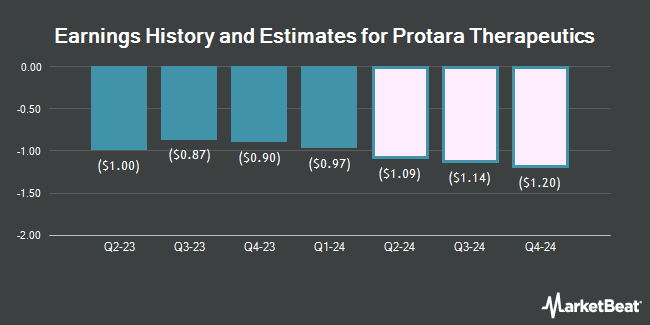

Protara Therapeutics, Inc. (NASDAQ:TARA - Free Report) - Research analysts at HC Wainwright lifted their Q1 2025 earnings per share estimates for shares of Protara Therapeutics in a note issued to investors on Thursday, March 6th. HC Wainwright analyst A. Fein now forecasts that the company will post earnings per share of ($0.53) for the quarter, up from their prior estimate of ($0.57). HC Wainwright currently has a "Buy" rating and a $23.00 target price on the stock. The consensus estimate for Protara Therapeutics' current full-year earnings is ($3.32) per share. HC Wainwright also issued estimates for Protara Therapeutics' Q2 2025 earnings at ($0.55) EPS, Q3 2025 earnings at ($0.57) EPS, Q4 2025 earnings at ($0.60) EPS, FY2025 earnings at ($2.25) EPS, FY2026 earnings at ($2.74) EPS, FY2027 earnings at ($2.75) EPS and FY2028 earnings at ($1.75) EPS.

TARA has been the topic of a number of other reports. Guggenheim reissued a "buy" rating and set a $20.00 price objective on shares of Protara Therapeutics in a report on Friday, December 6th. Lifesci Capital assumed coverage on shares of Protara Therapeutics in a research report on Tuesday. They issued an "outperform" rating and a $22.00 target price on the stock.

View Our Latest Research Report on Protara Therapeutics

Protara Therapeutics Stock Down 1.2 %

NASDAQ:TARA traded down $0.05 during midday trading on Monday, hitting $4.02. The company had a trading volume of 165,068 shares, compared to its average volume of 305,929. The company has a market capitalization of $82.93 million, a PE ratio of -1.42 and a beta of 1.69. Protara Therapeutics has a 52-week low of $1.60 and a 52-week high of $10.48. The stock's fifty day moving average price is $4.49 and its 200-day moving average price is $3.45.

Protara Therapeutics (NASDAQ:TARA - Get Free Report) last released its quarterly earnings results on Wednesday, March 12th. The company reported ($0.48) EPS for the quarter, topping analysts' consensus estimates of ($0.57) by $0.09.

Institutional Investors Weigh In On Protara Therapeutics

A number of large investors have recently added to or reduced their stakes in TARA. XTX Topco Ltd bought a new position in Protara Therapeutics during the 3rd quarter valued at approximately $60,000. HBK Investments L P purchased a new stake in shares of Protara Therapeutics in the 4th quarter worth about $106,000. Squarepoint Ops LLC purchased a new position in shares of Protara Therapeutics during the fourth quarter valued at about $110,000. Dimensional Fund Advisors LP bought a new position in Protara Therapeutics in the fourth quarter worth about $111,000. Finally, Bailard Inc. bought a new position in shares of Protara Therapeutics in the 4th quarter worth approximately $157,000. Institutional investors own 38.13% of the company's stock.

About Protara Therapeutics

(

Get Free Report)

Protara Therapeutics, Inc, a clinical-stage biopharmaceutical company, engages in advancing transformative therapies for the treatment of cancer and rare diseases. The company's lead program is TARA-002, an investigational cell therapy, which is in Phase II clinical trial for the treatment of non-muscle invasive bladder cancer and lymphatic malformations.

Further Reading

Before you consider Protara Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Protara Therapeutics wasn't on the list.

While Protara Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.