Hartline Investment Corp grew its stake in shares of Zebra Technologies Co. (NASDAQ:ZBRA - Free Report) by 10.8% in the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 16,842 shares of the industrial products company's stock after acquiring an additional 1,645 shares during the period. Zebra Technologies comprises approximately 0.8% of Hartline Investment Corp's investment portfolio, making the stock its 25th biggest holding. Hartline Investment Corp's holdings in Zebra Technologies were worth $6,237,000 at the end of the most recent reporting period.

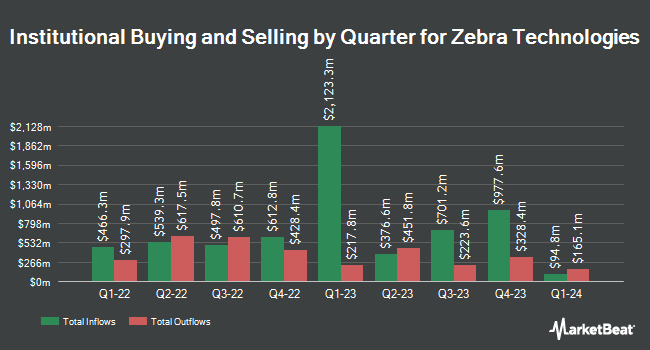

Several other institutional investors also recently bought and sold shares of ZBRA. Meridian Management Co. lifted its position in shares of Zebra Technologies by 2.5% in the 3rd quarter. Meridian Management Co. now owns 11,200 shares of the industrial products company's stock worth $4,148,000 after purchasing an additional 270 shares during the period. Sumitomo Mitsui Trust Group Inc. raised its stake in Zebra Technologies by 4.6% in the third quarter. Sumitomo Mitsui Trust Group Inc. now owns 426,660 shares of the industrial products company's stock worth $158,001,000 after buying an additional 18,922 shares in the last quarter. Entropy Technologies LP purchased a new stake in Zebra Technologies during the third quarter worth $357,000. Apollon Wealth Management LLC increased its holdings in shares of Zebra Technologies by 59.5% in the 3rd quarter. Apollon Wealth Management LLC now owns 1,113 shares of the industrial products company's stock valued at $412,000 after acquiring an additional 415 shares during the period. Finally, WCM Investment Management LLC increased its holdings in shares of Zebra Technologies by 0.3% in the 3rd quarter. WCM Investment Management LLC now owns 9,501 shares of the industrial products company's stock valued at $3,502,000 after acquiring an additional 27 shares during the period. 91.03% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of equities research analysts recently weighed in on the company. Morgan Stanley upped their price objective on Zebra Technologies from $290.00 to $305.00 and gave the stock an "underweight" rating in a research note on Wednesday, October 30th. Vertical Research began coverage on shares of Zebra Technologies in a report on Tuesday, July 23rd. They issued a "buy" rating and a $375.00 price target on the stock. StockNews.com raised shares of Zebra Technologies from a "hold" rating to a "buy" rating in a research report on Thursday, October 31st. TD Cowen increased their target price on shares of Zebra Technologies from $380.00 to $425.00 and gave the company a "buy" rating in a research report on Wednesday, October 30th. Finally, Truist Financial reaffirmed a "hold" rating and issued a $383.00 price target (up from $379.00) on shares of Zebra Technologies in a report on Wednesday, October 30th. One equities research analyst has rated the stock with a sell rating, three have assigned a hold rating, eight have given a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus target price of $385.18.

Check Out Our Latest Research Report on Zebra Technologies

Zebra Technologies Stock Performance

ZBRA stock traded down $2.46 during midday trading on Wednesday, reaching $400.23. The stock had a trading volume of 348,118 shares, compared to its average volume of 362,549. The firm has a fifty day simple moving average of $366.32 and a two-hundred day simple moving average of $337.00. Zebra Technologies Co. has a 52-week low of $208.50 and a 52-week high of $405.62. The company has a debt-to-equity ratio of 0.61, a quick ratio of 0.96 and a current ratio of 1.37. The stock has a market cap of $20.64 billion, a PE ratio of 54.45 and a beta of 1.64.

Zebra Technologies (NASDAQ:ZBRA - Get Free Report) last released its earnings results on Tuesday, October 29th. The industrial products company reported $3.49 EPS for the quarter, topping analysts' consensus estimates of $2.92 by $0.57. The firm had revenue of $1.26 billion during the quarter, compared to the consensus estimate of $1.22 billion. Zebra Technologies had a return on equity of 15.56% and a net margin of 8.20%. The company's revenue was up 31.3% compared to the same quarter last year. During the same quarter in the previous year, the company posted $0.57 earnings per share. As a group, equities research analysts anticipate that Zebra Technologies Co. will post 12.4 EPS for the current year.

Insider Transactions at Zebra Technologies

In other Zebra Technologies news, CFO Nathan Andrew Winters sold 1,837 shares of Zebra Technologies stock in a transaction dated Thursday, October 31st. The stock was sold at an average price of $381.73, for a total transaction of $701,238.01. Following the completion of the transaction, the chief financial officer now owns 11,421 shares in the company, valued at approximately $4,359,738.33. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this link. In related news, insider Jeffrey F. Schmitz sold 1,000 shares of the firm's stock in a transaction on Thursday, August 15th. The shares were sold at an average price of $341.69, for a total transaction of $341,690.00. Following the sale, the insider now owns 9,694 shares in the company, valued at approximately $3,312,342.86. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CFO Nathan Andrew Winters sold 1,837 shares of the stock in a transaction dated Thursday, October 31st. The stock was sold at an average price of $381.73, for a total transaction of $701,238.01. Following the sale, the chief financial officer now directly owns 11,421 shares in the company, valued at approximately $4,359,738.33. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 1.06% of the company's stock.

About Zebra Technologies

(

Free Report)

Zebra Technologies Corporation, together with its subsidiaries, provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide. It operates in two segments, Asset Intelligence & Tracking, and Enterprise Visibility & Mobility. The company designs, manufactures, and sells printers that produce labels, wristbands, tickets, receipts, and plastic cards; dye-sublimination thermal card printers that produce images, which are used for personal identification, access control, and financial transactions; radio frequency identification device (RFID) printers that encode data into passive RFID transponders; accessories and options for printers, including carrying cases, vehicle mounts, and battery chargers; stock and customized thermal labels, receipts, ribbons, plastic cards, and RFID tags for printers; and temperature-monitoring labels primarily used in vaccine distribution.

Read More

Before you consider Zebra Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zebra Technologies wasn't on the list.

While Zebra Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report