Harel Insurance Investments & Financial Services Ltd. grew its stake in Datadog, Inc. (NASDAQ:DDOG - Free Report) by 31.8% during the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 16,172 shares of the company's stock after purchasing an additional 3,906 shares during the period. Harel Insurance Investments & Financial Services Ltd.'s holdings in Datadog were worth $2,311,000 at the end of the most recent reporting period.

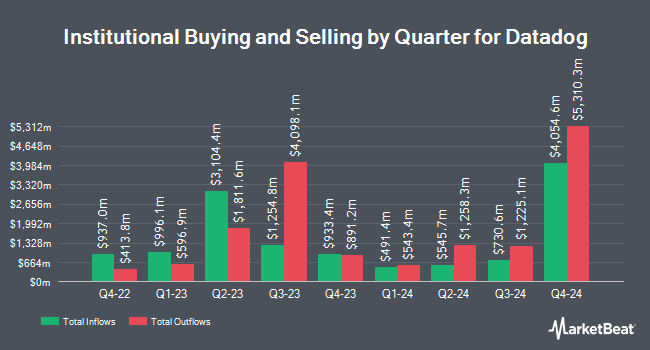

Several other large investors have also modified their holdings of the stock. RFG Advisory LLC purchased a new position in Datadog during the 4th quarter worth $291,000. Brighton Jones LLC acquired a new position in shares of Datadog during the fourth quarter worth about $209,000. New Century Financial Group LLC raised its holdings in Datadog by 64.8% during the fourth quarter. New Century Financial Group LLC now owns 3,493 shares of the company's stock worth $506,000 after purchasing an additional 1,373 shares in the last quarter. Donoghue Forlines LLC lifted its position in Datadog by 196.3% in the fourth quarter. Donoghue Forlines LLC now owns 13,653 shares of the company's stock valued at $1,951,000 after purchasing an additional 9,045 shares during the period. Finally, Avior Wealth Management LLC lifted its position in Datadog by 55.9% in the fourth quarter. Avior Wealth Management LLC now owns 226 shares of the company's stock valued at $32,000 after purchasing an additional 81 shares during the period. Hedge funds and other institutional investors own 78.29% of the company's stock.

Insiders Place Their Bets

In related news, Director Amit Agarwal sold 25,000 shares of the stock in a transaction on Wednesday, January 22nd. The stock was sold at an average price of $139.47, for a total value of $3,486,750.00. Following the transaction, the director now directly owns 195,667 shares of the company's stock, valued at approximately $27,289,676.49. This trade represents a 11.33 % decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, General Counsel Kerry Acocella sold 2,488 shares of Datadog stock in a transaction on Wednesday, December 4th. The shares were sold at an average price of $158.04, for a total value of $393,203.52. Following the completion of the transaction, the general counsel now owns 68,758 shares in the company, valued at $10,866,514.32. The trade was a 3.49 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 642,679 shares of company stock valued at $92,155,421 over the last quarter. Company insiders own 11.78% of the company's stock.

Datadog Stock Up 0.6 %

Shares of DDOG traded up $0.79 during mid-day trading on Friday, hitting $140.99. The company had a trading volume of 2,884,911 shares, compared to its average volume of 2,608,238. Datadog, Inc. has a 1-year low of $98.80 and a 1-year high of $170.08. The business's 50-day simple moving average is $147.36 and its 200-day simple moving average is $128.88. The stock has a market cap of $47.90 billion, a PE ratio of 266.02, a P/E/G ratio of 16.28 and a beta of 1.14.

Analyst Ratings Changes

A number of brokerages have recently issued reports on DDOG. DA Davidson increased their target price on Datadog from $140.00 to $150.00 and gave the stock a "buy" rating in a research note on Friday, November 8th. Jefferies Financial Group increased their price objective on Datadog from $155.00 to $170.00 and gave the stock a "buy" rating in a research report on Monday, January 6th. TD Cowen restated a "buy" rating and set a $165.00 target price on shares of Datadog in a research report on Tuesday, November 19th. Royal Bank of Canada upped their price target on shares of Datadog from $151.00 to $170.00 and gave the stock an "outperform" rating in a research note on Friday, January 3rd. Finally, Citigroup raised their price objective on shares of Datadog from $157.00 to $170.00 and gave the company a "buy" rating in a research note on Friday, January 17th. One investment analyst has rated the stock with a sell rating, four have issued a hold rating, twenty-six have given a buy rating and two have issued a strong buy rating to the company. According to data from MarketBeat, Datadog currently has a consensus rating of "Moderate Buy" and an average target price of $158.45.

View Our Latest Stock Analysis on DDOG

Datadog Profile

(

Free Report)

Datadog, Inc operates an observability and security platform for cloud applications in North America and internationally. The company's products comprise infrastructure and application performance monitoring, log management, digital experience monitoring, continuous profiler, database monitoring, data streams and universal service monitoring, network monitoring, incident management, workflow automation, observability pipelines, cloud cost and cloud security management, application security management, cloud SIEM, sensitive data scanner, and CI visibility.

Featured Articles

Before you consider Datadog, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Datadog wasn't on the list.

While Datadog currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.