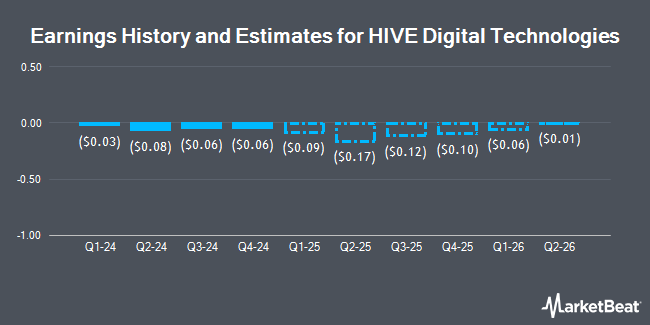

HIVE Digital Technologies Ltd. (NASDAQ:HIVE - Free Report) - Equities researchers at HC Wainwright raised their FY2025 EPS estimates for shares of HIVE Digital Technologies in a research note issued on Thursday, November 14th. HC Wainwright analyst M. Colonnese now forecasts that the company will post earnings per share of ($0.33) for the year, up from their prior estimate of ($0.35). HC Wainwright has a "Buy" rating and a $8.00 price target on the stock. The consensus estimate for HIVE Digital Technologies' current full-year earnings is ($0.27) per share. HC Wainwright also issued estimates for HIVE Digital Technologies' Q4 2025 earnings at ($0.07) EPS and Q4 2026 earnings at $0.03 EPS.

HIVE Digital Technologies (NASDAQ:HIVE - Get Free Report) last posted its quarterly earnings data on Tuesday, November 12th. The company reported ($0.06) EPS for the quarter, topping analysts' consensus estimates of ($0.09) by $0.03. The business had revenue of $22.65 million for the quarter, compared to analyst estimates of $25.32 million. HIVE Digital Technologies had a negative return on equity of 10.78% and a negative net margin of 12.04%. During the same period in the previous year, the company posted ($0.29) earnings per share.

HIVE has been the subject of several other reports. Canaccord Genuity Group upped their target price on shares of HIVE Digital Technologies from $6.00 to $7.00 and gave the company a "buy" rating in a research note on Thursday. Northland Securities lifted their target price on HIVE Digital Technologies from $5.50 to $7.00 and gave the stock an "outperform" rating in a research report on Thursday. Cantor Fitzgerald initiated coverage on HIVE Digital Technologies in a report on Tuesday, October 29th. They issued an "overweight" rating and a $9.00 price target for the company. Finally, Northland Capmk raised HIVE Digital Technologies to a "strong-buy" rating in a report on Thursday, September 19th. One analyst has rated the stock with a sell rating, five have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average price target of $7.40.

Check Out Our Latest Stock Analysis on HIVE

HIVE Digital Technologies Stock Performance

Shares of HIVE stock traded down $0.11 during trading hours on Monday, reaching $4.32. 4,790,618 shares of the company's stock were exchanged, compared to its average volume of 3,573,193. HIVE Digital Technologies has a fifty-two week low of $2.18 and a fifty-two week high of $5.74. The company has a quick ratio of 7.35, a current ratio of 5.56 and a debt-to-equity ratio of 0.06. The stock has a market capitalization of $547.91 million, a P/E ratio of -30.85 and a beta of 3.43. The business has a fifty day moving average price of $3.57 and a 200-day moving average price of $3.23.

Institutional Trading of HIVE Digital Technologies

A number of large investors have recently bought and sold shares of the stock. Lifeworks Advisors LLC acquired a new stake in shares of HIVE Digital Technologies in the 3rd quarter valued at $35,000. Vanguard Personalized Indexing Management LLC acquired a new position in HIVE Digital Technologies in the second quarter valued at about $36,000. Gladstone Institutional Advisory LLC bought a new stake in HIVE Digital Technologies during the third quarter worth about $44,000. Quadrature Capital Ltd acquired a new stake in shares of HIVE Digital Technologies during the third quarter worth approximately $50,000. Finally, Wellington Management Group LLP bought a new position in shares of HIVE Digital Technologies in the third quarter valued at approximately $120,000. 24.42% of the stock is currently owned by institutional investors.

HIVE Digital Technologies Company Profile

(

Get Free Report)

HIVE Digital Technologies Ltd. operates as a cryptocurrency mining company in Canada, Sweden, and Iceland. The company engages in the mining and sale of digital currencies, including Ethereum Classic, Bitcoin, and other coins. It also operates data centers; and offers infrastructure solutions. The company was formerly known as HIVE Blockchain Technologies Ltd.

See Also

Before you consider HIVE Digital Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HIVE Digital Technologies wasn't on the list.

While HIVE Digital Technologies currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.