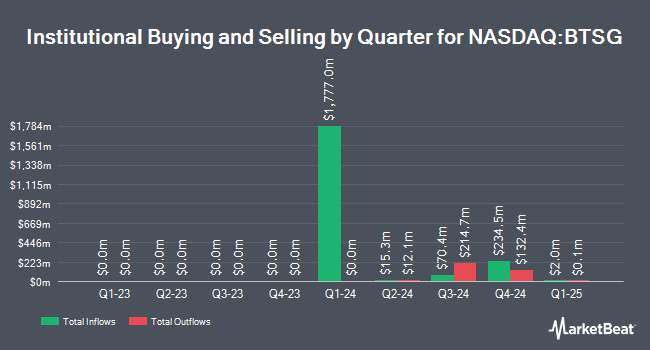

HBK Investments L P increased its holdings in shares of BrightSpring Health Services, Inc. (NASDAQ:BTSG - Free Report) by 7.1% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 750,000 shares of the company's stock after buying an additional 50,000 shares during the quarter. HBK Investments L P owned 0.43% of BrightSpring Health Services worth $11,010,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other institutional investors and hedge funds have also modified their holdings of BTSG. BNP Paribas Financial Markets boosted its stake in shares of BrightSpring Health Services by 5.0% during the 3rd quarter. BNP Paribas Financial Markets now owns 21,329 shares of the company's stock valued at $313,000 after buying an additional 1,011 shares during the period. nVerses Capital LLC purchased a new position in BrightSpring Health Services in the second quarter valued at about $55,000. California State Teachers Retirement System acquired a new position in BrightSpring Health Services in the 1st quarter worth about $59,000. Charles Schwab Investment Management Inc. lifted its holdings in shares of BrightSpring Health Services by 1.5% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 440,335 shares of the company's stock valued at $6,464,000 after buying an additional 6,326 shares during the last quarter. Finally, Intech Investment Management LLC bought a new stake in shares of BrightSpring Health Services in the 3rd quarter valued at approximately $159,000.

BrightSpring Health Services Price Performance

NASDAQ BTSG traded up $0.25 during trading on Friday, reaching $19.30. 364,959 shares of the company traded hands, compared to its average volume of 1,469,036. The company has a debt-to-equity ratio of 1.63, a quick ratio of 0.97 and a current ratio of 1.35. The company has a market cap of $3.36 billion and a price-to-earnings ratio of -73.27. BrightSpring Health Services, Inc. has a 1-year low of $7.85 and a 1-year high of $20.25. The stock's 50 day moving average price is $16.68 and its two-hundred day moving average price is $13.50.

BrightSpring Health Services (NASDAQ:BTSG - Get Free Report) last released its quarterly earnings results on Friday, November 1st. The company reported $0.11 earnings per share for the quarter, missing analysts' consensus estimates of $0.18 by ($0.07). The business had revenue of $2.91 billion for the quarter, compared to analyst estimates of $2.72 billion. BrightSpring Health Services had a negative net margin of 0.38% and a positive return on equity of 4.16%. The firm's revenue for the quarter was up 28.8% on a year-over-year basis. As a group, analysts anticipate that BrightSpring Health Services, Inc. will post 0.59 EPS for the current year.

Insider Buying and Selling

In other BrightSpring Health Services news, major shareholder Kkr Group Partnership L.P. acquired 11,619,998 shares of the company's stock in a transaction that occurred on Wednesday, September 11th. The shares were acquired at an average price of $11.13 per share, with a total value of $129,330,577.74. Following the purchase, the insider now owns 92,959,984 shares of the company's stock, valued at $1,034,644,621.92. This represents a 14.29 % increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is available at this link.

Analyst Ratings Changes

Several equities analysts recently weighed in on the stock. UBS Group raised their price objective on shares of BrightSpring Health Services from $16.00 to $20.00 and gave the company a "buy" rating in a research report on Wednesday, October 30th. KeyCorp assumed coverage on BrightSpring Health Services in a report on Friday, October 11th. They set a "sector weight" rating on the stock. BTIG Research increased their price target on BrightSpring Health Services from $15.00 to $20.00 and gave the company a "buy" rating in a report on Thursday, October 3rd. Wells Fargo & Company lifted their target price on shares of BrightSpring Health Services from $17.00 to $21.00 and gave the stock an "overweight" rating in a report on Wednesday. Finally, The Goldman Sachs Group lowered their price target on BrightSpring Health Services from $21.00 to $18.00 and set a "buy" rating on the stock in a research report on Friday, August 9th. One investment analyst has rated the stock with a hold rating and thirteen have assigned a buy rating to the company. Based on data from MarketBeat.com, BrightSpring Health Services currently has an average rating of "Moderate Buy" and a consensus target price of $17.21.

View Our Latest Stock Report on BrightSpring Health Services

BrightSpring Health Services Company Profile

(

Free Report)

BrightSpring Health Services, Inc operates a home and community-based healthcare services platform in the United States. The company's platform focuses on delivering pharmacy and provider services, including clinical and supportive care in home and community settings to Medicare, Medicaid, and insured populations.

Featured Stories

Before you consider BrightSpring Health Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BrightSpring Health Services wasn't on the list.

While BrightSpring Health Services currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.