Healthcare of Ontario Pension Plan Trust Fund decreased its position in Hims & Hers Health, Inc. (NYSE:HIMS - Free Report) by 5.6% during the third quarter, according to the company in its most recent disclosure with the SEC. The firm owned 498,500 shares of the company's stock after selling 29,642 shares during the quarter. Healthcare of Ontario Pension Plan Trust Fund owned approximately 0.23% of Hims & Hers Health worth $9,182,000 at the end of the most recent quarter.

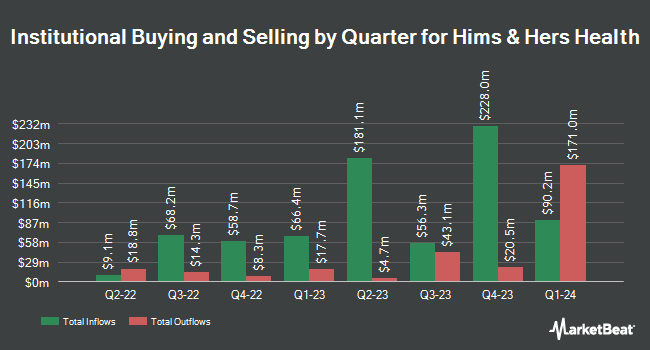

Several other institutional investors and hedge funds have also bought and sold shares of HIMS. Renaissance Technologies LLC increased its stake in shares of Hims & Hers Health by 113.1% in the 2nd quarter. Renaissance Technologies LLC now owns 6,039,408 shares of the company's stock worth $121,936,000 after purchasing an additional 3,205,108 shares in the last quarter. State of Michigan Retirement System raised its stake in shares of Hims & Hers Health by 177.8% in the second quarter. State of Michigan Retirement System now owns 500,000 shares of the company's stock worth $10,095,000 after buying an additional 320,000 shares during the period. Carnegie Investment Counsel bought a new position in shares of Hims & Hers Health in the third quarter worth about $5,531,000. Bank of New York Mellon Corp lifted its position in shares of Hims & Hers Health by 67.5% during the 2nd quarter. Bank of New York Mellon Corp now owns 678,602 shares of the company's stock valued at $13,701,000 after buying an additional 273,473 shares in the last quarter. Finally, Panagora Asset Management Inc. grew its stake in shares of Hims & Hers Health by 246.2% during the 2nd quarter. Panagora Asset Management Inc. now owns 378,192 shares of the company's stock valued at $7,636,000 after acquiring an additional 268,949 shares during the period. 63.52% of the stock is owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In related news, insider Soleil Boughton sold 2,339 shares of Hims & Hers Health stock in a transaction dated Tuesday, September 17th. The shares were sold at an average price of $16.50, for a total transaction of $38,593.50. Following the completion of the transaction, the insider now directly owns 176,952 shares of the company's stock, valued at approximately $2,919,708. The trade was a 1.30 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CEO Andrew Dudum sold 188,888 shares of the stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $14.56, for a total transaction of $2,750,209.28. Following the completion of the sale, the chief executive officer now directly owns 33,502 shares in the company, valued at $487,789.12. This trade represents a 84.94 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 1,153,519 shares of company stock valued at $24,486,721 over the last ninety days. 17.71% of the stock is owned by insiders.

Hims & Hers Health Price Performance

Shares of NYSE HIMS traded up $1.88 during midday trading on Friday, reaching $32.22. 10,258,617 shares of the stock traded hands, compared to its average volume of 9,809,085. The company's 50 day moving average is $22.01 and its 200 day moving average is $19.90. Hims & Hers Health, Inc. has a one year low of $8.09 and a one year high of $35.02. The stock has a market capitalization of $7.04 billion, a PE ratio of 73.23 and a beta of 1.06.

Hims & Hers Health (NYSE:HIMS - Get Free Report) last issued its quarterly earnings data on Monday, November 4th. The company reported $0.32 EPS for the quarter, topping analysts' consensus estimates of $0.06 by $0.26. Hims & Hers Health had a net margin of 8.19% and a return on equity of 10.97%. The business had revenue of $401.56 million during the quarter, compared to analysts' expectations of $382.20 million. During the same period last year, the company posted ($0.04) EPS. The business's revenue was up 77.1% on a year-over-year basis. As a group, equities analysts forecast that Hims & Hers Health, Inc. will post 0.29 EPS for the current year.

Analyst Ratings Changes

A number of equities research analysts have commented on the stock. Bank of America downgraded shares of Hims & Hers Health from a "buy" rating to an "underperform" rating and lowered their price target for the company from $32.00 to $18.00 in a report on Thursday, November 14th. TD Cowen restated a "buy" rating and set a $28.00 target price on shares of Hims & Hers Health in a research note on Wednesday, November 20th. Canaccord Genuity Group increased their price target on Hims & Hers Health from $24.00 to $28.00 and gave the stock a "buy" rating in a research note on Tuesday, November 5th. Piper Sandler reissued a "neutral" rating and set a $21.00 price target (up from $18.00) on shares of Hims & Hers Health in a report on Tuesday, November 5th. Finally, Needham & Company LLC started coverage on Hims & Hers Health in a research note on Thursday, August 22nd. They issued a "buy" rating and a $24.00 price objective for the company. One analyst has rated the stock with a sell rating, eight have assigned a hold rating and seven have given a buy rating to the stock. According to data from MarketBeat, Hims & Hers Health presently has an average rating of "Hold" and a consensus price target of $20.71.

Get Our Latest Research Report on HIMS

Hims & Hers Health Company Profile

(

Free Report)

Hims & Hers Health, Inc operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally. The company offers a range of curated prescription and non-prescription health and wellness products and services available to purchase on its websites and mobile application directly by customers.

Featured Stories

Before you consider Hims & Hers Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hims & Hers Health wasn't on the list.

While Hims & Hers Health currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.