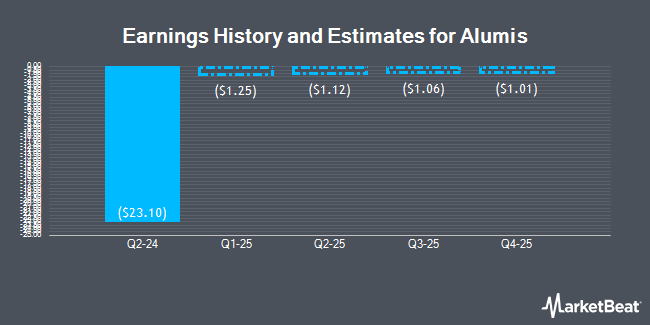

Alumis Inc. (NASDAQ:ALMS - Free Report) - Equities researchers at HC Wainwright raised their FY2024 earnings estimates for shares of Alumis in a note issued to investors on Thursday, November 14th. HC Wainwright analyst M. Kapoor now anticipates that the company will post earnings of ($9.75) per share for the year, up from their prior estimate of ($11.42). HC Wainwright currently has a "Buy" rating and a $26.00 price target on the stock. The consensus estimate for Alumis' current full-year earnings is ($7.98) per share. HC Wainwright also issued estimates for Alumis' Q4 2024 earnings at ($1.39) EPS, Q1 2025 earnings at ($1.40) EPS, Q2 2025 earnings at ($1.41) EPS, Q3 2025 earnings at ($1.43) EPS, Q4 2025 earnings at ($1.45) EPS and FY2025 earnings at ($5.68) EPS.

Several other equities research analysts have also weighed in on ALMS. Leerink Partnrs raised Alumis to a "strong-buy" rating in a report on Tuesday, July 23rd. Robert W. Baird initiated coverage on shares of Alumis in a research report on Thursday, October 31st. They set an "outperform" rating and a $25.00 target price for the company. Guggenheim initiated coverage on Alumis in a research note on Tuesday, July 23rd. They issued a "buy" rating and a $32.00 target price for the company. Baird R W raised Alumis to a "strong-buy" rating in a research note on Thursday, October 31st. Finally, Leerink Partners started coverage on shares of Alumis in a research note on Tuesday, July 23rd. They issued an "outperform" rating and a $29.00 target price on the stock. Six analysts have rated the stock with a buy rating and two have assigned a strong buy rating to the company's stock. Based on data from MarketBeat, Alumis presently has a consensus rating of "Buy" and an average target price of $26.83.

Read Our Latest Analysis on Alumis

Alumis Trading Down 2.4 %

Shares of NASDAQ:ALMS traded down $0.21 during mid-day trading on Monday, reaching $8.64. The company had a trading volume of 91,172 shares, compared to its average volume of 151,026. The company has a 50-day simple moving average of $11.22. Alumis has a one year low of $8.23 and a one year high of $13.53.

Institutional Inflows and Outflows

Several institutional investors have recently made changes to their positions in ALMS. Samsara BioCapital LLC purchased a new position in shares of Alumis during the third quarter valued at approximately $34,886,000. SR One Capital Management LP purchased a new position in Alumis in the second quarter worth about $26,067,000. Yu Fan bought a new position in shares of Alumis in the second quarter worth approximately $10,502,000. Ally Bridge Group NY LLC bought a new stake in shares of Alumis during the second quarter valued at approximately $8,229,000. Finally, Towerview LLC raised its holdings in Alumis by 22.6% in the 3rd quarter. Towerview LLC now owns 380,000 shares of the company's stock worth $4,058,000 after acquiring an additional 70,000 shares during the last quarter.

About Alumis

(

Get Free Report)

Our mission is to significantly improve the lives of patients by replacing broad immunosuppression with targeted therapies. Our name, Alumis, captures our mission to enlighten immunology, and is inspired by the words "allumer"-French for illuminate-and "immunis"-Latin for the immune system. We are a clinical stage biopharmaceutical company with an initial focus on developing our two Tyrosine Kinase 2 (TYK2) inhibitors: ESK-001, a second-generation inhibitor that we are developing to maximize target inhibition and optimize tolerability, and A-005, a central nervous system (CNS) penetrant molecule.

Further Reading

Before you consider Alumis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alumis wasn't on the list.

While Alumis currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.