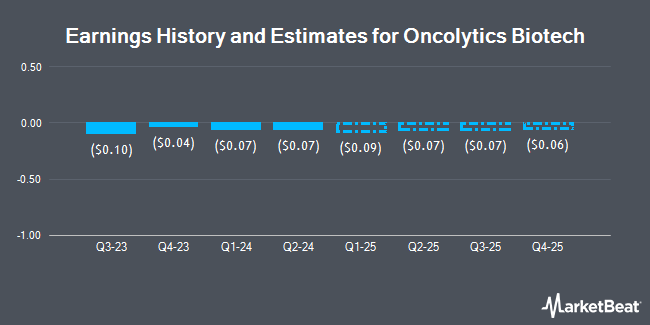

Oncolytics Biotech Inc. (NASDAQ:ONCY - Free Report) - Investment analysts at HC Wainwright dropped their FY2024 earnings per share estimates for shares of Oncolytics Biotech in a research report issued to clients and investors on Wednesday, November 13th. HC Wainwright analyst P. Trucchio now forecasts that the company will post earnings of ($0.30) per share for the year, down from their prior forecast of ($0.29). HC Wainwright currently has a "Buy" rating and a $5.00 target price on the stock. The consensus estimate for Oncolytics Biotech's current full-year earnings is ($0.30) per share. HC Wainwright also issued estimates for Oncolytics Biotech's Q3 2025 earnings at ($0.07) EPS, Q4 2025 earnings at ($0.06) EPS, FY2026 earnings at ($0.30) EPS, FY2027 earnings at ($0.29) EPS and FY2028 earnings at ($0.09) EPS.

Several other research analysts have also commented on the company. Raymond James raised Oncolytics Biotech to a "moderate buy" rating in a report on Thursday. Leede Financial downgraded Oncolytics Biotech from a "strong-buy" rating to a "moderate buy" rating in a research report on Wednesday, November 13th.

Read Our Latest Research Report on Oncolytics Biotech

Oncolytics Biotech Trading Up 1.7 %

Shares of ONCY traded up $0.02 during trading hours on Monday, reaching $1.00. 186,147 shares of the company's stock traded hands, compared to its average volume of 327,588. Oncolytics Biotech has a 12 month low of $0.84 and a 12 month high of $1.75. The stock has a market cap of $76.80 million, a PE ratio of -3.70 and a beta of 1.69. The firm's 50 day simple moving average is $1.09 and its 200-day simple moving average is $1.05.

Institutional Trading of Oncolytics Biotech

An institutional investor recently bought a new position in Oncolytics Biotech stock. Virtu Financial LLC bought a new stake in shares of Oncolytics Biotech Inc. (NASDAQ:ONCY - Free Report) in the first quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor bought 51,889 shares of the company's stock, valued at approximately $55,000. Virtu Financial LLC owned approximately 0.07% of Oncolytics Biotech as of its most recent SEC filing. Hedge funds and other institutional investors own 6.82% of the company's stock.

Oncolytics Biotech Company Profile

(

Get Free Report)

Oncolytics Biotech Inc, a clinical-stage biopharmaceutical company, focuses on the discovery and development of pharmaceutical products for the treatment of cancer. The company is developing pelareorep, an intravenously delivered immunotherapeutic agent, which is in phase 3 clinical trial for the treatment of hormone receptor-positive / human epidermal growth factor 2-negative metastatic breast cancer and advanced/metastatic pancreatic ductal adenocarcinoma.

Read More

Before you consider Oncolytics Biotech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oncolytics Biotech wasn't on the list.

While Oncolytics Biotech currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.