our Latest Research Report on FMC

FMC Price Performance

Shares of NYSE:FMC traded down $2.69 during midday trading on Wednesday, hitting $60.93. 2,051,262 shares of the stock were exchanged, compared to its average volume of 1,692,005. The stock has a market cap of $7.61 billion, a P/E ratio of 5.24, a PEG ratio of 1.66 and a beta of 0.85. The company has a current ratio of 1.48, a quick ratio of 1.09 and a debt-to-equity ratio of 0.65. FMC Co. has a twelve month low of $49.49 and a twelve month high of $68.72. The company has a 50 day moving average price of $63.15 and a 200-day moving average price of $61.04.

FMC (NYSE:FMC - Get Free Report) last announced its earnings results on Tuesday, October 29th. The basic materials company reported $0.69 earnings per share for the quarter, beating the consensus estimate of $0.49 by $0.20. FMC had a net margin of 34.93% and a return on equity of 7.68%. The firm had revenue of $1.07 billion during the quarter, compared to the consensus estimate of $1.04 billion. During the same quarter in the previous year, the company posted $0.44 EPS. The firm's revenue for the quarter was up 8.5% on a year-over-year basis. On average, research analysts forecast that FMC Co. will post 3.35 earnings per share for the current year.

FMC Profile

(

Free Report)

FMC Corporation, an agricultural sciences company, provides crop protection, plant health, and professional pest and turf management products. It develops, markets, and sells crop protection chemicals that includes insecticides, herbicides, and fungicides; and biologicals, crop nutrition, and seed treatment products, which are used in agriculture to enhance crop yield and quality by controlling a range of insects, weeds, and diseases, as well as in non-agricultural markets for pest control.

Featured Stories

Before you consider FMC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FMC wasn't on the list.

While FMC currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.