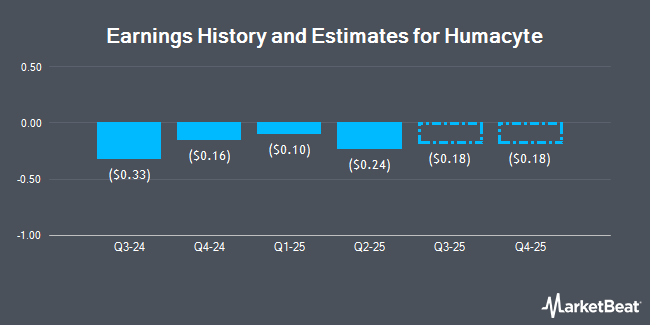

Humacyte, Inc. (NASDAQ:HUMA - Free Report) - Analysts at HC Wainwright decreased their FY2024 earnings per share estimates for Humacyte in a research report issued on Wednesday, November 13th. HC Wainwright analyst V. Bernardino now expects that the company will earn ($1.36) per share for the year, down from their prior forecast of ($1.28). HC Wainwright has a "Buy" rating and a $12.00 price objective on the stock. The consensus estimate for Humacyte's current full-year earnings is ($1.22) per share. HC Wainwright also issued estimates for Humacyte's FY2025 earnings at ($0.77) EPS.

A number of other equities analysts also recently commented on the company. Cantor Fitzgerald reissued an "overweight" rating and set a $13.00 price objective on shares of Humacyte in a research report on Friday, September 20th. TD Cowen restated a "buy" rating and issued a $10.00 price objective on shares of Humacyte in a report on Friday, October 18th. BTIG Research reiterated a "buy" rating and set a $10.00 target price on shares of Humacyte in a research note on Friday, October 18th. EF Hutton Acquisition Co. I upgraded Humacyte to a "strong-buy" rating in a research note on Monday, September 9th. Finally, Piper Sandler set a $6.00 price objective on Humacyte and gave the stock a "neutral" rating in a research report on Friday, October 18th. One research analyst has rated the stock with a hold rating, five have assigned a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, Humacyte currently has a consensus rating of "Buy" and a consensus price target of $11.00.

Read Our Latest Report on HUMA

Humacyte Price Performance

Shares of NASDAQ HUMA remained flat at $4.84 during mid-day trading on Friday. The stock had a trading volume of 3,097,970 shares, compared to its average volume of 2,394,560. Humacyte has a twelve month low of $2.35 and a twelve month high of $9.97. The stock has a market cap of $577.06 million, a P/E ratio of -3.61 and a beta of 1.47. The company has a quick ratio of 5.41, a current ratio of 1.10 and a debt-to-equity ratio of 0.61. The business's fifty day moving average price is $5.43 and its 200-day moving average price is $6.16.

Humacyte (NASDAQ:HUMA - Get Free Report) last issued its quarterly earnings results on Tuesday, August 13th. The company reported ($0.27) EPS for the quarter, missing the consensus estimate of ($0.23) by ($0.04).

Institutional Investors Weigh In On Humacyte

Several institutional investors have recently modified their holdings of the company. State Street Corp raised its holdings in Humacyte by 66.1% during the third quarter. State Street Corp now owns 4,764,155 shares of the company's stock worth $25,917,000 after purchasing an additional 1,895,529 shares during the last quarter. Vanguard Group Inc. increased its position in shares of Humacyte by 28.7% in the first quarter. Vanguard Group Inc. now owns 4,019,681 shares of the company's stock valued at $12,501,000 after buying an additional 896,415 shares in the last quarter. Millennium Management LLC raised its stake in shares of Humacyte by 504.3% during the 2nd quarter. Millennium Management LLC now owns 1,599,307 shares of the company's stock worth $7,677,000 after buying an additional 1,334,641 shares during the last quarter. Charles Schwab Investment Management Inc. boosted its position in shares of Humacyte by 10.2% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 721,318 shares of the company's stock worth $3,924,000 after buying an additional 66,946 shares in the last quarter. Finally, Renaissance Technologies LLC grew its stake in Humacyte by 693.0% in the 2nd quarter. Renaissance Technologies LLC now owns 600,300 shares of the company's stock valued at $2,881,000 after acquiring an additional 524,600 shares during the last quarter. Hedge funds and other institutional investors own 44.71% of the company's stock.

Insider Activity at Humacyte

In other news, CEO Laura E. Niklason sold 277,090 shares of the stock in a transaction dated Wednesday, August 28th. The shares were sold at an average price of $6.47, for a total value of $1,792,772.30. Following the completion of the transaction, the chief executive officer now owns 4,029,374 shares in the company, valued at $26,070,049.78. This trade represents a 6.43 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, Director Brady W. Dougan sold 252,676 shares of the business's stock in a transaction dated Tuesday, August 27th. The stock was sold at an average price of $6.71, for a total transaction of $1,695,455.96. Following the sale, the director now directly owns 4,306,464 shares in the company, valued at approximately $28,896,373.44. This represents a 5.54 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 1,084,153 shares of company stock valued at $6,869,996 in the last three months. 11.20% of the stock is currently owned by company insiders.

Humacyte Company Profile

(

Get Free Report)

Humacyte, Inc engages in the development and manufacture of off-the-shelf, implantable, and bioengineered human tissues for the treatment of diseases and conditions across a range of anatomic locations in multiple therapeutic areas. The company using its proprietary and scientific technology platform to engineer and manufacture human acellular vessels (HAVs) to be implanted into patient without inducing a foreign body response or leading to immune rejection.

Featured Stories

Before you consider Humacyte, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Humacyte wasn't on the list.

While Humacyte currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.