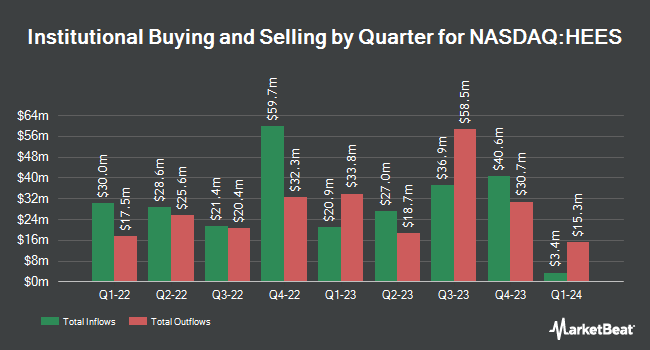

Charles Schwab Investment Management Inc. increased its position in shares of H&E Equipment Services, Inc. (NASDAQ:HEES - Free Report) by 7.9% during the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 571,947 shares of the industrial products company's stock after buying an additional 41,749 shares during the quarter. Charles Schwab Investment Management Inc. owned about 1.56% of H&E Equipment Services worth $27,842,000 at the end of the most recent reporting period.

Several other institutional investors have also recently made changes to their positions in HEES. American Century Companies Inc. raised its position in shares of H&E Equipment Services by 104.6% during the 2nd quarter. American Century Companies Inc. now owns 1,410,554 shares of the industrial products company's stock valued at $62,304,000 after buying an additional 721,270 shares during the period. Loews Corp purchased a new stake in shares of H&E Equipment Services during the 2nd quarter valued at approximately $5,742,000. Assenagon Asset Management S.A. raised its position in shares of H&E Equipment Services by 186.0% during the 3rd quarter. Assenagon Asset Management S.A. now owns 194,102 shares of the industrial products company's stock valued at $9,449,000 after buying an additional 126,244 shares during the period. Millennium Management LLC raised its position in shares of H&E Equipment Services by 200.6% during the 2nd quarter. Millennium Management LLC now owns 133,554 shares of the industrial products company's stock valued at $5,899,000 after buying an additional 89,128 shares during the period. Finally, Cubist Systematic Strategies LLC acquired a new stake in H&E Equipment Services in the 2nd quarter valued at approximately $2,793,000. Hedge funds and other institutional investors own 84.08% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts recently weighed in on the stock. UBS Group dropped their target price on shares of H&E Equipment Services from $63.00 to $60.00 and set a "buy" rating for the company in a report on Wednesday, August 14th. KeyCorp assumed coverage on shares of H&E Equipment Services in a report on Friday, August 9th. They issued a "sector weight" rating for the company. Finally, B. Riley reiterated a "buy" rating and issued a $60.00 target price (down previously from $62.00) on shares of H&E Equipment Services in a report on Wednesday, October 30th. Three research analysts have rated the stock with a hold rating and four have given a buy rating to the stock. Based on data from MarketBeat.com, H&E Equipment Services presently has an average rating of "Moderate Buy" and an average price target of $61.25.

Get Our Latest Stock Analysis on HEES

H&E Equipment Services Price Performance

Shares of HEES traded up $0.51 during mid-day trading on Thursday, reaching $59.57. 213,671 shares of the company's stock were exchanged, compared to its average volume of 269,013. The company has a market cap of $2.18 billion, a price-to-earnings ratio of 14.99, a PEG ratio of 13.32 and a beta of 1.84. The company has a quick ratio of 0.59, a current ratio of 0.64 and a debt-to-equity ratio of 2.09. H&E Equipment Services, Inc. has a 52-week low of $40.92 and a 52-week high of $66.18. The company has a 50-day simple moving average of $54.61 and a two-hundred day simple moving average of $49.31.

H&E Equipment Services (NASDAQ:HEES - Get Free Report) last announced its quarterly earnings results on Tuesday, October 29th. The industrial products company reported $0.85 earnings per share for the quarter, missing analysts' consensus estimates of $1.00 by ($0.15). The company had revenue of $384.86 million during the quarter, compared to analyst estimates of $388.18 million. H&E Equipment Services had a net margin of 9.47% and a return on equity of 25.46%. The firm's revenue for the quarter was down 4.0% compared to the same quarter last year. During the same quarter last year, the business earned $1.46 EPS. On average, sell-side analysts predict that H&E Equipment Services, Inc. will post 3.34 EPS for the current fiscal year.

H&E Equipment Services Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, December 13th. Shareholders of record on Friday, November 29th will be issued a $0.275 dividend. The ex-dividend date of this dividend is Friday, November 29th. This represents a $1.10 dividend on an annualized basis and a dividend yield of 1.85%. H&E Equipment Services's dividend payout ratio (DPR) is presently 27.92%.

About H&E Equipment Services

(

Free Report)

H&E Equipment Services, Inc operates as an integrated equipment services company in the United States. The company operates in five segments: Equipment Rentals, Sales of Rental Equipment, Sales of New Equipment, Parts Sales, and Repair and Maintenance Services. The Equipment Rentals segment provides construction and industrial equipment for rent on a daily, weekly, and monthly basis.

Read More

Before you consider H&E Equipment Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and H&E Equipment Services wasn't on the list.

While H&E Equipment Services currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.