Arcellx (NASDAQ:ACLX - Free Report) had its target price hoisted by HC Wainwright from $80.00 to $95.00 in a research note published on Wednesday morning, Benzinga reports. The firm currently has a buy rating on the stock.

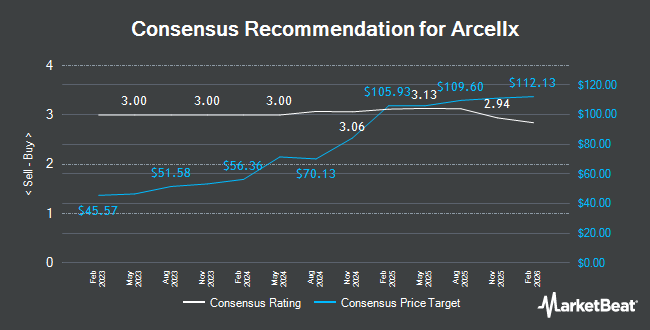

A number of other research analysts have also recently commented on ACLX. Morgan Stanley boosted their price target on Arcellx from $81.00 to $106.00 and gave the stock an "overweight" rating in a report on Wednesday. Needham & Company LLC reiterated a "buy" rating and issued a $96.00 price target on shares of Arcellx in a report on Thursday, October 31st. Stifel Nicolaus raised their price objective on Arcellx from $83.00 to $122.00 and gave the company a "buy" rating in a research report on Friday, October 18th. Robert W. Baird boosted their target price on Arcellx from $77.00 to $106.00 and gave the stock an "outperform" rating in a research report on Wednesday. Finally, Canaccord Genuity Group raised their target price on shares of Arcellx from $85.00 to $115.00 and gave the company a "buy" rating in a report on Thursday, October 17th. Thirteen investment analysts have rated the stock with a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, the stock has a consensus rating of "Buy" and an average target price of $95.85.

Read Our Latest Analysis on Arcellx

Arcellx Trading Up 6.8 %

Arcellx stock traded up $5.94 during trading hours on Wednesday, hitting $93.06. 836,268 shares of the stock traded hands, compared to its average volume of 474,700. Arcellx has a one year low of $43.50 and a one year high of $97.54. The firm's 50-day moving average price is $81.21 and its two-hundred day moving average price is $65.15. The company has a market cap of $5.00 billion, a PE ratio of -83.77 and a beta of 0.27.

Arcellx (NASDAQ:ACLX - Get Free Report) last posted its quarterly earnings data on Thursday, August 8th. The company reported ($0.51) EPS for the quarter, beating analysts' consensus estimates of ($0.52) by $0.01. The company had revenue of $27.38 million during the quarter, compared to analysts' expectations of $22.04 million. Arcellx had a negative return on equity of 12.42% and a negative net margin of 37.23%. The business's revenue for the quarter was up 91.5% on a year-over-year basis. On average, sell-side analysts expect that Arcellx will post -1.65 earnings per share for the current fiscal year.

Insider Transactions at Arcellx

In related news, Director Kavita Patel sold 1,500 shares of the stock in a transaction on Tuesday, October 22nd. The shares were sold at an average price of $89.69, for a total transaction of $134,535.00. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this link. In other news, insider Christopher Heery sold 21,684 shares of the company's stock in a transaction on Monday, August 26th. The shares were sold at an average price of $71.12, for a total transaction of $1,542,166.08. Following the transaction, the insider now directly owns 9,278 shares of the company's stock, valued at $659,851.36. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, Director Kavita Patel sold 1,500 shares of the company's stock in a transaction dated Tuesday, October 22nd. The stock was sold at an average price of $89.69, for a total transaction of $134,535.00. The disclosure for this sale can be found here. Insiders have sold a total of 70,556 shares of company stock worth $5,033,845 in the last quarter. Company insiders own 6.24% of the company's stock.

Institutional Inflows and Outflows

Several institutional investors have recently bought and sold shares of the business. Great Point Partners LLC raised its stake in shares of Arcellx by 64.0% in the 2nd quarter. Great Point Partners LLC now owns 492,000 shares of the company's stock valued at $27,153,000 after purchasing an additional 192,000 shares in the last quarter. Bamco Inc. NY raised its stake in Arcellx by 292.1% during the first quarter. Bamco Inc. NY now owns 248,993 shares of the company's stock worth $17,317,000 after acquiring an additional 185,493 shares during the period. Vanguard Group Inc. boosted its stake in Arcellx by 8.1% in the first quarter. Vanguard Group Inc. now owns 2,228,856 shares of the company's stock valued at $155,017,000 after acquiring an additional 167,037 shares during the period. Affinity Asset Advisors LLC grew its holdings in shares of Arcellx by 53.3% during the second quarter. Affinity Asset Advisors LLC now owns 460,000 shares of the company's stock valued at $25,387,000 after purchasing an additional 160,000 shares during the last quarter. Finally, Price T Rowe Associates Inc. MD raised its position in shares of Arcellx by 6.7% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 1,344,553 shares of the company's stock worth $93,514,000 after purchasing an additional 84,373 shares during the period. 96.03% of the stock is currently owned by institutional investors and hedge funds.

About Arcellx

(

Get Free Report)

Arcellx, Inc, together with its subsidiary, engages in the development of various immunotherapies for patients with cancer and other incurable diseases in the United States. The company's lead ddCAR product candidate is anitocabtagene autoleucel, which is in phase 2 clinical trial for the treatment of patients with relapsed or refractory multiple myeloma (rrMM).

Further Reading

Before you consider Arcellx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arcellx wasn't on the list.

While Arcellx currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.