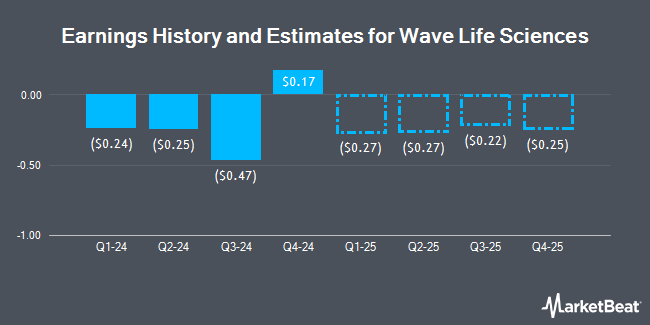

Wave Life Sciences Ltd. (NASDAQ:WVE - Free Report) - Equities researchers at HC Wainwright dropped their FY2024 EPS estimates for shares of Wave Life Sciences in a note issued to investors on Wednesday, November 13th. HC Wainwright analyst A. Fein now forecasts that the company will post earnings of ($1.37) per share for the year, down from their previous estimate of ($1.27). HC Wainwright currently has a "Buy" rating and a $22.00 price target on the stock. The consensus estimate for Wave Life Sciences' current full-year earnings is ($1.14) per share. HC Wainwright also issued estimates for Wave Life Sciences' FY2025 earnings at ($0.74) EPS, FY2026 earnings at $0.08 EPS and FY2027 earnings at $0.71 EPS.

A number of other analysts also recently weighed in on WVE. Truist Financial increased their target price on shares of Wave Life Sciences from $17.00 to $36.00 and gave the company a "buy" rating in a research report on Tuesday, November 12th. JPMorgan Chase & Co. raised their price objective on Wave Life Sciences from $13.00 to $17.00 and gave the company an "overweight" rating in a research note on Thursday, October 17th. Wells Fargo & Company lifted their target price on Wave Life Sciences from $11.00 to $22.00 and gave the stock an "overweight" rating in a research note on Wednesday, October 16th. StockNews.com lowered Wave Life Sciences from a "hold" rating to a "sell" rating in a report on Wednesday, November 13th. Finally, Leerink Partners lifted their price objective on Wave Life Sciences from $20.00 to $22.00 and gave the stock an "outperform" rating in a report on Wednesday, October 16th. One analyst has rated the stock with a sell rating, one has issued a hold rating, eight have assigned a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average target price of $21.89.

Get Our Latest Report on Wave Life Sciences

Wave Life Sciences Stock Performance

Shares of Wave Life Sciences stock traded down $0.82 on Monday, hitting $12.85. The stock had a trading volume of 1,694,480 shares, compared to its average volume of 1,117,034. The stock has a 50 day moving average of $10.76 and a 200 day moving average of $7.55. Wave Life Sciences has a twelve month low of $3.50 and a twelve month high of $16.74. The firm has a market capitalization of $1.96 billion, a P/E ratio of -12.17 and a beta of -1.20.

Insiders Place Their Bets

In related news, CEO Paul Bolno sold 48,366 shares of the company's stock in a transaction that occurred on Wednesday, August 21st. The stock was sold at an average price of $5.78, for a total value of $279,555.48. Following the sale, the chief executive officer now owns 359,059 shares in the company, valued at $2,075,361.02. This represents a 11.87 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, major shareholder Plc Gsk acquired 2,791,930 shares of the stock in a transaction on Friday, September 27th. The stock was bought at an average price of $8.00 per share, for a total transaction of $22,335,440.00. Following the transaction, the insider now owns 16,775,691 shares in the company, valued at approximately $134,205,528. This represents a 19.97 % increase in their position. The disclosure for this purchase can be found here. Insiders sold 452,056 shares of company stock valued at $5,955,438 over the last three months. 29.10% of the stock is owned by company insiders.

Institutional Inflows and Outflows

Several large investors have recently made changes to their positions in the business. Mirae Asset Global Investments Co. Ltd. lifted its holdings in shares of Wave Life Sciences by 23.4% in the 3rd quarter. Mirae Asset Global Investments Co. Ltd. now owns 4,512 shares of the company's stock worth $37,000 after acquiring an additional 856 shares during the last quarter. Ameritas Investment Partners Inc. raised its holdings in shares of Wave Life Sciences by 50.2% in the 1st quarter. Ameritas Investment Partners Inc. now owns 7,334 shares of the company's stock valued at $45,000 after purchasing an additional 2,451 shares in the last quarter. Profund Advisors LLC acquired a new stake in shares of Wave Life Sciences in the 2nd quarter valued at $53,000. Point72 DIFC Ltd acquired a new stake in shares of Wave Life Sciences in the 3rd quarter valued at $98,000. Finally, Principal Financial Group Inc. purchased a new position in shares of Wave Life Sciences in the 2nd quarter valued at $74,000. 89.73% of the stock is owned by institutional investors and hedge funds.

Wave Life Sciences Company Profile

(

Get Free Report)

Wave Life Sciences Ltd., a clinical-stage biotechnology company, designs, develops, and commercializes ribonucleic acid (RNA) medicines through PRISM, a discovery and drug development platform. The company's RNA medicines platform, PRISM, combines multiple modalities, chemistry innovation, and deep insights into human genetics to deliver scientific breakthroughs that treat both rare and prevalent disorders.

Read More

Before you consider Wave Life Sciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wave Life Sciences wasn't on the list.

While Wave Life Sciences currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.