Harvey Partners LLC acquired a new stake in SolarWinds Co. (NYSE:SWI - Free Report) during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm acquired 150,000 shares of the software maker's stock, valued at approximately $1,958,000. Harvey Partners LLC owned approximately 0.09% of SolarWinds as of its most recent filing with the Securities and Exchange Commission.

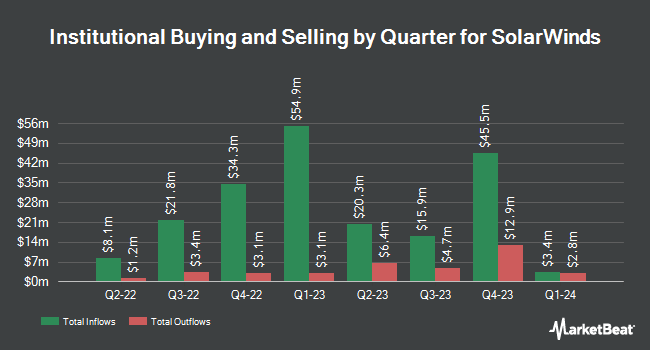

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in SWI. Verition Fund Management LLC acquired a new position in shares of SolarWinds in the third quarter valued at approximately $171,000. Walleye Capital LLC purchased a new position in SolarWinds during the third quarter worth about $222,000. Public Sector Pension Investment Board purchased a new position in SolarWinds during the third quarter worth about $1,496,000. FMR LLC lifted its position in SolarWinds by 28.6% during the third quarter. FMR LLC now owns 106,286 shares of the software maker's stock worth $1,387,000 after buying an additional 23,623 shares during the period. Finally, West Tower Group LLC lifted its position in SolarWinds by 38.3% during the third quarter. West Tower Group LLC now owns 7,221 shares of the software maker's stock worth $94,000 after buying an additional 2,000 shares during the period. Hedge funds and other institutional investors own 93.96% of the company's stock.

Insider Activity at SolarWinds

In other news, CEO Sudhakar Ramakrishna sold 200,000 shares of the business's stock in a transaction dated Thursday, November 7th. The stock was sold at an average price of $13.68, for a total transaction of $2,736,000.00. Following the sale, the chief executive officer now directly owns 2,212,171 shares in the company, valued at approximately $30,262,499.28. The trade was a 8.29 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, Director William G. Bock sold 16,000 shares of the business's stock in a transaction dated Tuesday, November 5th. The stock was sold at an average price of $13.13, for a total value of $210,080.00. Following the sale, the director now owns 88,857 shares in the company, valued at approximately $1,166,692.41. This trade represents a 15.26 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders sold 351,000 shares of company stock valued at $4,703,780. 1.95% of the stock is owned by corporate insiders.

SolarWinds Price Performance

NYSE:SWI traded up $0.13 during mid-day trading on Tuesday, reaching $13.70. 329,029 shares of the company were exchanged, compared to its average volume of 553,167. SolarWinds Co. has a 12 month low of $10.14 and a 12 month high of $14.02. The company has a fifty day moving average of $13.04 and a 200 day moving average of $12.42. The company has a quick ratio of 0.71, a current ratio of 0.71 and a debt-to-equity ratio of 0.88. The stock has a market cap of $2.34 billion, a PE ratio of 62.32 and a beta of 0.96.

SolarWinds (NYSE:SWI - Get Free Report) last announced its earnings results on Thursday, October 31st. The software maker reported $0.27 EPS for the quarter, topping the consensus estimate of $0.25 by $0.02. The firm had revenue of $200.03 million for the quarter, compared to the consensus estimate of $194.03 million. SolarWinds had a net margin of 4.93% and a return on equity of 7.96%. The business's quarterly revenue was up 5.5% on a year-over-year basis. During the same period last year, the company posted $0.11 EPS. On average, research analysts anticipate that SolarWinds Co. will post 0.74 EPS for the current fiscal year.

Analyst Ratings Changes

A number of equities research analysts have weighed in on SWI shares. Robert W. Baird raised their price objective on SolarWinds from $14.00 to $15.00 and gave the company a "neutral" rating in a research note on Friday, November 1st. Scotiabank initiated coverage on shares of SolarWinds in a research report on Friday, September 13th. They set a "sector perform" rating and a $13.00 price objective for the company. Five analysts have rated the stock with a hold rating, According to data from MarketBeat, SolarWinds presently has an average rating of "Hold" and an average target price of $14.00.

View Our Latest Stock Analysis on SolarWinds

About SolarWinds

(

Free Report)

SolarWinds Corporation provides information technology (IT) management software products in the United States and internationally. It provides a suite of network management software that offers real-time visibility into network utilization and bandwidth, as well as the ability to detect, diagnose, and resolve network performance problems; and a suite of infrastructure management products, which monitors and analyzes the performance of applications and their supporting infrastructure, including servers, physical, virtual and cloud infrastructure, storage, and databases.

Read More

Before you consider SolarWinds, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SolarWinds wasn't on the list.

While SolarWinds currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.