Harvest Fund Management Co. Ltd lifted its holdings in shares of Barrett Business Services, Inc. (NASDAQ:BBSI - Free Report) by 165.7% during the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 10,596 shares of the business services provider's stock after purchasing an additional 6,608 shares during the quarter. Harvest Fund Management Co. Ltd's holdings in Barrett Business Services were worth $459,000 as of its most recent SEC filing.

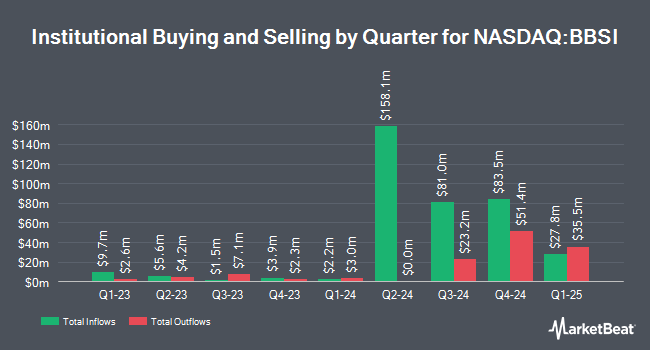

Other hedge funds and other institutional investors have also made changes to their positions in the company. Westside Investment Management Inc. acquired a new stake in shares of Barrett Business Services in the third quarter worth approximately $34,000. Truvestments Capital LLC purchased a new position in shares of Barrett Business Services in the 3rd quarter worth $34,000. Quantbot Technologies LP acquired a new position in Barrett Business Services in the third quarter valued at $77,000. Continental Investors Services Inc. purchased a new stake in Barrett Business Services during the third quarter valued at about $216,000. Finally, Longboard Asset Management LP acquired a new stake in Barrett Business Services during the fourth quarter worth about $217,000. Hedge funds and other institutional investors own 86.76% of the company's stock.

Barrett Business Services Stock Performance

Shares of NASDAQ:BBSI traded up $0.33 during mid-day trading on Wednesday, hitting $41.62. 131,541 shares of the company traded hands, compared to its average volume of 129,352. The firm's 50 day simple moving average is $41.69 and its 200 day simple moving average is $40.60. The firm has a market cap of $1.08 billion, a P/E ratio of 21.96, a PEG ratio of 1.21 and a beta of 1.31. Barrett Business Services, Inc. has a 52-week low of $28.42 and a 52-week high of $44.97.

Barrett Business Services Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Friday, March 28th. Investors of record on Friday, March 14th will be issued a dividend of $0.08 per share. This represents a $0.32 dividend on an annualized basis and a yield of 0.77%. The ex-dividend date of this dividend is Friday, March 14th. Barrett Business Services's payout ratio is 16.08%.

Analyst Upgrades and Downgrades

A number of analysts have recently issued reports on the company. StockNews.com upgraded Barrett Business Services from a "hold" rating to a "buy" rating in a report on Friday, March 7th. Barrington Research reiterated an "outperform" rating and set a $45.00 price objective on shares of Barrett Business Services in a research note on Wednesday, March 12th.

View Our Latest Stock Analysis on BBSI

Barrett Business Services Profile

(

Free Report)

Barrett Business Services, Inc provides business management solutions for small and mid-sized companies in the United States. The company develops a management platform that integrates a knowledge-based approach from the management consulting industry with tools from the human resource outsourcing industry.

Featured Stories

Before you consider Barrett Business Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Barrett Business Services wasn't on the list.

While Barrett Business Services currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.