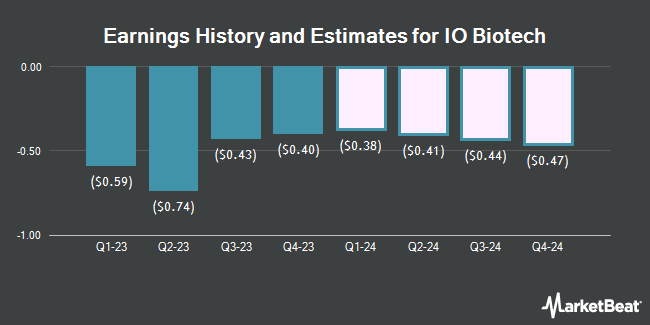

IO Biotech, Inc. (NASDAQ:IOBT - Free Report) - Equities research analysts at HC Wainwright decreased their FY2024 EPS estimates for shares of IO Biotech in a research note issued on Tuesday, November 12th. HC Wainwright analyst E. Bodnar now anticipates that the company will earn ($1.36) per share for the year, down from their previous forecast of ($1.32). HC Wainwright has a "Buy" rating and a $12.00 price target on the stock. The consensus estimate for IO Biotech's current full-year earnings is ($1.18) per share. HC Wainwright also issued estimates for IO Biotech's Q4 2024 earnings at ($0.39) EPS, FY2025 earnings at ($1.03) EPS, FY2026 earnings at ($0.88) EPS, FY2027 earnings at ($0.59) EPS and FY2028 earnings at ($0.27) EPS.

IOBT has been the subject of several other research reports. Morgan Stanley boosted their price target on shares of IO Biotech from $4.00 to $6.00 and gave the stock an "overweight" rating in a report on Monday, September 16th. Piper Sandler reiterated an "overweight" rating and set a $10.00 price target on shares of IO Biotech in a report on Tuesday, September 3rd.

Get Our Latest Analysis on IOBT

IO Biotech Trading Down 7.9 %

IOBT traded down $0.07 during trading hours on Friday, hitting $0.82. 376,834 shares of the company's stock were exchanged, compared to its average volume of 230,305. IO Biotech has a 12-month low of $0.73 and a 12-month high of $2.10. The firm has a market cap of $54.02 million, a P/E ratio of -0.60 and a beta of 0.42. The firm has a 50 day moving average of $1.09 and a 200 day moving average of $1.25.

IO Biotech (NASDAQ:IOBT - Get Free Report) last announced its earnings results on Tuesday, November 12th. The company reported ($0.36) earnings per share for the quarter, missing the consensus estimate of ($0.29) by ($0.07).

Institutional Inflows and Outflows

A hedge fund recently raised its stake in IO Biotech stock. Renaissance Technologies LLC increased its holdings in shares of IO Biotech, Inc. (NASDAQ:IOBT - Free Report) by 8.1% in the second quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 180,800 shares of the company's stock after purchasing an additional 13,600 shares during the period. Renaissance Technologies LLC owned 0.27% of IO Biotech worth $212,000 as of its most recent SEC filing. Institutional investors and hedge funds own 54.76% of the company's stock.

About IO Biotech

(

Get Free Report)

IO Biotech, Inc, a clinical-stage biopharmaceutical company, develops immune-modulating therapeutic cancer vaccines based on the T-win technology platform. The company's lead product candidate, IO102-IO103, which is designed to target immunosuppressive mechanisms mediated by Indoleamine 2,3-dehydrogenase (IDO), and programmed death-ligand (PD-L1) that is in phase 3 clinical trial to treat melanoma, as well as in phase 2 clinical trial to treat lung, head and neck, bladder, and melanoma cancer.

See Also

Before you consider IO Biotech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IO Biotech wasn't on the list.

While IO Biotech currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.