Akero Therapeutics, Inc. (NASDAQ:AKRO - Free Report) - Stock analysts at HC Wainwright upped their FY2028 earnings per share estimates for Akero Therapeutics in a report issued on Monday, November 11th. HC Wainwright analyst E. Arce now expects that the company will earn $1.66 per share for the year, up from their previous estimate of $1.47. HC Wainwright has a "Buy" rating and a $50.00 price objective on the stock. The consensus estimate for Akero Therapeutics' current full-year earnings is ($3.70) per share.

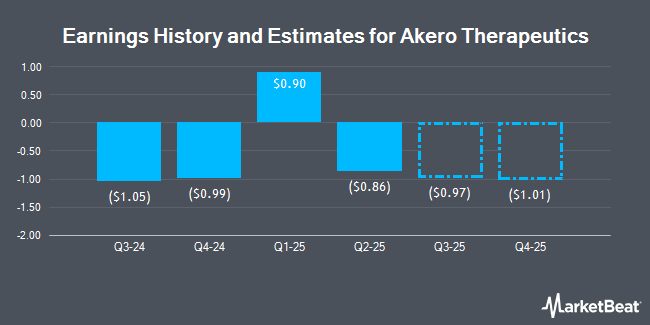

Akero Therapeutics (NASDAQ:AKRO - Get Free Report) last announced its quarterly earnings data on Friday, November 8th. The company reported ($1.05) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.90) by ($0.15).

Akero Therapeutics Trading Down 2.5 %

Shares of NASDAQ:AKRO traded down $0.82 on Wednesday, reaching $31.56. 221,256 shares of the company traded hands, compared to its average volume of 865,385. The business's 50-day simple moving average is $29.27 and its 200 day simple moving average is $25.46. Akero Therapeutics has a 52 week low of $13.86 and a 52 week high of $37.00. The company has a quick ratio of 24.89, a current ratio of 17.25 and a debt-to-equity ratio of 0.05.

Insider Activity

In related news, CEO Andrew Cheng sold 1,738 shares of the firm's stock in a transaction dated Tuesday, September 10th. The stock was sold at an average price of $26.18, for a total value of $45,500.84. Following the sale, the chief executive officer now directly owns 605,417 shares of the company's stock, valued at $15,849,817.06. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. In other Akero Therapeutics news, CEO Andrew Cheng sold 1,738 shares of the firm's stock in a transaction dated Tuesday, September 10th. The shares were sold at an average price of $26.18, for a total value of $45,500.84. Following the completion of the sale, the chief executive officer now directly owns 605,417 shares in the company, valued at $15,849,817.06. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at this link. Also, CFO William Richard White sold 75,159 shares of the firm's stock in a transaction dated Monday, August 26th. The stock was sold at an average price of $27.21, for a total transaction of $2,045,076.39. Following the completion of the sale, the chief financial officer now owns 41,791 shares of the company's stock, valued at $1,137,133.11. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 428,397 shares of company stock valued at $12,997,971. 7.94% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

Large investors have recently modified their holdings of the company. Vanguard Group Inc. lifted its stake in Akero Therapeutics by 19.0% in the 1st quarter. Vanguard Group Inc. now owns 3,669,923 shares of the company's stock worth $92,702,000 after purchasing an additional 584,875 shares in the last quarter. Perceptive Advisors LLC boosted its stake in shares of Akero Therapeutics by 8.1% during the second quarter. Perceptive Advisors LLC now owns 1,499,897 shares of the company's stock valued at $35,188,000 after purchasing an additional 112,426 shares in the last quarter. Bank of New York Mellon Corp boosted its stake in shares of Akero Therapeutics by 32.8% during the second quarter. Bank of New York Mellon Corp now owns 251,234 shares of the company's stock valued at $5,894,000 after purchasing an additional 61,988 shares in the last quarter. The Manufacturers Life Insurance Company boosted its stake in shares of Akero Therapeutics by 26.1% during the second quarter. The Manufacturers Life Insurance Company now owns 107,172 shares of the company's stock valued at $2,514,000 after purchasing an additional 22,195 shares in the last quarter. Finally, Rheos Capital Works Inc. boosted its stake in shares of Akero Therapeutics by 27.8% during the third quarter. Rheos Capital Works Inc. now owns 276,000 shares of the company's stock valued at $7,918,000 after purchasing an additional 60,000 shares in the last quarter.

Akero Therapeutics Company Profile

(

Get Free Report)

Akero Therapeutics, Inc, together with its subsidiary, engages in the development of treatments for patients with serious metabolic diseases in the United States. The company's lead product candidate is efruxifermin (EFX), which is in Phase 3 clinical trials that protects against cellular stress and regulates the metabolism of lipids, carbohydrates, and proteins throughout the body for the treatment of biopsy-confirmed metabolic dysfunction-associated steatohepatitis (MASH) patients.

Featured Articles

Before you consider Akero Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Akero Therapeutics wasn't on the list.

While Akero Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.