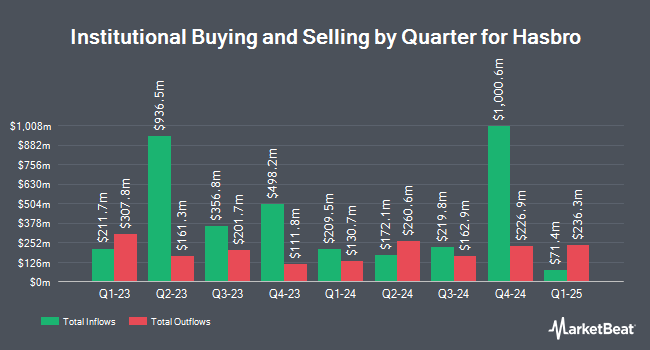

Advisors Asset Management Inc. grew its position in shares of Hasbro, Inc. (NASDAQ:HAS - Free Report) by 306.8% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 10,462 shares of the company's stock after purchasing an additional 7,890 shares during the period. Advisors Asset Management Inc.'s holdings in Hasbro were worth $757,000 at the end of the most recent quarter.

Several other institutional investors have also recently made changes to their positions in the company. Price T Rowe Associates Inc. MD raised its stake in Hasbro by 2.1% in the first quarter. Price T Rowe Associates Inc. MD now owns 181,123 shares of the company's stock valued at $10,238,000 after purchasing an additional 3,656 shares in the last quarter. California State Teachers Retirement System lifted its holdings in shares of Hasbro by 1.4% during the 1st quarter. California State Teachers Retirement System now owns 227,068 shares of the company's stock worth $12,834,000 after acquiring an additional 3,055 shares during the last quarter. Tidal Investments LLC grew its position in Hasbro by 14.5% in the first quarter. Tidal Investments LLC now owns 42,402 shares of the company's stock worth $2,396,000 after acquiring an additional 5,368 shares in the last quarter. Comerica Bank increased its stake in Hasbro by 11.1% in the first quarter. Comerica Bank now owns 57,090 shares of the company's stock valued at $3,227,000 after acquiring an additional 5,697 shares during the last quarter. Finally, Swedbank AB purchased a new stake in Hasbro during the first quarter valued at about $82,523,000. Institutional investors own 91.83% of the company's stock.

Analysts Set New Price Targets

Several research firms have commented on HAS. Stifel Nicolaus lifted their price target on shares of Hasbro from $78.00 to $82.00 and gave the stock a "buy" rating in a research note on Tuesday, October 8th. Morgan Stanley lifted their target price on shares of Hasbro from $80.00 to $92.00 and gave the stock an "overweight" rating in a research report on Friday, October 25th. JPMorgan Chase & Co. raised their price objective on Hasbro from $76.00 to $82.00 and gave the company an "overweight" rating in a research note on Monday, October 21st. Jefferies Financial Group boosted their target price on Hasbro from $75.00 to $83.00 and gave the company a "buy" rating in a research note on Tuesday, October 1st. Finally, Bank of America raised their price target on Hasbro from $90.00 to $95.00 and gave the stock a "buy" rating in a research report on Tuesday, October 15th. Two investment analysts have rated the stock with a hold rating and eight have given a buy rating to the company. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $80.67.

View Our Latest Stock Analysis on Hasbro

Hasbro Trading Down 0.5 %

NASDAQ:HAS opened at $64.00 on Wednesday. The company has a debt-to-equity ratio of 2.64, a current ratio of 1.47 and a quick ratio of 1.29. Hasbro, Inc. has a one year low of $44.85 and a one year high of $73.46. The company's 50-day simple moving average is $68.19 and its 200 day simple moving average is $64.39.

Hasbro (NASDAQ:HAS - Get Free Report) last announced its quarterly earnings data on Thursday, October 24th. The company reported $1.73 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.28 by $0.45. Hasbro had a positive return on equity of 47.91% and a negative net margin of 14.83%. The business had revenue of $1.28 billion during the quarter, compared to analysts' expectations of $1.30 billion. During the same quarter in the previous year, the business earned $1.64 earnings per share. The firm's quarterly revenue was down 14.8% compared to the same quarter last year. As a group, equities analysts anticipate that Hasbro, Inc. will post 3.93 earnings per share for the current fiscal year.

Hasbro Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Wednesday, December 4th. Shareholders of record on Wednesday, November 20th will be paid a dividend of $0.70 per share. This represents a $2.80 annualized dividend and a yield of 4.38%. The ex-dividend date is Wednesday, November 20th. Hasbro's dividend payout ratio is currently -60.34%.

Hasbro Company Profile

(

Free Report)

Hasbro, Inc, together with its subsidiaries, operates as a toy and game company in the United States, Europe, Canada, Mexico, Latin America, Australia, China, and Hong Kong. The company operates through Consumer Products; Wizards of the Coast and Digital Gaming; Entertainment; and Corporate and Other segments.

Featured Articles

Before you consider Hasbro, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hasbro wasn't on the list.

While Hasbro currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.