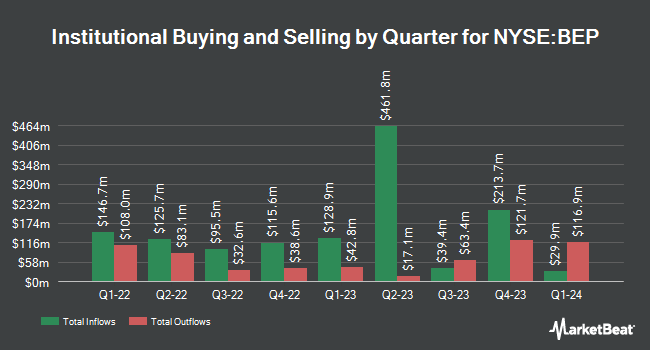

Healthcare of Ontario Pension Plan Trust Fund lifted its holdings in shares of Brookfield Renewable Partners L.P. (NYSE:BEP - Free Report) TSE: BEP by 8.1% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 328,066 shares of the utilities provider's stock after purchasing an additional 24,467 shares during the period. Healthcare of Ontario Pension Plan Trust Fund owned 0.12% of Brookfield Renewable Partners worth $9,245,000 at the end of the most recent reporting period.

Other large investors have also added to or reduced their stakes in the company. Cadence Bank acquired a new position in Brookfield Renewable Partners during the 3rd quarter worth approximately $212,000. BNP Paribas Financial Markets lifted its holdings in shares of Brookfield Renewable Partners by 609.2% in the 3rd quarter. BNP Paribas Financial Markets now owns 11,808 shares of the utilities provider's stock worth $333,000 after purchasing an additional 10,143 shares in the last quarter. Bank of Montreal Can grew its position in Brookfield Renewable Partners by 0.4% in the 3rd quarter. Bank of Montreal Can now owns 6,744,285 shares of the utilities provider's stock valued at $190,469,000 after purchasing an additional 26,189 shares during the period. Mirabella Financial Services LLP increased its stake in Brookfield Renewable Partners by 145.2% during the 3rd quarter. Mirabella Financial Services LLP now owns 466,736 shares of the utilities provider's stock valued at $13,153,000 after purchasing an additional 276,374 shares in the last quarter. Finally, MAI Capital Management raised its holdings in Brookfield Renewable Partners by 294.2% during the third quarter. MAI Capital Management now owns 86,683 shares of the utilities provider's stock worth $2,443,000 after buying an additional 64,695 shares during the last quarter. Institutional investors and hedge funds own 63.16% of the company's stock.

Analysts Set New Price Targets

Several equities research analysts have recently commented on BEP shares. Royal Bank of Canada reissued an "outperform" rating and set a $31.00 target price on shares of Brookfield Renewable Partners in a research report on Wednesday, October 9th. UBS Group upgraded Brookfield Renewable Partners from a "neutral" rating to a "buy" rating and upped their price target for the stock from $24.00 to $31.00 in a report on Monday, September 30th. JPMorgan Chase & Co. decreased their price objective on shares of Brookfield Renewable Partners from $31.00 to $29.00 and set a "neutral" rating for the company in a research note on Thursday, October 17th. CIBC lifted their target price on Brookfield Renewable Partners from $33.00 to $34.00 and gave the stock an "outperformer" rating in a research note on Tuesday, October 22nd. Finally, StockNews.com cut shares of Brookfield Renewable Partners from a "hold" rating to a "sell" rating in a report on Friday, August 2nd. One equities research analyst has rated the stock with a sell rating, one has given a hold rating, six have assigned a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of $31.78.

Get Our Latest Analysis on Brookfield Renewable Partners

Brookfield Renewable Partners Price Performance

NYSE BEP traded up $0.04 during trading hours on Friday, hitting $26.03. The company had a trading volume of 367,578 shares, compared to its average volume of 480,679. The company has a debt-to-equity ratio of 0.93, a quick ratio of 0.73 and a current ratio of 0.73. The firm has a market capitalization of $7.42 billion, a price-to-earnings ratio of -31.74 and a beta of 0.95. Brookfield Renewable Partners L.P. has a 52 week low of $19.92 and a 52 week high of $29.56. The firm has a 50 day simple moving average of $26.56 and a 200 day simple moving average of $25.90.

Brookfield Renewable Partners (NYSE:BEP - Get Free Report) TSE: BEP last released its quarterly earnings data on Friday, November 8th. The utilities provider reported ($0.32) EPS for the quarter, missing analysts' consensus estimates of ($0.04) by ($0.28). Brookfield Renewable Partners had a net margin of 1.16% and a return on equity of 0.24%. The firm had revenue of $1.47 billion during the quarter, compared to the consensus estimate of $843.18 million. During the same quarter last year, the business posted ($0.14) earnings per share. Equities research analysts expect that Brookfield Renewable Partners L.P. will post -0.57 earnings per share for the current year.

Brookfield Renewable Partners Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Tuesday, December 31st. Stockholders of record on Friday, November 29th will be issued a $0.355 dividend. The ex-dividend date of this dividend is Friday, November 29th. This represents a $1.42 annualized dividend and a dividend yield of 5.46%. Brookfield Renewable Partners's payout ratio is currently -173.17%.

Brookfield Renewable Partners Profile

(

Free Report)

Brookfield Renewable Partners L.P. owns a portfolio of renewable power generating facilities primarily in North America, Colombia, and Brazil. The company generates electricity through hydroelectric, wind, solar, distributed generation, and pumped storage, as well as renewable natural gas, carbon capture and storage, recycling, cogeneration biomass, nuclear services, and power transformation.

Featured Stories

Before you consider Brookfield Renewable Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brookfield Renewable Partners wasn't on the list.

While Brookfield Renewable Partners currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.