Harvest Fund Management Co. Ltd increased its position in shares of GE HealthCare Technologies Inc. (NASDAQ:GEHC - Free Report) by 92.7% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 27,740 shares of the company's stock after buying an additional 13,347 shares during the period. Harvest Fund Management Co. Ltd's holdings in GE HealthCare Technologies were worth $2,603,000 at the end of the most recent reporting period.

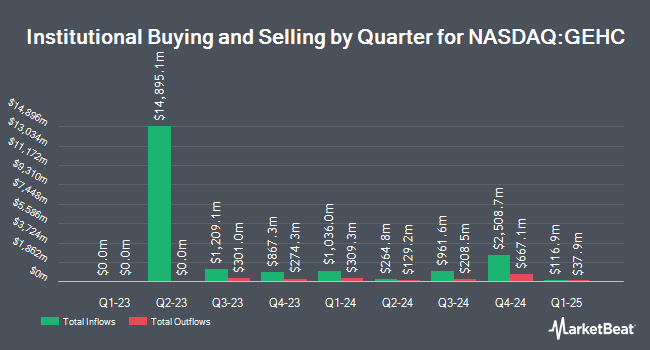

A number of other institutional investors have also recently added to or reduced their stakes in GEHC. EntryPoint Capital LLC increased its stake in shares of GE HealthCare Technologies by 680.0% in the first quarter. EntryPoint Capital LLC now owns 468 shares of the company's stock worth $43,000 after buying an additional 408 shares during the last quarter. CreativeOne Wealth LLC acquired a new stake in shares of GE HealthCare Technologies in the 1st quarter valued at about $212,000. Janus Henderson Group PLC lifted its position in shares of GE HealthCare Technologies by 12.0% during the first quarter. Janus Henderson Group PLC now owns 834,278 shares of the company's stock worth $75,832,000 after purchasing an additional 89,400 shares during the last quarter. B. Riley Wealth Advisors Inc. grew its stake in GE HealthCare Technologies by 17.0% in the first quarter. B. Riley Wealth Advisors Inc. now owns 7,404 shares of the company's stock worth $673,000 after purchasing an additional 1,074 shares in the last quarter. Finally, California State Teachers Retirement System increased its holdings in GE HealthCare Technologies by 2.2% in the first quarter. California State Teachers Retirement System now owns 682,116 shares of the company's stock valued at $62,011,000 after buying an additional 14,800 shares during the last quarter. Institutional investors and hedge funds own 82.06% of the company's stock.

Insider Buying and Selling at GE HealthCare Technologies

In related news, CEO Roland Rott sold 3,577 shares of the stock in a transaction that occurred on Wednesday, November 6th. The stock was sold at an average price of $86.48, for a total transaction of $309,338.96. Following the completion of the sale, the chief executive officer now owns 24,298 shares in the company, valued at $2,101,291.04. This represents a 12.83 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Corporate insiders own 0.27% of the company's stock.

GE HealthCare Technologies Stock Down 0.5 %

Shares of GEHC traded down $0.42 during mid-day trading on Monday, reaching $82.02. The company's stock had a trading volume of 1,281,572 shares, compared to its average volume of 3,071,764. GE HealthCare Technologies Inc. has a 1 year low of $66.39 and a 1 year high of $94.55. The company has a quick ratio of 0.98, a current ratio of 1.23 and a debt-to-equity ratio of 1.12. The company has a market cap of $37.47 billion, a price-to-earnings ratio of 22.65, a price-to-earnings-growth ratio of 2.95 and a beta of 1.24. The business has a fifty day moving average of $88.35 and a 200 day moving average of $83.62.

GE HealthCare Technologies (NASDAQ:GEHC - Get Free Report) last posted its quarterly earnings results on Wednesday, October 30th. The company reported $1.14 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.06 by $0.08. GE HealthCare Technologies had a net margin of 8.56% and a return on equity of 25.19%. The business had revenue of $4.86 billion during the quarter, compared to analyst estimates of $4.87 billion. During the same period in the prior year, the firm earned $0.99 earnings per share. The firm's revenue was up .9% compared to the same quarter last year. As a group, analysts forecast that GE HealthCare Technologies Inc. will post 4.3 earnings per share for the current fiscal year.

GE HealthCare Technologies Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, November 15th. Investors of record on Friday, October 18th were issued a $0.03 dividend. The ex-dividend date of this dividend was Friday, October 18th. This represents a $0.12 annualized dividend and a yield of 0.15%. GE HealthCare Technologies's dividend payout ratio (DPR) is currently 3.30%.

Analyst Ratings Changes

A number of brokerages have recently weighed in on GEHC. JPMorgan Chase & Co. began coverage on GE HealthCare Technologies in a report on Monday, September 9th. They issued a "neutral" rating and a $90.00 price target for the company. Evercore ISI upped their target price on GE HealthCare Technologies from $98.00 to $102.00 and gave the company an "outperform" rating in a report on Tuesday, October 1st. Wells Fargo & Company boosted their price objective on GE HealthCare Technologies from $95.00 to $96.00 and gave the company an "overweight" rating in a research report on Thursday, October 31st. BTIG Research upgraded shares of GE HealthCare Technologies from a "neutral" rating to a "buy" rating and set a $100.00 target price for the company in a research report on Wednesday, September 18th. Finally, Stifel Nicolaus raised their price target on GE HealthCare Technologies from $100.00 to $102.00 and gave the company a "buy" rating in a report on Monday, September 30th. One analyst has rated the stock with a sell rating, five have given a hold rating, eight have issued a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average price target of $94.36.

Read Our Latest Stock Analysis on GEHC

GE HealthCare Technologies Profile

(

Free Report)

GE HealthCare Technologies Inc engages in the development, manufacture, and marketing of products, services, and complementary digital solutions used in the diagnosis, treatment, and monitoring of patients in the United States, Canada, and internationally. The company operates through four segments: Imaging, Ultrasound, Patient Care Solutions, and Pharmaceutical Diagnostics.

Featured Stories

Before you consider GE HealthCare Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GE HealthCare Technologies wasn't on the list.

While GE HealthCare Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.