Calumet Specialty Products Partners, L.P. (NASDAQ:CLMT - Free Report) - Research analysts at HC Wainwright cut their FY2026 earnings estimates for shares of Calumet Specialty Products Partners in a note issued to investors on Monday, November 11th. HC Wainwright analyst A. Dayal now forecasts that the oil and gas company will post earnings of $1.86 per share for the year, down from their prior estimate of $1.89. HC Wainwright has a "Buy" rating and a $25.00 price objective on the stock. The consensus estimate for Calumet Specialty Products Partners' current full-year earnings is ($2.17) per share. HC Wainwright also issued estimates for Calumet Specialty Products Partners' FY2027 earnings at $2.40 EPS and FY2028 earnings at $2.68 EPS.

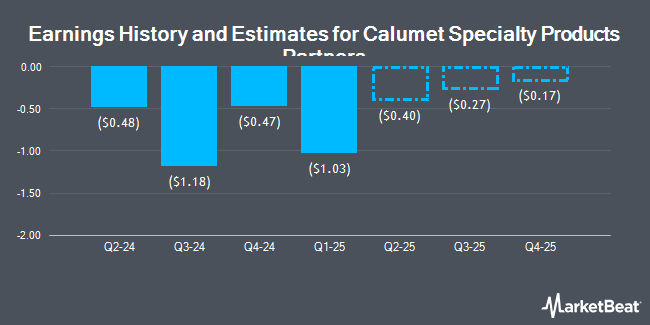

Calumet Specialty Products Partners (NASDAQ:CLMT - Get Free Report) last released its earnings results on Friday, November 8th. The oil and gas company reported ($1.18) earnings per share for the quarter, missing the consensus estimate of ($0.59) by ($0.59). The business had revenue of $1.10 billion during the quarter, compared to analysts' expectations of $888.36 million. The company's revenue for the quarter was down 4.3% on a year-over-year basis. During the same quarter last year, the firm earned $0.03 earnings per share.

Several other equities research analysts have also weighed in on the stock. StockNews.com assumed coverage on shares of Calumet Specialty Products Partners in a report on Wednesday, October 23rd. They issued a "sell" rating on the stock. Wells Fargo & Company lifted their target price on Calumet Specialty Products Partners from $25.00 to $29.00 and gave the stock an "overweight" rating in a report on Monday, October 21st. TD Cowen dropped their price target on Calumet Specialty Products Partners from $27.00 to $26.00 and set a "buy" rating on the stock in a research report on Monday. Finally, The Goldman Sachs Group decreased their price objective on Calumet Specialty Products Partners from $17.00 to $15.00 and set a "buy" rating for the company in a research report on Monday, August 5th. One investment analyst has rated the stock with a sell rating and four have given a buy rating to the company's stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $23.75.

Get Our Latest Report on CLMT

Calumet Specialty Products Partners Trading Up 0.4 %

Shares of NASDAQ:CLMT traded up $0.09 during mid-day trading on Wednesday, reaching $20.42. The stock had a trading volume of 221,279 shares, compared to its average volume of 393,728. The firm has a 50 day simple moving average of $19.40 and a two-hundred day simple moving average of $17.04. Calumet Specialty Products Partners has a twelve month low of $9.97 and a twelve month high of $25.29. The firm has a market cap of $1.75 billion, a PE ratio of -7.37 and a beta of 1.90.

Hedge Funds Weigh In On Calumet Specialty Products Partners

Several hedge funds have recently made changes to their positions in the business. Founders Financial Alliance LLC boosted its holdings in shares of Calumet Specialty Products Partners by 8.4% in the 2nd quarter. Founders Financial Alliance LLC now owns 48,400 shares of the oil and gas company's stock valued at $777,000 after buying an additional 3,750 shares during the last quarter. Creative Planning grew its position in shares of Calumet Specialty Products Partners by 46.4% in the 2nd quarter. Creative Planning now owns 62,459 shares of the oil and gas company's stock valued at $1,002,000 after acquiring an additional 19,800 shares during the period. DRW Securities LLC acquired a new position in shares of Calumet Specialty Products Partners during the 2nd quarter worth about $898,000. Wedbush Securities Inc. bought a new stake in shares of Calumet Specialty Products Partners in the 2nd quarter valued at about $169,000. Finally, Wasserstein Debt Opportunities Management L.P. lifted its stake in Calumet Specialty Products Partners by 2.9% in the 2nd quarter. Wasserstein Debt Opportunities Management L.P. now owns 6,891,314 shares of the oil and gas company's stock valued at $110,606,000 after purchasing an additional 193,063 shares during the last quarter. 34.41% of the stock is owned by institutional investors.

About Calumet Specialty Products Partners

(

Get Free Report)

Calumet, Inc manufactures, formulates, and markets a diversified slate of specialty branded products and renewable fuels to various consumer-facing and industrial markets in North America and internationally. It operates through Specialty Products and Solutions; Montana/Renewables; and Performance brands segments.

Read More

Before you consider Calumet Specialty Products Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Calumet Specialty Products Partners wasn't on the list.

While Calumet Specialty Products Partners currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.