SpringWorks Therapeutics (NASDAQ:SWTX - Free Report) had its target price cut by HC Wainwright from $76.00 to $74.00 in a research report report published on Tuesday morning,Benzinga reports. They currently have a buy rating on the stock.

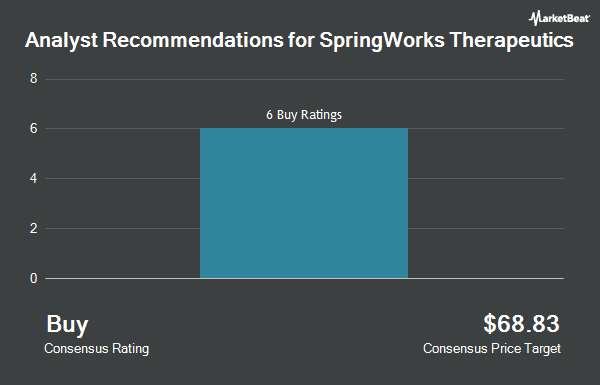

SWTX has been the topic of a number of other research reports. Wedbush reaffirmed an "outperform" rating and set a $77.00 price target on shares of SpringWorks Therapeutics in a research report on Thursday, November 7th. JPMorgan Chase & Co. upped their price target on shares of SpringWorks Therapeutics from $64.00 to $68.00 and gave the company an "overweight" rating in a research report on Wednesday, September 4th. Six analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, the stock has a consensus rating of "Buy" and a consensus target price of $68.17.

Check Out Our Latest Stock Report on SWTX

SpringWorks Therapeutics Stock Down 1.3 %

Shares of NASDAQ SWTX traded down $0.42 during midday trading on Tuesday, reaching $33.10. 4,619,357 shares of the company were exchanged, compared to its average volume of 972,918. SpringWorks Therapeutics has a one year low of $18.00 and a one year high of $53.92. The stock has a market cap of $2.46 billion, a P/E ratio of -7.58 and a beta of 0.79. The stock's 50-day moving average price is $33.09 and its 200-day moving average price is $37.32.

Hedge Funds Weigh In On SpringWorks Therapeutics

Institutional investors have recently made changes to their positions in the stock. Russell Investments Group Ltd. boosted its holdings in SpringWorks Therapeutics by 49.0% in the 1st quarter. Russell Investments Group Ltd. now owns 170,047 shares of the company's stock worth $8,370,000 after buying an additional 55,893 shares during the period. Price T Rowe Associates Inc. MD lifted its holdings in shares of SpringWorks Therapeutics by 48.0% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 4,110,462 shares of the company's stock worth $202,318,000 after acquiring an additional 1,333,892 shares during the last quarter. Vanguard Group Inc. lifted its holdings in shares of SpringWorks Therapeutics by 8.2% during the 1st quarter. Vanguard Group Inc. now owns 6,529,325 shares of the company's stock worth $321,373,000 after acquiring an additional 492,783 shares during the last quarter. D. E. Shaw & Co. Inc. lifted its holdings in shares of SpringWorks Therapeutics by 16.9% during the 2nd quarter. D. E. Shaw & Co. Inc. now owns 758,712 shares of the company's stock worth $28,581,000 after acquiring an additional 109,865 shares during the last quarter. Finally, Seven Eight Capital LP bought a new stake in shares of SpringWorks Therapeutics during the 2nd quarter worth $1,854,000.

About SpringWorks Therapeutics

(

Get Free Report)

SpringWorks Therapeutics, Inc, a commercial-stage biopharmaceutical company, engages in the development and commercialization of medicines for underserved patient populations suffering from rare diseases and cancer. Its lead product candidate is OGSIVEO (nirogacestat), an oral small molecule gamma secretase inhibitor that is in Phase III DeFi trial for the treatment of desmoid tumors; and Nirogacestat, is also in Phase 2 clinical development as a monotherapy for the treatment of ovarian granulosa cell tumors (GCT), a subtype of ovarian cancer.

Read More

Before you consider SpringWorks Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SpringWorks Therapeutics wasn't on the list.

While SpringWorks Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.