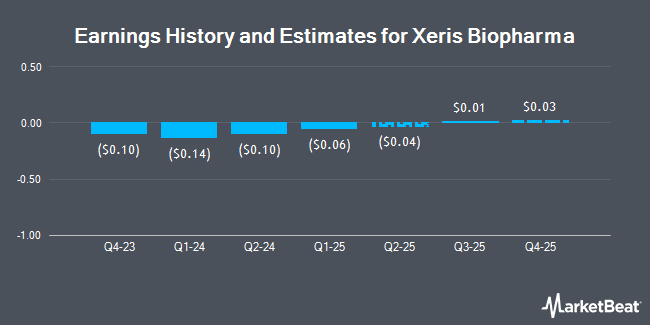

Xeris Biopharma Holdings, Inc. (NASDAQ:XERS - Free Report) - Research analysts at HC Wainwright decreased their FY2027 earnings per share estimates for shares of Xeris Biopharma in a research note issued on Monday, November 11th. HC Wainwright analyst O. Livnat now forecasts that the company will earn $0.19 per share for the year, down from their previous estimate of $0.27. HC Wainwright currently has a "Buy" rating and a $6.60 target price on the stock. The consensus estimate for Xeris Biopharma's current full-year earnings is ($0.40) per share.

Separately, Piper Sandler cut shares of Xeris Biopharma from an "overweight" rating to a "neutral" rating and set a $3.00 target price on the stock. in a report on Monday.

Read Our Latest Analysis on XERS

Xeris Biopharma Stock Down 4.6 %

Shares of NASDAQ XERS traded down $0.15 during trading on Tuesday, reaching $3.13. The company had a trading volume of 2,531,332 shares, compared to its average volume of 1,722,042. Xeris Biopharma has a 12-month low of $1.46 and a 12-month high of $3.64. The stock has a market cap of $466.37 million, a PE ratio of -6.80 and a beta of 2.70. The business's 50-day moving average is $2.97 and its 200 day moving average is $2.51.

Hedge Funds Weigh In On Xeris Biopharma

A number of hedge funds and other institutional investors have recently modified their holdings of XERS. Vanguard Group Inc. increased its position in Xeris Biopharma by 7.3% during the 1st quarter. Vanguard Group Inc. now owns 7,606,242 shares of the company's stock valued at $16,810,000 after purchasing an additional 519,897 shares during the period. SG Americas Securities LLC raised its holdings in Xeris Biopharma by 188.5% during the third quarter. SG Americas Securities LLC now owns 60,202 shares of the company's stock worth $172,000 after purchasing an additional 39,335 shares in the last quarter. Simplicity Wealth LLC purchased a new position in Xeris Biopharma during the second quarter worth $27,000. Bayesian Capital Management LP purchased a new position in shares of Xeris Biopharma in the 1st quarter worth about $37,000. Finally, Renaissance Technologies LLC grew its stake in Xeris Biopharma by 33.9% during the 2nd quarter. Renaissance Technologies LLC now owns 1,351,640 shares of the company's stock valued at $3,041,000 after purchasing an additional 342,300 shares in the last quarter. 42.75% of the stock is currently owned by hedge funds and other institutional investors.

About Xeris Biopharma

(

Get Free Report)

Xeris Biopharma Holdings, Inc, a biopharmaceutical company, engages in developing and commercializing therapies in Illinois. The company offers Gvoke, a ready-to-use liquid-stable glucagon for the treatment of severe hypoglycemia pediatric and adult patients; Keveyis, a therapy for the treatment of hyperkalemic, hypokalemic, and related variants of primary periodic paralysis; and Recorlev, a cortisol synthesis inhibitor proved for the treatment of endogenous hypercortisolemia in adult patients with Cushing's syndrome.

See Also

Before you consider Xeris Biopharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Xeris Biopharma wasn't on the list.

While Xeris Biopharma currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.