Connor Clark & Lunn Investment Management Ltd. lifted its position in shares of Health Catalyst, Inc. (NASDAQ:HCAT - Free Report) by 118.0% during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 131,532 shares of the company's stock after purchasing an additional 71,201 shares during the period. Connor Clark & Lunn Investment Management Ltd. owned about 0.22% of Health Catalyst worth $1,071,000 as of its most recent SEC filing.

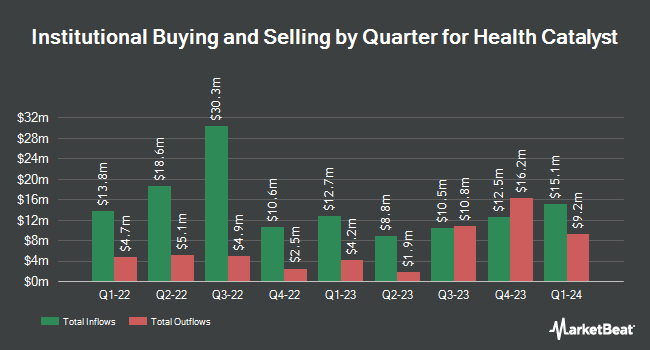

Several other institutional investors and hedge funds have also made changes to their positions in HCAT. Quest Partners LLC acquired a new position in Health Catalyst in the third quarter worth $34,000. Summit Global Investments increased its position in Health Catalyst by 8.1% in the third quarter. Summit Global Investments now owns 66,544 shares of the company's stock worth $542,000 after buying an additional 4,991 shares during the period. Impax Asset Management Group plc lifted its stake in Health Catalyst by 16.4% in the third quarter. Impax Asset Management Group plc now owns 2,554,475 shares of the company's stock valued at $20,793,000 after buying an additional 360,201 shares during the last quarter. Harbor Capital Advisors Inc. lifted its stake in Health Catalyst by 21.3% in the third quarter. Harbor Capital Advisors Inc. now owns 11,764 shares of the company's stock valued at $96,000 after buying an additional 2,064 shares during the last quarter. Finally, Janney Montgomery Scott LLC acquired a new position in shares of Health Catalyst during the third quarter valued at $897,000. 85.00% of the stock is currently owned by hedge funds and other institutional investors.

Health Catalyst Price Performance

HCAT stock traded up $0.15 during trading hours on Thursday, hitting $8.65. 470,217 shares of the stock traded hands, compared to its average volume of 560,398. The stock has a 50-day simple moving average of $8.13 and a 200 day simple moving average of $7.30. The company has a market cap of $526.34 million, a P/E ratio of -6.41 and a beta of 1.32. Health Catalyst, Inc. has a one year low of $5.42 and a one year high of $11.41. The company has a current ratio of 1.41, a quick ratio of 1.41 and a debt-to-equity ratio of 0.32.

Health Catalyst (NASDAQ:HCAT - Get Free Report) last issued its quarterly earnings results on Wednesday, November 6th. The company reported $0.07 earnings per share for the quarter, missing analysts' consensus estimates of $0.10 by ($0.03). The business had revenue of $76.40 million during the quarter, compared to analyst estimates of $76.27 million. Health Catalyst had a negative net margin of 26.20% and a negative return on equity of 7.51%. Health Catalyst's revenue was up 3.5% compared to the same quarter last year. During the same period in the previous year, the company posted ($0.22) earnings per share. Equities analysts forecast that Health Catalyst, Inc. will post -0.35 earnings per share for the current year.

Insider Buying and Selling

In other Health Catalyst news, insider Kevin Lee Freeman sold 7,500 shares of the firm's stock in a transaction dated Tuesday, September 3rd. The shares were sold at an average price of $7.22, for a total value of $54,150.00. Following the completion of the transaction, the insider now directly owns 255,881 shares in the company, valued at $1,847,460.82. This trade represents a 2.85 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through this link. Also, COO Daniel Lesueur sold 8,137 shares of Health Catalyst stock in a transaction that occurred on Wednesday, September 4th. The stock was sold at an average price of $7.58, for a total transaction of $61,678.46. Following the completion of the transaction, the chief operating officer now directly owns 140,108 shares in the company, valued at approximately $1,062,018.64. This trade represents a 5.49 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 34,068 shares of company stock worth $257,555. Corporate insiders own 2.50% of the company's stock.

Analyst Upgrades and Downgrades

HCAT has been the topic of a number of analyst reports. Citigroup increased their price objective on shares of Health Catalyst from $9.00 to $10.50 and gave the stock a "buy" rating in a report on Wednesday, November 13th. JPMorgan Chase & Co. raised their price target on shares of Health Catalyst from $10.00 to $13.00 and gave the company an "overweight" rating in a research note on Wednesday, September 4th. Royal Bank of Canada boosted their price objective on Health Catalyst from $8.00 to $9.00 and gave the stock a "sector perform" rating in a research report on Thursday, November 7th. Piper Sandler reissued an "overweight" rating and issued a $12.00 price objective (up from $11.00) on shares of Health Catalyst in a report on Tuesday. Finally, Stephens lifted their target price on Health Catalyst from $7.00 to $9.00 and gave the company an "equal weight" rating in a research note on Thursday, November 14th. Three research analysts have rated the stock with a hold rating and nine have assigned a buy rating to the company. According to MarketBeat.com, Health Catalyst has a consensus rating of "Moderate Buy" and an average price target of $11.79.

Get Our Latest Analysis on Health Catalyst

About Health Catalyst

(

Free Report)

Health Catalyst, Inc provides data and analytics technology and services to healthcare organizations in the United States. It operates in two segments, Technology and Professional Services. The company provides data operating system data platform which provides clients single comprehensive environment to integrate and organize data from their disparate software systems; and analytics applications, a software analytics applications build for data platform to analyze clients face across clinical and quality, population health, and financial and operational use cases.

Featured Stories

Before you consider Health Catalyst, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Health Catalyst wasn't on the list.

While Health Catalyst currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.