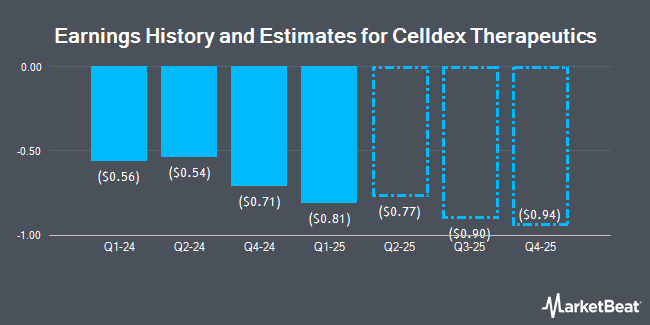

Celldex Therapeutics, Inc. (NASDAQ:CLDX - Free Report) - Analysts at HC Wainwright upped their FY2024 earnings per share (EPS) estimates for shares of Celldex Therapeutics in a note issued to investors on Thursday, November 7th. HC Wainwright analyst J. Pantginis now anticipates that the biopharmaceutical company will earn ($2.39) per share for the year, up from their previous estimate of ($2.48). HC Wainwright has a "Buy" rating and a $80.00 price target on the stock. The consensus estimate for Celldex Therapeutics' current full-year earnings is ($2.50) per share. HC Wainwright also issued estimates for Celldex Therapeutics' Q4 2024 earnings at ($0.66) EPS and FY2025 earnings at ($3.02) EPS.

Celldex Therapeutics (NASDAQ:CLDX - Get Free Report) last posted its quarterly earnings data on Thursday, August 8th. The biopharmaceutical company reported ($0.54) EPS for the quarter, beating the consensus estimate of ($0.59) by $0.05. Celldex Therapeutics had a negative return on equity of 19.75% and a negative net margin of 1,544.32%. The firm had revenue of $2.50 million during the quarter, compared to the consensus estimate of $1.13 million.

A number of other brokerages also recently issued reports on CLDX. The Goldman Sachs Group started coverage on Celldex Therapeutics in a research note on Monday, September 30th. They issued a "neutral" rating and a $45.00 target price for the company. Cantor Fitzgerald reaffirmed an "overweight" rating and issued a $67.00 target price on shares of Celldex Therapeutics in a research note on Monday, September 16th. Citigroup started coverage on Celldex Therapeutics in a research note on Monday, October 7th. They issued a "buy" rating and a $70.00 target price for the company. Wolfe Research downgraded Celldex Therapeutics from an "outperform" rating to a "peer perform" rating in a research note on Friday, September 27th. Finally, Wells Fargo & Company raised Celldex Therapeutics from a "hold" rating to a "strong-buy" rating in a research note on Thursday, September 26th. Two research analysts have rated the stock with a hold rating, six have given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, Celldex Therapeutics presently has an average rating of "Moderate Buy" and a consensus price target of $62.25.

Check Out Our Latest Stock Analysis on CLDX

Celldex Therapeutics Price Performance

NASDAQ CLDX traded down $0.43 during mid-day trading on Monday, hitting $25.79. The stock had a trading volume of 357,527 shares, compared to its average volume of 869,801. Celldex Therapeutics has a twelve month low of $24.43 and a twelve month high of $53.18. The stock has a market capitalization of $1.71 billion, a price-to-earnings ratio of -10.16 and a beta of 1.60. The firm's 50 day moving average is $33.60 and its 200 day moving average is $35.79.

Hedge Funds Weigh In On Celldex Therapeutics

Hedge funds have recently modified their holdings of the business. KBC Group NV grew its holdings in shares of Celldex Therapeutics by 31.2% during the 3rd quarter. KBC Group NV now owns 2,081 shares of the biopharmaceutical company's stock worth $71,000 after purchasing an additional 495 shares during the period. Point72 Asia Singapore Pte. Ltd. purchased a new position in Celldex Therapeutics during the 2nd quarter valued at about $76,000. Headlands Technologies LLC purchased a new position in Celldex Therapeutics during the 1st quarter valued at about $147,000. CANADA LIFE ASSURANCE Co boosted its holdings in Celldex Therapeutics by 26.4% during the 1st quarter. CANADA LIFE ASSURANCE Co now owns 4,570 shares of the biopharmaceutical company's stock valued at $192,000 after acquiring an additional 955 shares during the period. Finally, Ameritas Investment Partners Inc. boosted its holdings in Celldex Therapeutics by 34.3% during the 1st quarter. Ameritas Investment Partners Inc. now owns 6,198 shares of the biopharmaceutical company's stock valued at $260,000 after acquiring an additional 1,582 shares during the period.

Celldex Therapeutics Company Profile

(

Get Free Report)

Celldex Therapeutics, Inc, a biopharmaceutical company, engages in developing therapeutic monoclonal and bispecific antibodies for the treatment of various diseases. Its drug candidates include antibody-based therapeutics to treat patients with inflammatory, allergic, autoimmune, and other devastating diseases.

Recommended Stories

Before you consider Celldex Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Celldex Therapeutics wasn't on the list.

While Celldex Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.