Healthcare of Ontario Pension Plan Trust Fund decreased its stake in shares of Constellium SE (NYSE:CSTM - Free Report) by 14.6% in the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 485,025 shares of the industrial products company's stock after selling 83,000 shares during the quarter. Healthcare of Ontario Pension Plan Trust Fund owned about 0.34% of Constellium worth $7,887,000 as of its most recent filing with the Securities & Exchange Commission.

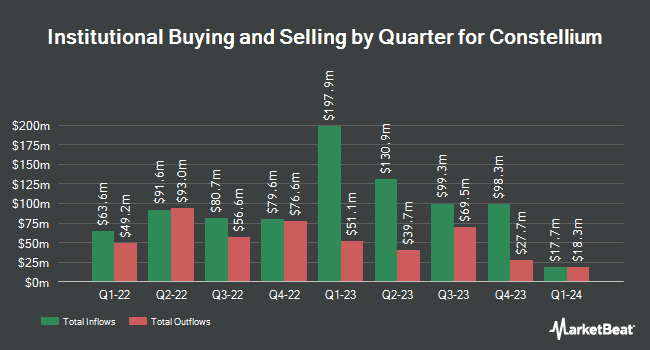

Several other hedge funds also recently modified their holdings of the stock. FMR LLC increased its position in Constellium by 3.4% in the 3rd quarter. FMR LLC now owns 14,681,988 shares of the industrial products company's stock valued at $238,729,000 after buying an additional 484,011 shares in the last quarter. Westwood Holdings Group Inc. increased its holdings in shares of Constellium by 47.7% during the second quarter. Westwood Holdings Group Inc. now owns 4,131,418 shares of the industrial products company's stock valued at $77,877,000 after acquiring an additional 1,334,550 shares in the last quarter. Rubric Capital Management LP raised its position in shares of Constellium by 0.9% during the second quarter. Rubric Capital Management LP now owns 3,662,895 shares of the industrial products company's stock worth $69,046,000 after purchasing an additional 32,548 shares during the period. Vaughan Nelson Investment Management L.P. lifted its holdings in shares of Constellium by 8.3% in the 2nd quarter. Vaughan Nelson Investment Management L.P. now owns 3,360,198 shares of the industrial products company's stock worth $63,339,000 after purchasing an additional 257,618 shares in the last quarter. Finally, Highland Peak Capital LLC grew its position in Constellium by 14.1% in the 2nd quarter. Highland Peak Capital LLC now owns 1,902,378 shares of the industrial products company's stock valued at $35,860,000 after purchasing an additional 234,756 shares during the period. Institutional investors own 92.59% of the company's stock.

Analysts Set New Price Targets

Several research analysts have weighed in on CSTM shares. StockNews.com downgraded shares of Constellium from a "buy" rating to a "hold" rating in a report on Thursday, October 24th. BMO Capital Markets dropped their price target on shares of Constellium from $22.00 to $18.00 and set an "outperform" rating on the stock in a research report on Thursday, October 24th. JPMorgan Chase & Co. cut their price target on Constellium from $25.00 to $24.00 and set an "overweight" rating for the company in a research note on Friday, October 11th. Finally, Deutsche Bank Aktiengesellschaft downgraded Constellium from a "buy" rating to a "hold" rating and lowered their price objective for the stock from $22.00 to $12.00 in a research note on Thursday, October 24th. Two research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average price target of $21.00.

View Our Latest Stock Report on Constellium

Constellium Stock Up 0.1 %

CSTM stock traded up $0.01 during trading on Friday, reaching $12.26. The stock had a trading volume of 245,133 shares, compared to its average volume of 1,109,221. The company has a quick ratio of 0.52, a current ratio of 1.28 and a debt-to-equity ratio of 1.93. The company has a market capitalization of $1.77 billion, a price-to-earnings ratio of 16.60 and a beta of 1.65. Constellium SE has a one year low of $10.49 and a one year high of $23.20. The company's 50 day moving average is $13.29 and its two-hundred day moving average is $16.59.

Constellium (NYSE:CSTM - Get Free Report) last released its earnings results on Wednesday, October 23rd. The industrial products company reported $0.02 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.40 by ($0.38). The business had revenue of $1.64 billion during the quarter, compared to the consensus estimate of $1.80 billion. Constellium had a net margin of 1.47% and a return on equity of 10.83%. The business's revenue was down 4.7% on a year-over-year basis. During the same period in the prior year, the company earned $0.47 earnings per share. Equities research analysts forecast that Constellium SE will post 0.71 EPS for the current year.

Constellium Company Profile

(

Free Report)

Constellium SE, together with its subsidiaries, engages in the design, manufacture, and sale of rolled and extruded aluminum products for the packaging, aerospace, automotive, defense, and other transportation and industry end-markets. The company operates through three segments: Packaging & Automotive Rolled Products, Aerospace & Transportation, and Automotive Structures & Industry.

See Also

Before you consider Constellium, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Constellium wasn't on the list.

While Constellium currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.