Healthcare of Ontario Pension Plan Trust Fund purchased a new stake in shares of GitLab Inc. (NASDAQ:GTLB - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm purchased 23,378 shares of the company's stock, valued at approximately $1,205,000.

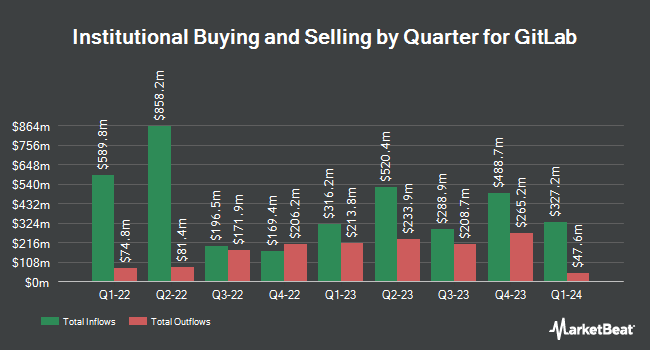

Several other institutional investors also recently modified their holdings of the business. Future Financial Wealth Managment LLC bought a new stake in GitLab in the third quarter worth approximately $52,000. Rakuten Securities Inc. raised its stake in shares of GitLab by 268.1% in the third quarter. Rakuten Securities Inc. now owns 1,417 shares of the company's stock worth $73,000 after purchasing an additional 1,032 shares during the last quarter. Quarry LP raised its holdings in shares of GitLab by 527.0% in the second quarter. Quarry LP now owns 1,787 shares of the company's stock valued at $89,000 after purchasing an additional 1,502 shares during the last quarter. Capital Performance Advisors LLP purchased a new position in GitLab in the third quarter worth $96,000. Finally, Canton Hathaway LLC increased its position in shares of GitLab by 26.3% during the 2nd quarter. Canton Hathaway LLC now owns 2,086 shares of the company's stock valued at $104,000 after purchasing an additional 435 shares during the last quarter. Institutional investors own 91.72% of the company's stock.

Insider Activity

In other news, CFO Brian G. Robins sold 16,668 shares of the business's stock in a transaction that occurred on Monday, September 9th. The shares were sold at an average price of $53.67, for a total transaction of $894,571.56. Following the completion of the transaction, the chief financial officer now directly owns 250,109 shares of the company's stock, valued at $13,423,350.03. The trade was a 6.25 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, CAO Erin Mannix sold 1,433 shares of GitLab stock in a transaction that occurred on Thursday, September 19th. The stock was sold at an average price of $52.80, for a total transaction of $75,662.40. Following the completion of the sale, the chief accounting officer now directly owns 72,448 shares of the company's stock, valued at approximately $3,825,254.40. This trade represents a 1.94 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 185,033 shares of company stock worth $10,569,356 over the last three months. 21.36% of the stock is currently owned by corporate insiders.

Analysts Set New Price Targets

GTLB has been the topic of a number of research analyst reports. UBS Group boosted their target price on shares of GitLab from $62.00 to $65.00 and gave the company a "buy" rating in a research note on Wednesday, September 4th. Baird R W upgraded GitLab to a "strong-buy" rating in a research note on Tuesday, August 27th. Cantor Fitzgerald upgraded GitLab to a "strong-buy" rating in a research note on Tuesday, November 12th. TD Cowen boosted their price objective on GitLab from $63.00 to $70.00 and gave the company a "buy" rating in a research note on Thursday, November 21st. Finally, Morgan Stanley began coverage on shares of GitLab in a research note on Wednesday, October 9th. They issued an "overweight" rating and a $70.00 target price for the company. Three equities research analysts have rated the stock with a hold rating, twenty have issued a buy rating and two have given a strong buy rating to the stock. According to data from MarketBeat, GitLab has a consensus rating of "Moderate Buy" and a consensus price target of $67.17.

Check Out Our Latest Research Report on GTLB

GitLab Stock Down 1.2 %

Shares of NASDAQ:GTLB traded down $0.76 during midday trading on Monday, hitting $62.99. 2,396,864 shares of the stock traded hands, compared to its average volume of 2,329,504. The business's 50 day moving average is $56.80 and its two-hundred day moving average is $51.97. The stock has a market capitalization of $10.11 billion, a PE ratio of -26.92 and a beta of 0.45. GitLab Inc. has a one year low of $40.72 and a one year high of $78.53.

GitLab (NASDAQ:GTLB - Get Free Report) last posted its quarterly earnings data on Tuesday, September 3rd. The company reported $0.15 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.10 by $0.05. GitLab had a negative return on equity of 15.40% and a negative net margin of 54.62%. The business had revenue of $182.58 million during the quarter, compared to the consensus estimate of $176.86 million. During the same quarter in the prior year, the company earned ($0.29) earnings per share. The firm's quarterly revenue was up 30.8% compared to the same quarter last year. As a group, sell-side analysts forecast that GitLab Inc. will post -0.41 earnings per share for the current year.

About GitLab

(

Free Report)

GitLab Inc, through its subsidiaries, develops software for the software development lifecycle in the United States, Europe, and the Asia Pacific. It offers GitLab, a DevOps platform, which is a single application that leads to faster cycle time and allows visibility throughout and control over various stages of the DevOps lifecycle.

Read More

Before you consider GitLab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GitLab wasn't on the list.

While GitLab currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.