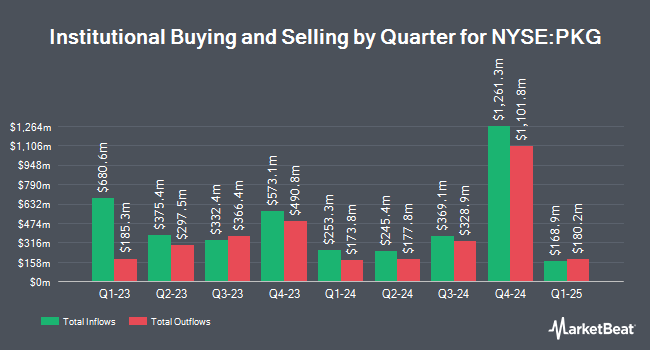

Headlands Technologies LLC purchased a new stake in shares of Packaging Co. of America (NYSE:PKG - Free Report) during the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm purchased 4,128 shares of the industrial products company's stock, valued at approximately $929,000.

A number of other institutional investors also recently modified their holdings of the company. Fortitude Family Office LLC grew its stake in Packaging Co. of America by 150.8% in the 4th quarter. Fortitude Family Office LLC now owns 163 shares of the industrial products company's stock valued at $37,000 after buying an additional 98 shares during the last quarter. Centricity Wealth Management LLC bought a new stake in Packaging Co. of America during the fourth quarter valued at about $44,000. Golden State Wealth Management LLC acquired a new stake in shares of Packaging Co. of America in the fourth quarter valued at about $48,000. Rialto Wealth Management LLC bought a new position in shares of Packaging Co. of America in the fourth quarter worth about $63,000. Finally, Intact Investment Management Inc. acquired a new position in shares of Packaging Co. of America during the 4th quarter worth about $68,000. Institutional investors own 89.78% of the company's stock.

Packaging Co. of America Stock Performance

PKG traded down $2.51 during trading on Monday, reaching $180.91. 439,749 shares of the company's stock were exchanged, compared to its average volume of 683,837. The company has a market capitalization of $16.27 billion, a P/E ratio of 20.16, a PEG ratio of 2.41 and a beta of 0.84. The company has a quick ratio of 1.98, a current ratio of 2.95 and a debt-to-equity ratio of 0.58. The business has a 50 day moving average price of $205.91 and a 200 day moving average price of $221.66. Packaging Co. of America has a fifty-two week low of $169.00 and a fifty-two week high of $250.82.

Packaging Co. of America (NYSE:PKG - Get Free Report) last issued its earnings results on Tuesday, January 28th. The industrial products company reported $2.47 earnings per share for the quarter, missing the consensus estimate of $2.51 by ($0.04). Packaging Co. of America had a net margin of 9.60% and a return on equity of 19.67%. As a group, analysts predict that Packaging Co. of America will post 10.44 earnings per share for the current fiscal year.

Packaging Co. of America Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, April 15th. Stockholders of record on Friday, March 14th will be paid a $1.25 dividend. The ex-dividend date of this dividend is Friday, March 14th. This represents a $5.00 annualized dividend and a dividend yield of 2.76%. Packaging Co. of America's dividend payout ratio is currently 55.99%.

Wall Street Analyst Weigh In

A number of analysts have issued reports on PKG shares. Jefferies Financial Group raised Packaging Co. of America from a "hold" rating to a "buy" rating and raised their target price for the company from $215.00 to $280.00 in a report on Wednesday, December 18th. StockNews.com downgraded shares of Packaging Co. of America from a "buy" rating to a "hold" rating in a research note on Sunday. Wells Fargo & Company dropped their target price on shares of Packaging Co. of America from $253.00 to $236.00 and set an "overweight" rating on the stock in a research report on Thursday, January 30th. Citigroup raised their price target on shares of Packaging Co. of America from $232.00 to $235.00 and gave the stock a "neutral" rating in a research report on Monday, January 6th. Finally, Truist Financial reaffirmed a "buy" rating and set a $265.00 price objective (down previously from $282.00) on shares of Packaging Co. of America in a research report on Thursday, January 30th. Three analysts have rated the stock with a hold rating, four have given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $233.00.

View Our Latest Stock Report on Packaging Co. of America

About Packaging Co. of America

(

Free Report)

Packaging Corporation of America engages in the production of container products. It operates through the following segments: Packaging, Paper, and Corporate and Other. The Packaging segment offers a variety of corrugated packaging products, such as conventional shipping containers. The Paper segment manufactures and sells a range of papers, including communication-based papers, and pressure sensitive papers.

See Also

Before you consider Packaging Co. of America, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Packaging Co. of America wasn't on the list.

While Packaging Co. of America currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.