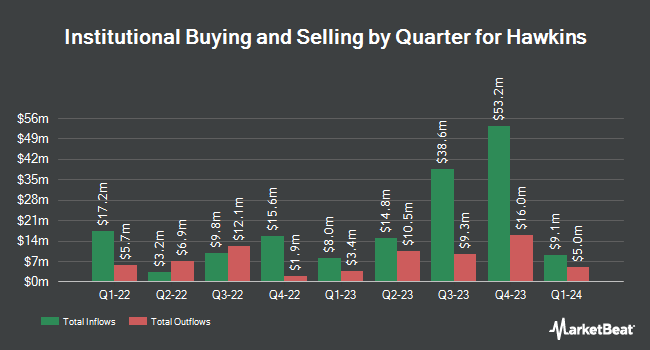

Eagle Asset Management Inc. cut its holdings in shares of Hawkins, Inc. (NASDAQ:HWKN - Free Report) by 6.1% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 64,836 shares of the specialty chemicals company's stock after selling 4,178 shares during the quarter. Eagle Asset Management Inc. owned approximately 0.31% of Hawkins worth $8,122,000 at the end of the most recent reporting period.

A number of other hedge funds also recently made changes to their positions in the business. GAMMA Investing LLC raised its position in Hawkins by 71.8% in the third quarter. GAMMA Investing LLC now owns 402 shares of the specialty chemicals company's stock worth $51,000 after acquiring an additional 168 shares during the period. Farther Finance Advisors LLC raised its holdings in shares of Hawkins by 289.2% in the 3rd quarter. Farther Finance Advisors LLC now owns 467 shares of the specialty chemicals company's stock worth $59,000 after purchasing an additional 347 shares during the period. SG Americas Securities LLC bought a new position in Hawkins during the third quarter valued at $100,000. USA Financial Formulas increased its position in Hawkins by 35.1% in the third quarter. USA Financial Formulas now owns 885 shares of the specialty chemicals company's stock worth $113,000 after buying an additional 230 shares during the last quarter. Finally, Shell Asset Management Co. raised its stake in shares of Hawkins by 36.9% in the first quarter. Shell Asset Management Co. now owns 2,342 shares of the specialty chemicals company's stock valued at $180,000 after buying an additional 631 shares during the period. 69.71% of the stock is currently owned by institutional investors.

Hawkins Stock Performance

Shares of NASDAQ:HWKN traded up $4.98 during trading on Monday, hitting $135.01. 86,010 shares of the company were exchanged, compared to its average volume of 128,050. Hawkins, Inc. has a 52-week low of $54.44 and a 52-week high of $136.43. The stock has a 50 day moving average of $123.19 and a 200 day moving average of $109.03. The company has a debt-to-equity ratio of 0.21, a current ratio of 2.27 and a quick ratio of 1.39. The company has a market cap of $2.82 billion, a PE ratio of 33.26, a P/E/G ratio of 4.51 and a beta of 0.77.

Hawkins (NASDAQ:HWKN - Get Free Report) last issued its earnings results on Wednesday, October 30th. The specialty chemicals company reported $1.16 EPS for the quarter, missing the consensus estimate of $1.18 by ($0.02). Hawkins had a return on equity of 19.64% and a net margin of 8.74%. The company had revenue of $247.03 million during the quarter, compared to the consensus estimate of $259.59 million. As a group, equities research analysts predict that Hawkins, Inc. will post 4.12 EPS for the current year.

Hawkins Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Friday, November 29th. Stockholders of record on Friday, November 15th will be given a dividend of $0.18 per share. The ex-dividend date is Friday, November 15th. This represents a $0.72 dividend on an annualized basis and a dividend yield of 0.53%. Hawkins's dividend payout ratio (DPR) is currently 18.41%.

Analyst Ratings Changes

Separately, BWS Financial reaffirmed a "neutral" rating and set a $122.00 price objective on shares of Hawkins in a report on Thursday, October 31st.

View Our Latest Stock Report on HWKN

About Hawkins

(

Free Report)

Hawkins, Inc operates as a specialty chemical and ingredients company in the United States. It operates through three segments: Industrial, Water Treatment, and Health and Nutrition. The Industrial segment offers industrial chemicals, products, and services to agriculture, chemical processing, electronics, energy, food, pharmaceutical, and plating industries.

Recommended Stories

Before you consider Hawkins, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hawkins wasn't on the list.

While Hawkins currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.