HBT Financial (NASDAQ:HBT - Get Free Report) will likely be announcing its earnings results before the market opens on Wednesday, January 22nd. Analysts expect the company to announce earnings of $0.58 per share and revenue of $57,490.00 billion for the quarter.

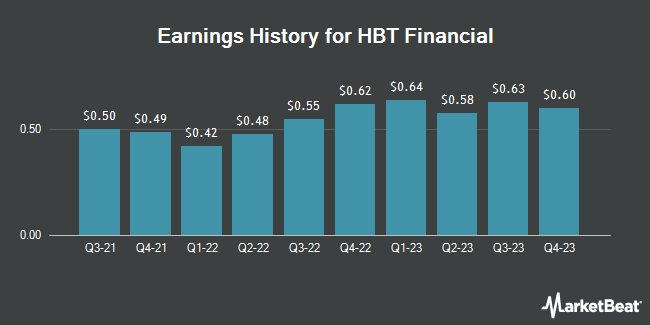

HBT Financial (NASDAQ:HBT - Get Free Report) last released its quarterly earnings results on Monday, October 21st. The company reported $0.61 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.58 by $0.03. HBT Financial had a return on equity of 14.70% and a net margin of 24.68%. The firm had revenue of $56.44 million for the quarter, compared to the consensus estimate of $57.05 million. On average, analysts expect HBT Financial to post $2 EPS for the current fiscal year and $2 EPS for the next fiscal year.

HBT Financial Stock Performance

Shares of HBT traded up $0.46 during trading hours on Wednesday, hitting $22.29. The stock had a trading volume of 17,059 shares, compared to its average volume of 32,651. The firm has a market capitalization of $703.45 million, a PE ratio of 10.13 and a beta of 0.88. The company has a debt-to-equity ratio of 0.20, a current ratio of 0.82 and a quick ratio of 0.82. HBT Financial has a 12 month low of $17.75 and a 12 month high of $25.35. The stock has a fifty day moving average price of $23.10 and a 200 day moving average price of $22.28.

HBT Financial Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Tuesday, November 12th. Shareholders of record on Monday, November 4th were paid a dividend of $0.19 per share. The ex-dividend date was Monday, November 4th. This represents a $0.76 dividend on an annualized basis and a dividend yield of 3.41%. HBT Financial's dividend payout ratio is currently 34.55%.

HBT Financial declared that its Board of Directors has authorized a stock buyback program on Wednesday, December 18th that allows the company to repurchase $15.00 million in outstanding shares. This repurchase authorization allows the company to buy up to 2.1% of its stock through open market purchases. Stock repurchase programs are often a sign that the company's leadership believes its shares are undervalued.

Insiders Place Their Bets

In other news, Chairman Fred L. Drake sold 2,500 shares of the firm's stock in a transaction on Wednesday, December 11th. The shares were sold at an average price of $24.11, for a total transaction of $60,275.00. Following the sale, the chairman now directly owns 71,170 shares in the company, valued at $1,715,908.70. This trade represents a 3.39 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. Insiders sold a total of 14,498 shares of company stock worth $351,985 over the last three months. 59.80% of the stock is currently owned by company insiders.

Analyst Upgrades and Downgrades

Several analysts recently issued reports on HBT shares. Piper Sandler cut their target price on shares of HBT Financial from $25.00 to $24.00 and set a "neutral" rating for the company in a research report on Tuesday, October 22nd. DA Davidson lowered HBT Financial from a "buy" rating to a "neutral" rating and reduced their price objective for the stock from $26.00 to $24.00 in a research note on Wednesday, September 25th. Finally, Keefe, Bruyette & Woods lifted their target price on HBT Financial from $25.00 to $27.00 and gave the company an "outperform" rating in a research report on Wednesday, December 4th. One analyst has rated the stock with a sell rating, two have given a hold rating and two have given a buy rating to the company's stock. According to MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus target price of $24.40.

Check Out Our Latest Stock Analysis on HBT

About HBT Financial

(

Get Free Report)

HBT Financial, Inc operates as the bank holding company for Heartland Bank and Trust Company that provides business, commercial, and retail banking products and services to individuals, businesses, and municipal entities in Central and Northeastern Illinois, and Eastern Iowa. The company's deposits accounts consist of noninterest-bearing demand deposits, interest-bearing transaction accounts, money market accounts, savings accounts, certificates of deposits, health savings accounts, and individual retirement accounts.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider HBT Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HBT Financial wasn't on the list.

While HBT Financial currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.