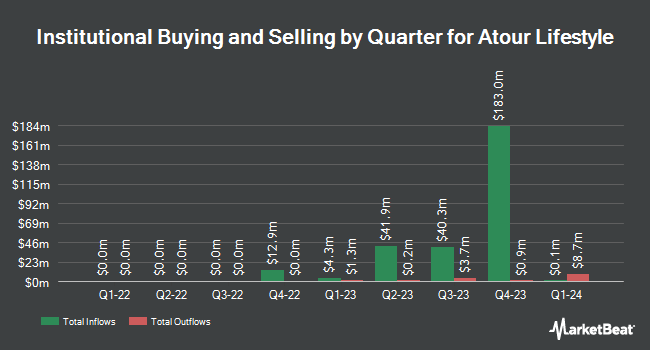

Healthcare of Ontario Pension Plan Trust Fund lifted its stake in Atour Lifestyle Holdings Limited (NASDAQ:ATAT - Free Report) by 174.4% during the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 1,116,600 shares of the company's stock after purchasing an additional 709,700 shares during the quarter. Healthcare of Ontario Pension Plan Trust Fund owned about 0.81% of Atour Lifestyle worth $28,965,000 as of its most recent filing with the Securities & Exchange Commission.

A number of other hedge funds have also recently made changes to their positions in the stock. Loomis Sayles & Co. L P purchased a new position in Atour Lifestyle in the 3rd quarter worth approximately $34,000. XTX Topco Ltd purchased a new position in Atour Lifestyle in the 2nd quarter worth approximately $390,000. Van Berkom & Associates Inc. purchased a new position in Atour Lifestyle in the 2nd quarter worth approximately $492,000. Los Angeles Capital Management LLC purchased a new position in Atour Lifestyle in the 3rd quarter worth approximately $666,000. Finally, Marshall Wace LLP raised its stake in Atour Lifestyle by 19.6% during the 2nd quarter. Marshall Wace LLP now owns 63,289 shares of the company's stock valued at $1,161,000 after buying an additional 10,386 shares during the last quarter. 17.79% of the stock is owned by institutional investors.

Atour Lifestyle Stock Down 0.7 %

ATAT traded down $0.17 during mid-day trading on Thursday, reaching $24.83. 2,527,745 shares of the company traded hands, compared to its average volume of 950,414. The stock has a market capitalization of $3.42 billion, a P/E ratio of 21.41, a P/E/G ratio of 0.62 and a beta of 0.64. The company's fifty day moving average price is $26.02 and its 200-day moving average price is $20.78. Atour Lifestyle Holdings Limited has a 52-week low of $15.06 and a 52-week high of $29.15.

Atour Lifestyle (NASDAQ:ATAT - Get Free Report) last announced its earnings results on Thursday, August 29th. The company reported $0.30 earnings per share for the quarter, missing analysts' consensus estimates of $0.32 by ($0.02). Atour Lifestyle had a net margin of 17.43% and a return on equity of 48.26%. The company had revenue of $247.28 million for the quarter, compared to analysts' expectations of $244.72 million. As a group, sell-side analysts forecast that Atour Lifestyle Holdings Limited will post 1.22 earnings per share for the current fiscal year.

Atour Lifestyle Company Profile

(

Free Report)

Atour Lifestyle Holdings Limited, through its subsidiaries, develops lifestyle brands around hotel offerings in the People's Republic of China. The company provides hotel management services, including day-to-day management services of the hotels for the franchisees; and sells hotel supplies and other products.

Read More

Before you consider Atour Lifestyle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atour Lifestyle wasn't on the list.

While Atour Lifestyle currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.