Healthcare of Ontario Pension Plan Trust Fund trimmed its position in shares of H World Group Limited (NASDAQ:HTHT - Free Report) by 47.7% during the third quarter, according to its most recent Form 13F filing with the SEC. The firm owned 82,400 shares of the company's stock after selling 75,200 shares during the period. Healthcare of Ontario Pension Plan Trust Fund's holdings in H World Group were worth $3,065,000 at the end of the most recent reporting period.

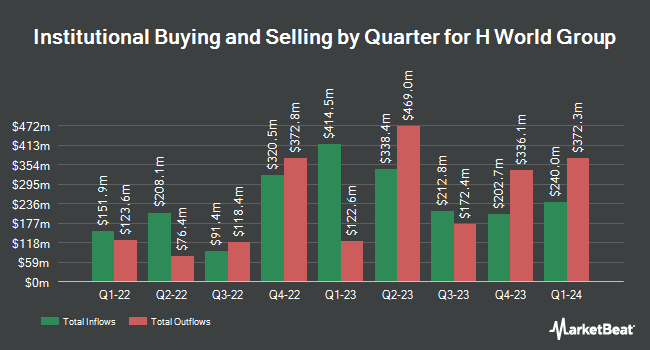

Several other hedge funds have also recently added to or reduced their stakes in HTHT. California State Teachers Retirement System raised its holdings in shares of H World Group by 1.8% in the 1st quarter. California State Teachers Retirement System now owns 36,662 shares of the company's stock valued at $1,419,000 after purchasing an additional 636 shares in the last quarter. Swedbank AB purchased a new position in H World Group in the first quarter valued at $2,717,000. E Fund Management Hong Kong Co. Ltd. raised its stake in H World Group by 2.1% in the second quarter. E Fund Management Hong Kong Co. Ltd. now owns 166,373 shares of the company's stock valued at $5,544,000 after buying an additional 3,416 shares in the last quarter. Blue Trust Inc. lifted its holdings in H World Group by 716.7% during the 2nd quarter. Blue Trust Inc. now owns 1,225 shares of the company's stock worth $41,000 after buying an additional 1,075 shares during the last quarter. Finally, Summit Global Investments acquired a new position in shares of H World Group during the 2nd quarter worth about $1,126,000. Institutional investors and hedge funds own 46.41% of the company's stock.

Analyst Ratings Changes

Separately, Benchmark decreased their target price on H World Group from $53.00 to $48.00 and set a "buy" rating for the company in a research note on Wednesday. Five investment analysts have rated the stock with a buy rating, Based on data from MarketBeat, the stock has an average rating of "Buy" and a consensus price target of $46.80.

Check Out Our Latest Stock Analysis on HTHT

H World Group Stock Performance

Shares of HTHT stock traded up $0.14 during mid-day trading on Friday, hitting $32.17. 1,893,777 shares of the stock were exchanged, compared to its average volume of 1,948,096. The stock's fifty day simple moving average is $37.01 and its two-hundred day simple moving average is $33.84. The company has a debt-to-equity ratio of 0.60, a quick ratio of 0.96 and a current ratio of 0.88. H World Group Limited has a 12-month low of $27.03 and a 12-month high of $42.98. The stock has a market capitalization of $10.50 billion, a price-to-earnings ratio of 19.50, a P/E/G ratio of 0.98 and a beta of 0.77.

About H World Group

(

Free Report)

H World Group Limited develops leased and owned, manachised, and franchised hotels in the People's Republic of China. The company operates hotels under its own brands, such as HanTing Hotel, Ni Hao Hotel, Hi Inn, Elan Hotel, Zleep Hotels, Ibis Hotel, JI Hotel, Orange Hotel, Starway Hotel, Ibis Styles Hotel, CitiGO Hotel, Crystal Orange Hotel, IntercityHotel, Manxin Hotel, Mercure Hotel, Madison Hotel, Novotel Hotel, Joya Hotel, Blossom House, Steigenberger Hotels & Resorts, MAXX by Steigenberger, Jaz in the City, Grand Mercure, Steigenberger Icon, and Song Hotels.

Featured Articles

Before you consider H World Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and H World Group wasn't on the list.

While H World Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.