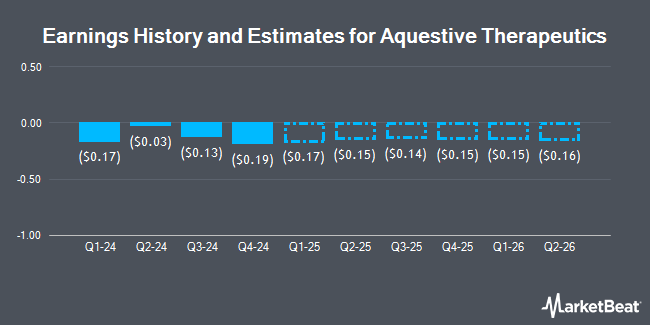

Aquestive Therapeutics, Inc. (NASDAQ:AQST - Free Report) - HC Wainwright decreased their Q2 2025 earnings estimates for shares of Aquestive Therapeutics in a research report issued to clients and investors on Wednesday, November 6th. HC Wainwright analyst R. Selvaraju now expects that the company will earn ($0.15) per share for the quarter, down from their prior forecast of ($0.14). HC Wainwright has a "Buy" rating and a $10.00 price objective on the stock. The consensus estimate for Aquestive Therapeutics' current full-year earnings is ($0.48) per share. HC Wainwright also issued estimates for Aquestive Therapeutics' FY2025 earnings at ($0.59) EPS.

Several other equities analysts have also recently issued reports on the company. Leerink Partners raised their price objective on Aquestive Therapeutics from $12.00 to $13.00 and gave the stock an "outperform" rating in a research note on Friday, October 25th. JMP Securities restated a "market outperform" rating and issued a $9.00 price target on shares of Aquestive Therapeutics in a research report on Tuesday, October 8th. Six research analysts have rated the stock with a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, Aquestive Therapeutics presently has an average rating of "Buy" and an average target price of $8.83.

Get Our Latest Stock Report on Aquestive Therapeutics

Aquestive Therapeutics Stock Up 7.5 %

Shares of AQST traded up $0.38 during mid-day trading on Friday, hitting $5.46. The stock had a trading volume of 1,741,806 shares, compared to its average volume of 1,753,536. Aquestive Therapeutics has a fifty-two week low of $1.55 and a fifty-two week high of $6.23. The company has a market cap of $497.19 million, a PE ratio of -12.13 and a beta of 2.82. The company's fifty day simple moving average is $4.94 and its two-hundred day simple moving average is $3.85.

Aquestive Therapeutics (NASDAQ:AQST - Get Free Report) last posted its quarterly earnings results on Monday, November 4th. The company reported ($0.13) EPS for the quarter, missing analysts' consensus estimates of ($0.12) by ($0.01). The company had revenue of $13.54 million during the quarter, compared to analyst estimates of $12.69 million. During the same period last year, the business earned ($0.03) EPS.

Institutional Investors Weigh In On Aquestive Therapeutics

Several large investors have recently added to or reduced their stakes in AQST. GSA Capital Partners LLP boosted its holdings in shares of Aquestive Therapeutics by 525.5% during the third quarter. GSA Capital Partners LLP now owns 137,151 shares of the company's stock valued at $683,000 after acquiring an additional 115,223 shares during the period. Chartwell Investment Partners LLC acquired a new stake in shares of Aquestive Therapeutics in the 3rd quarter worth about $535,000. Cahill Wealth Management LLC boosted its stake in Aquestive Therapeutics by 20.6% during the 3rd quarter. Cahill Wealth Management LLC now owns 142,941 shares of the company's stock valued at $712,000 after purchasing an additional 24,380 shares during the period. Harvey Capital Management Inc. acquired a new position in Aquestive Therapeutics during the 3rd quarter valued at about $88,000. Finally, Janney Montgomery Scott LLC grew its position in Aquestive Therapeutics by 4.9% in the 3rd quarter. Janney Montgomery Scott LLC now owns 923,285 shares of the company's stock worth $4,598,000 after purchasing an additional 42,800 shares during the last quarter. 32.45% of the stock is owned by institutional investors and hedge funds.

Aquestive Therapeutics Company Profile

(

Get Free Report)

Aquestive Therapeutics, Inc operates as a pharmaceutical company in the United States and internationally. The company markets Sympazan, an oral soluble film formulation of clobazam for the treatment of lennox-gastaut syndrome; Suboxone, a sublingual film formulation of buprenorphine and naloxone for the treatment of opioid dependence; Zuplenz, an oral soluble film formulation of ondansetron for the treatment of nausea and vomiting associated with chemotherapy and post-operative recovery; and Azstarys, a once-daily product for the treatment of attention deficit hyperactivity disorder.

Read More

Before you consider Aquestive Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aquestive Therapeutics wasn't on the list.

While Aquestive Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.