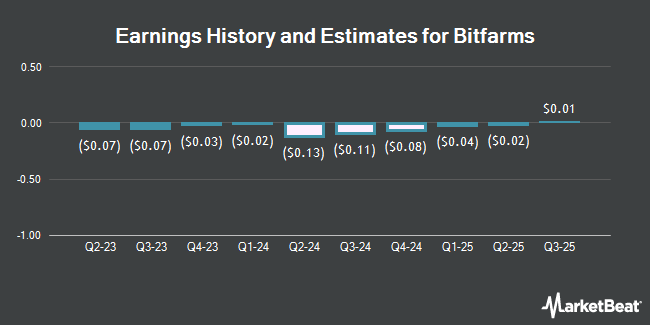

Bitfarms Ltd. (NASDAQ:BITF - Free Report) - Investment analysts at HC Wainwright raised their FY2024 EPS estimates for shares of Bitfarms in a research report issued to clients and investors on Thursday, November 14th. HC Wainwright analyst M. Colonnese now forecasts that the company will earn ($0.22) per share for the year, up from their prior forecast of ($0.52). HC Wainwright currently has a "Buy" rating and a $4.00 target price on the stock. The consensus estimate for Bitfarms' current full-year earnings is ($0.20) per share. HC Wainwright also issued estimates for Bitfarms' Q4 2024 earnings at ($0.04) EPS, Q1 2025 earnings at ($0.04) EPS, Q2 2025 earnings at ($0.03) EPS, Q3 2025 earnings at ($0.01) EPS, Q4 2025 earnings at ($0.01) EPS and FY2025 earnings at ($0.09) EPS.

Separately, Cantor Fitzgerald reissued an "overweight" rating and issued a $5.00 price objective on shares of Bitfarms in a research note on Thursday, October 3rd. One analyst has rated the stock with a hold rating and four have issued a buy rating to the company's stock. According to MarketBeat, the company has an average rating of "Moderate Buy" and an average price target of $3.66.

Get Our Latest Report on Bitfarms

Bitfarms Price Performance

NASDAQ BITF traded down $0.09 during trading hours on Monday, reaching $2.16. The company's stock had a trading volume of 50,302,668 shares, compared to its average volume of 23,439,566. The stock has a market cap of $978.33 million, a PE ratio of -6.00 and a beta of 3.64. Bitfarms has a fifty-two week low of $1.01 and a fifty-two week high of $3.91. The company's 50-day moving average is $2.05 and its two-hundred day moving average is $2.24. The company has a debt-to-equity ratio of 0.04, a quick ratio of 5.09 and a current ratio of 3.70.

Institutional Inflows and Outflows

Several large investors have recently modified their holdings of BITF. Chesapeake Capital Corp IL raised its holdings in Bitfarms by 27.9% in the third quarter. Chesapeake Capital Corp IL now owns 22,000 shares of the company's stock valued at $50,000 after buying an additional 4,800 shares during the period. Gladstone Institutional Advisory LLC raised its holdings in Bitfarms by 3.2% in the third quarter. Gladstone Institutional Advisory LLC now owns 159,550 shares of the company's stock valued at $337,000 after buying an additional 5,000 shares during the period. HighTower Advisors LLC purchased a new position in Bitfarms in the third quarter valued at approximately $25,000. WINTON GROUP Ltd purchased a new position in Bitfarms in the second quarter valued at approximately $38,000. Finally, Zurcher Kantonalbank Zurich Cantonalbank raised its holdings in Bitfarms by 22.2% in the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 83,562 shares of the company's stock valued at $176,000 after buying an additional 15,167 shares during the period. 20.59% of the stock is currently owned by hedge funds and other institutional investors.

Bitfarms Company Profile

(

Get Free Report)

Bitfarms Ltd. engages in the mining of cryptocurrency coins and tokens in Canada, the United States, Paraguay, and Argentina. It owns and operates server farms that primarily validates transactions on the Bitcoin Blockchain and earning cryptocurrency from block rewards and transaction fees. The company also provides electrician services to commercial and residential customers in Quebec, Canada.

See Also

Before you consider Bitfarms, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bitfarms wasn't on the list.

While Bitfarms currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.