StockNews.com upgraded shares of Harley-Davidson (NYSE:HOG - Free Report) from a sell rating to a hold rating in a report issued on Wednesday morning.

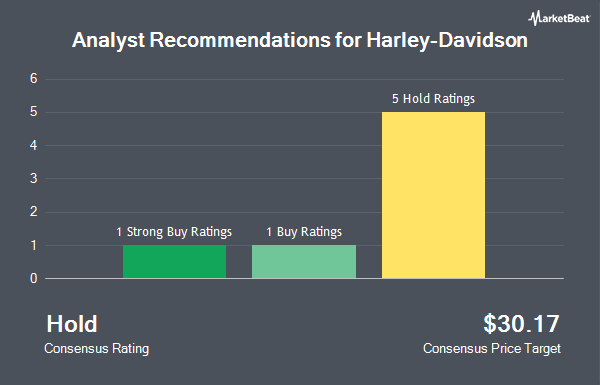

Several other research analysts also recently issued reports on the company. Baird R W downgraded Harley-Davidson from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, October 2nd. Bank of America cut their target price on shares of Harley-Davidson from $50.00 to $45.00 and set a "buy" rating for the company in a research report on Tuesday, October 15th. Robert W. Baird lowered shares of Harley-Davidson from an "outperform" rating to a "neutral" rating and lowered their price target for the company from $44.00 to $40.00 in a research report on Wednesday, October 2nd. Citigroup cut their price objective on Harley-Davidson from $39.00 to $34.00 and set a "neutral" rating for the company in a research report on Friday, October 25th. Finally, UBS Group lowered their target price on Harley-Davidson from $40.00 to $35.00 and set a "neutral" rating on the stock in a report on Thursday, November 7th. Five investment analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. According to MarketBeat, the stock currently has an average rating of "Hold" and a consensus target price of $42.57.

Get Our Latest Report on HOG

Harley-Davidson Price Performance

Shares of HOG traded up $0.29 on Wednesday, reaching $33.75. The stock had a trading volume of 237,862 shares, compared to its average volume of 1,706,302. The firm has a 50-day moving average of $34.72 and a 200 day moving average of $35.08. The firm has a market capitalization of $4.30 billion, a PE ratio of 7.53, a PEG ratio of 0.46 and a beta of 1.46. Harley-Davidson has a twelve month low of $29.67 and a twelve month high of $44.16. The company has a quick ratio of 1.25, a current ratio of 1.41 and a debt-to-equity ratio of 1.38.

Harley-Davidson Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Friday, September 27th. Investors of record on Monday, September 16th were issued a $0.1725 dividend. The ex-dividend date of this dividend was Monday, September 16th. This represents a $0.69 dividend on an annualized basis and a yield of 2.04%. Harley-Davidson's payout ratio is 15.54%.

Insider Buying and Selling

In other news, Director Maryrose Sylvester sold 4,278 shares of the business's stock in a transaction dated Wednesday, October 30th. The stock was sold at an average price of $32.25, for a total transaction of $137,965.50. Following the completion of the sale, the director now owns 17,687 shares in the company, valued at approximately $570,405.75. The trade was a 19.48 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. 0.87% of the stock is currently owned by company insiders.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently bought and sold shares of the business. GAMMA Investing LLC boosted its position in shares of Harley-Davidson by 19.0% in the second quarter. GAMMA Investing LLC now owns 2,008 shares of the company's stock worth $67,000 after buying an additional 320 shares during the period. Fifth Third Bancorp grew its position in Harley-Davidson by 19.5% in the second quarter. Fifth Third Bancorp now owns 1,970 shares of the company's stock valued at $66,000 after acquiring an additional 322 shares in the last quarter. MML Investors Services LLC raised its stake in shares of Harley-Davidson by 4.7% during the third quarter. MML Investors Services LLC now owns 8,430 shares of the company's stock valued at $325,000 after purchasing an additional 379 shares during the period. Covestor Ltd lifted its position in shares of Harley-Davidson by 14.7% during the third quarter. Covestor Ltd now owns 3,505 shares of the company's stock worth $135,000 after purchasing an additional 448 shares in the last quarter. Finally, Signaturefd LLC boosted its stake in shares of Harley-Davidson by 46.8% in the second quarter. Signaturefd LLC now owns 1,872 shares of the company's stock valued at $63,000 after purchasing an additional 597 shares during the period. 85.10% of the stock is owned by institutional investors and hedge funds.

Harley-Davidson Company Profile

(

Get Free Report)

Harley-Davidson, Inc manufactures and sells motorcycles in the United States and internationally. The company operates in three segments: Harley-Davidson Motor Company, LiveWire, and Harley-Davidson Financial Services. The Harley-Davidson Motor Company segment designs, manufactures, and sells motorcycles, including cruiser, trike, touring, standard, sportbike, adventure, and dual sport, as well as motorcycle parts, accessories, and apparel, as well as licenses its trademarks and related services.

Read More

Before you consider Harley-Davidson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Harley-Davidson wasn't on the list.

While Harley-Davidson currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.