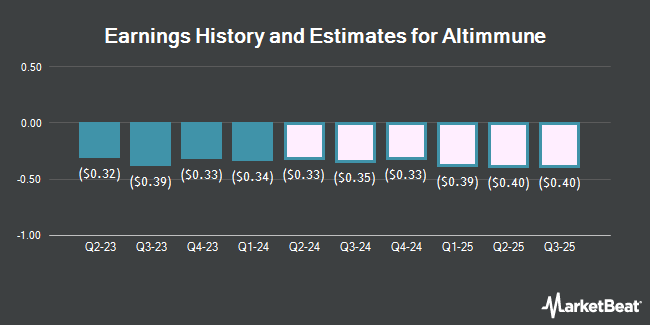

Altimmune, Inc. (NASDAQ:ALT - Free Report) - Research analysts at HC Wainwright decreased their FY2024 earnings estimates for shares of Altimmune in a research report issued on Wednesday, November 13th. HC Wainwright analyst P. Trucchio now anticipates that the company will post earnings of ($1.28) per share for the year, down from their previous forecast of ($1.25). HC Wainwright has a "Buy" rating and a $12.00 price objective on the stock. The consensus estimate for Altimmune's current full-year earnings is ($1.36) per share. HC Wainwright also issued estimates for Altimmune's Q1 2025 earnings at ($0.33) EPS, Q4 2025 earnings at ($0.33) EPS, FY2025 earnings at ($1.32) EPS, FY2026 earnings at ($1.45) EPS, FY2027 earnings at ($1.45) EPS and FY2028 earnings at ($0.15) EPS.

Altimmune (NASDAQ:ALT - Get Free Report) last released its quarterly earnings data on Tuesday, November 12th. The company reported ($0.32) EPS for the quarter, topping analysts' consensus estimates of ($0.35) by $0.03. The firm had revenue of $0.01 million for the quarter. Altimmune had a negative return on equity of 55.81% and a negative net margin of 199,076.92%. During the same quarter in the prior year, the company posted ($0.39) EPS.

A number of other research analysts have also commented on the company. Evercore ISI raised Altimmune to a "strong-buy" rating in a report on Friday, August 9th. UBS Group started coverage on shares of Altimmune in a research note on Tuesday, November 12th. They set a "buy" rating and a $26.00 target price for the company. Finally, B. Riley reaffirmed a "buy" rating and set a $20.00 price objective on shares of Altimmune in a research report on Monday, August 12th. Two equities research analysts have rated the stock with a hold rating, five have issued a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $20.00.

View Our Latest Analysis on ALT

Altimmune Trading Down 6.0 %

Altimmune stock traded down $0.46 during mid-day trading on Monday, hitting $7.15. 4,476,008 shares of the company's stock were exchanged, compared to its average volume of 3,874,781. Altimmune has a 1-year low of $2.41 and a 1-year high of $14.84. The stock has a 50 day moving average of $7.04 and a two-hundred day moving average of $6.91. The stock has a market cap of $508.54 million, a P/E ratio of -4.61 and a beta of 0.09.

Institutional Investors Weigh In On Altimmune

Several large investors have recently made changes to their positions in the company. Larson Financial Group LLC bought a new position in shares of Altimmune in the third quarter valued at approximately $31,000. CANADA LIFE ASSURANCE Co bought a new position in Altimmune in the 1st quarter valued at $44,000. TFO Wealth Partners LLC acquired a new position in Altimmune in the first quarter worth $51,000. Horizon Wealth Management LLC bought a new stake in shares of Altimmune during the second quarter worth $66,000. Finally, PFG Investments LLC acquired a new stake in shares of Altimmune in the second quarter valued at $67,000. Institutional investors own 78.05% of the company's stock.

About Altimmune

(

Get Free Report)

Altimmune, Inc, a clinical stage biopharmaceutical company, focuses on developing treatments for obesity and liver diseases. The company's lead product candidate, pemvidutide, a GLP-1/glucagon dual receptor agonist that is in Phase 2 trial for the treatment of obesity and metabolic dysfunction-associated steatohepatitis.

Further Reading

Before you consider Altimmune, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Altimmune wasn't on the list.

While Altimmune currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for March 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.