HBK Investments L P reduced its stake in shares of Paramount Group, Inc. (NYSE:PGRE - Free Report) by 15.0% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 2,396,622 shares of the financial services provider's stock after selling 422,657 shares during the quarter. HBK Investments L P owned 1.10% of Paramount Group worth $11,791,000 as of its most recent SEC filing.

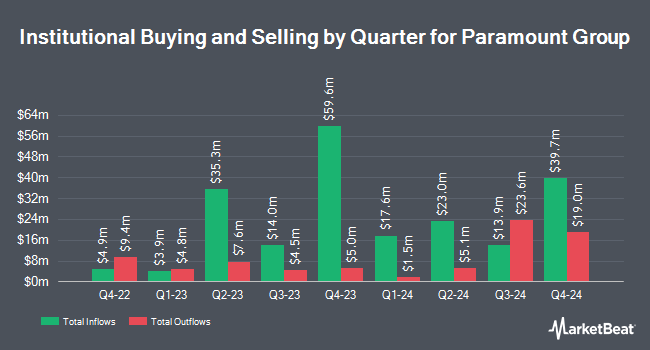

A number of other hedge funds and other institutional investors also recently made changes to their positions in the stock. Long Pond Capital LP raised its position in Paramount Group by 131.4% in the 2nd quarter. Long Pond Capital LP now owns 7,501,361 shares of the financial services provider's stock valued at $34,731,000 after purchasing an additional 4,259,635 shares during the last quarter. Dimensional Fund Advisors LP boosted its position in Paramount Group by 0.7% in the 2nd quarter. Dimensional Fund Advisors LP now owns 2,310,207 shares of the financial services provider's stock valued at $10,696,000 after buying an additional 15,806 shares during the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its stake in shares of Paramount Group by 398.0% in the 3rd quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 1,388,257 shares of the financial services provider's stock valued at $6,830,000 after buying an additional 1,109,485 shares during the period. Bank of New York Mellon Corp increased its stake in shares of Paramount Group by 6.5% in the 2nd quarter. Bank of New York Mellon Corp now owns 1,043,027 shares of the financial services provider's stock valued at $4,829,000 after buying an additional 63,789 shares during the period. Finally, Millennium Management LLC lifted its position in Paramount Group by 4,007.2% during the 2nd quarter. Millennium Management LLC now owns 953,947 shares of the financial services provider's stock valued at $4,417,000 after purchasing an additional 930,721 shares during the period. 65.64% of the stock is owned by institutional investors.

Analysts Set New Price Targets

Separately, Wells Fargo & Company raised their price objective on shares of Paramount Group from $3.50 to $4.00 and gave the company an "underweight" rating in a research note on Wednesday, September 11th.

Get Our Latest Research Report on Paramount Group

Paramount Group Trading Down 0.6 %

PGRE stock traded down $0.03 during midday trading on Friday, hitting $4.86. 606,214 shares of the company's stock were exchanged, compared to its average volume of 1,094,969. The company has a market cap of $1.06 billion, a PE ratio of -5.02 and a beta of 1.25. The company has a debt-to-equity ratio of 0.91, a quick ratio of 4.45 and a current ratio of 4.45. The stock's fifty day moving average price is $5.00 and its 200-day moving average price is $4.88. Paramount Group, Inc. has a one year low of $4.21 and a one year high of $5.92.

Paramount Group Profile

(

Free Report)

Paramount Group, Inc ("Paramount" or the "Company") is a fully-integrated real estate investment trust that owns, operates, manages, acquires and redevelops high-quality, Class A office properties located in select central business district submarkets of New York and San Francisco. Paramount is focused on maximizing the value of its portfolio by leveraging the sought-after locations of its assets and its proven property management capabilities to attract and retain high-quality tenants.

See Also

Before you consider Paramount Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paramount Group wasn't on the list.

While Paramount Group currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.