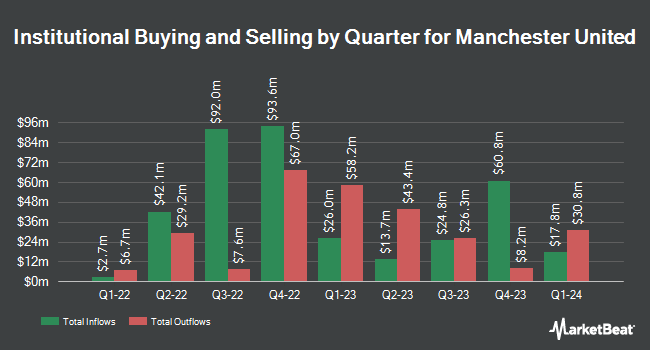

Harvey Partners LLC boosted its position in shares of Manchester United plc (NYSE:MANU - Free Report) by 156.9% in the third quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 740,000 shares of the company's stock after acquiring an additional 452,000 shares during the quarter. Manchester United accounts for 1.4% of Harvey Partners LLC's portfolio, making the stock its 29th biggest holding. Harvey Partners LLC owned 0.44% of Manchester United worth $11,973,000 at the end of the most recent reporting period.

Other hedge funds also recently bought and sold shares of the company. Brown Brothers Harriman & Co. bought a new stake in Manchester United during the third quarter valued at about $49,000. Emfo LLC bought a new position in shares of Manchester United in the second quarter worth about $50,000. Dnca Finance bought a new position in shares of Manchester United in the second quarter worth about $53,000. Nkcfo LLC bought a new position in shares of Manchester United in the second quarter worth about $113,000. Finally, Verition Fund Management LLC bought a new position in shares of Manchester United in the third quarter worth about $209,000. Hedge funds and other institutional investors own 23.34% of the company's stock.

Manchester United Stock Down 2.3 %

Manchester United stock traded down $0.40 during midday trading on Tuesday, reaching $16.89. 218,278 shares of the stock traded hands, compared to its average volume of 706,895. The stock's fifty day moving average is $16.66 and its 200-day moving average is $16.69. Manchester United plc has a 12 month low of $13.50 and a 12 month high of $22.00. The company has a debt-to-equity ratio of 3.25, a current ratio of 0.36 and a quick ratio of 0.35.

Manchester United (NYSE:MANU - Get Free Report) last announced its quarterly earnings results on Wednesday, September 11th. The company reported ($0.20) EPS for the quarter, beating analysts' consensus estimates of ($0.22) by $0.02. Manchester United had a negative return on equity of 37.41% and a negative net margin of 13.36%. The company had revenue of $179.43 million during the quarter, compared to analyst estimates of $180.82 million. As a group, analysts predict that Manchester United plc will post -0.54 EPS for the current fiscal year.

Manchester United Company Profile

(

Free Report)

Manchester United plc, together with its subsidiaries, owns and operates a professional sports team in the United Kingdom. It operates Manchester United Football Club, a professional football club. The company develops marketing and sponsorship relationships with international and regional companies to leverage its brand.

See Also

Before you consider Manchester United, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Manchester United wasn't on the list.

While Manchester United currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.