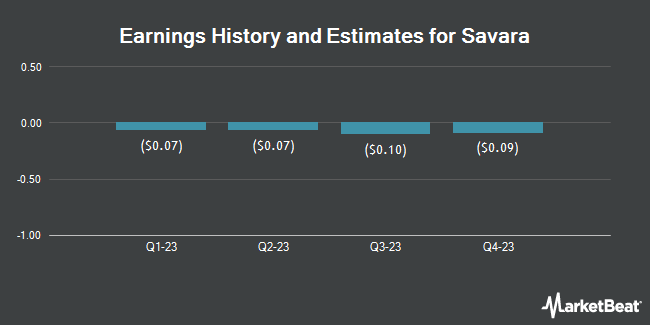

Savara Inc (NASDAQ:SVRA - Free Report) - Stock analysts at HC Wainwright increased their FY2024 earnings estimates for Savara in a research note issued on Wednesday, November 13th. HC Wainwright analyst A. Fein now forecasts that the company will earn ($0.46) per share for the year, up from their previous estimate of ($0.48). HC Wainwright currently has a "Buy" rating and a $6.00 price target on the stock. The consensus estimate for Savara's current full-year earnings is ($0.44) per share. HC Wainwright also issued estimates for Savara's Q4 2024 earnings at ($0.11) EPS, FY2025 earnings at ($0.49) EPS, FY2026 earnings at ($0.44) EPS, FY2027 earnings at ($0.25) EPS and FY2028 earnings at $0.00 EPS.

Savara (NASDAQ:SVRA - Get Free Report) last posted its quarterly earnings data on Tuesday, November 12th. The company reported ($0.11) earnings per share for the quarter, hitting the consensus estimate of ($0.11).

SVRA has been the subject of several other research reports. JMP Securities reaffirmed a "market outperform" rating and issued a $9.00 price objective on shares of Savara in a research note on Tuesday, October 1st. Evercore ISI reissued an "in-line" rating and set a $5.00 target price (down previously from $7.00) on shares of Savara in a research report on Wednesday. One analyst has rated the stock with a hold rating and five have issued a buy rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $10.17.

Read Our Latest Analysis on SVRA

Savara Trading Down 6.6 %

Shares of Savara stock traded down $0.21 on Friday, hitting $2.98. The stock had a trading volume of 3,586,571 shares, compared to its average volume of 1,223,730. The stock has a 50 day moving average of $3.91 and a 200 day moving average of $4.20. Savara has a twelve month low of $2.83 and a twelve month high of $5.70. The company has a debt-to-equity ratio of 0.13, a quick ratio of 11.31 and a current ratio of 17.70. The firm has a market capitalization of $511.43 million, a P/E ratio of -6.86 and a beta of 1.02.

Institutional Trading of Savara

Several hedge funds and other institutional investors have recently bought and sold shares of the stock. CANADA LIFE ASSURANCE Co purchased a new stake in shares of Savara in the first quarter worth $35,000. Choreo LLC bought a new position in shares of Savara during the second quarter valued at $59,000. DRW Securities LLC bought a new position in shares of Savara during the second quarter valued at $62,000. Principal Financial Group Inc. lifted its holdings in shares of Savara by 64.4% during the second quarter. Principal Financial Group Inc. now owns 17,795 shares of the company's stock valued at $72,000 after purchasing an additional 6,973 shares in the last quarter. Finally, Profund Advisors LLC bought a new position in shares of Savara during the second quarter valued at $105,000. Institutional investors own 87.93% of the company's stock.

About Savara

(

Get Free Report)

Savara Inc, formerly Mast Therapeutics, Inc, is a clinical-stage pharmaceutical company. The Company is focused on the development and commercialization of novel therapies for the treatment of patients with rare respiratory diseases. Its pipeline includes AeroVanc, Molgradex and AIR001. AeroVanc is an inhaled formulation of vancomycin, which the Company is developing for the treatment of persistent methicillin-resistant Staphylococcus aureus, lung infection in cystic fibrosis patients.

Read More

Before you consider Savara, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Savara wasn't on the list.

While Savara currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.