Headlands Technologies LLC reduced its position in Morningstar, Inc. (NASDAQ:MORN - Free Report) by 89.2% in the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 170 shares of the business services provider's stock after selling 1,410 shares during the quarter. Headlands Technologies LLC's holdings in Morningstar were worth $57,000 at the end of the most recent quarter.

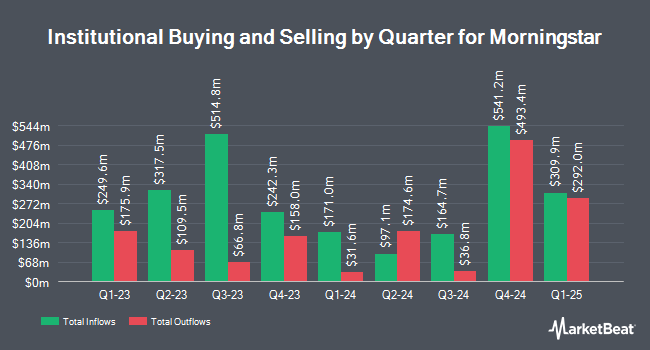

Several other hedge funds also recently bought and sold shares of the company. Geode Capital Management LLC boosted its holdings in Morningstar by 12.9% in the 4th quarter. Geode Capital Management LLC now owns 561,431 shares of the business services provider's stock valued at $189,116,000 after purchasing an additional 64,020 shares during the period. National Bank of Canada FI raised its position in shares of Morningstar by 3.7% in the fourth quarter. National Bank of Canada FI now owns 28,121 shares of the business services provider's stock worth $9,470,000 after buying an additional 1,008 shares in the last quarter. Alliancebernstein L.P. boosted its stake in Morningstar by 5.2% during the fourth quarter. Alliancebernstein L.P. now owns 34,728 shares of the business services provider's stock valued at $11,695,000 after buying an additional 1,727 shares during the period. Wellington Management Group LLP grew its position in Morningstar by 13.7% during the fourth quarter. Wellington Management Group LLP now owns 1,080,599 shares of the business services provider's stock worth $363,903,000 after buying an additional 130,087 shares in the last quarter. Finally, O Shaughnessy Asset Management LLC increased its stake in Morningstar by 3.5% in the 4th quarter. O Shaughnessy Asset Management LLC now owns 3,031 shares of the business services provider's stock worth $1,021,000 after acquiring an additional 102 shares during the last quarter. Hedge funds and other institutional investors own 57.02% of the company's stock.

Insider Activity

In other news, Chairman Joseph D. Mansueto sold 3,635 shares of the firm's stock in a transaction that occurred on Wednesday, February 5th. The shares were sold at an average price of $325.44, for a total value of $1,182,974.40. Following the transaction, the chairman now owns 10,142,694 shares in the company, valued at approximately $3,300,838,335.36. This trade represents a 0.04 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. Over the last three months, insiders have sold 59,544 shares of company stock valued at $18,770,097. 39.90% of the stock is currently owned by insiders.

Wall Street Analyst Weigh In

MORN has been the subject of several recent analyst reports. StockNews.com lowered Morningstar from a "buy" rating to a "hold" rating in a report on Friday. BMO Capital Markets decreased their price target on shares of Morningstar from $387.00 to $370.00 and set an "outperform" rating on the stock in a report on Monday, March 3rd.

Check Out Our Latest Analysis on MORN

Morningstar Price Performance

Shares of NASDAQ MORN traded up $2.65 during trading hours on Friday, reaching $273.35. 170,878 shares of the stock traded hands, compared to its average volume of 131,017. The company's 50-day simple moving average is $301.06 and its two-hundred day simple moving average is $324.55. The company has a market capitalization of $11.71 billion, a P/E ratio of 36.11 and a beta of 1.16. Morningstar, Inc. has a 52-week low of $250.34 and a 52-week high of $365.00. The company has a quick ratio of 1.14, a current ratio of 1.14 and a debt-to-equity ratio of 0.55.

Morningstar (NASDAQ:MORN - Get Free Report) last announced its quarterly earnings data on Wednesday, February 26th. The business services provider reported $2.14 earnings per share for the quarter, topping analysts' consensus estimates of $1.99 by $0.15. Morningstar had a net margin of 14.69% and a return on equity of 23.28%. The firm had revenue of $591.00 million during the quarter, compared to analyst estimates of $580.81 million.

Morningstar Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, April 30th. Shareholders of record on Friday, April 4th will be given a dividend of $0.455 per share. This represents a $1.82 annualized dividend and a yield of 0.67%. This is a positive change from Morningstar's previous quarterly dividend of $0.41. The ex-dividend date is Friday, April 4th. Morningstar's dividend payout ratio is presently 21.24%.

About Morningstar

(

Free Report)

Morningstar, Inc provides independent investment insights in the United States, Asia. Australia, Continental Europe, the United Kingdom, and internationally. The company operates in five segments: Morningstar Data and Analytics; PitchBook; Morningstar Wealth; Morningstar Credit; and Morningstar Retirement.

Featured Stories

Before you consider Morningstar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Morningstar wasn't on the list.

While Morningstar currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.