Healthcare of Ontario Pension Plan Trust Fund purchased a new stake in M/I Homes, Inc. (NYSE:MHO - Free Report) during the third quarter, according to the company in its most recent filing with the SEC. The firm purchased 8,100 shares of the construction company's stock, valued at approximately $1,388,000.

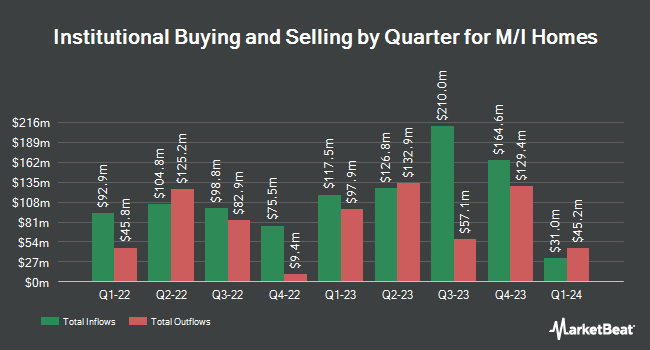

Several other institutional investors and hedge funds also recently added to or reduced their stakes in MHO. Assenagon Asset Management S.A. grew its holdings in shares of M/I Homes by 260.3% during the third quarter. Assenagon Asset Management S.A. now owns 199,877 shares of the construction company's stock valued at $34,251,000 after purchasing an additional 144,406 shares during the last quarter. Vision Capital Corp acquired a new position in shares of M/I Homes in the 3rd quarter worth $12,424,000. Renaissance Technologies LLC raised its holdings in shares of M/I Homes by 187.0% during the second quarter. Renaissance Technologies LLC now owns 79,200 shares of the construction company's stock valued at $9,673,000 after acquiring an additional 51,600 shares during the period. American Century Companies Inc. raised its stake in M/I Homes by 7.7% during the 2nd quarter. American Century Companies Inc. now owns 703,983 shares of the construction company's stock valued at $85,984,000 after purchasing an additional 50,330 shares during the period. Finally, Royce & Associates LP boosted its holdings in shares of M/I Homes by 30.0% during the third quarter. Royce & Associates LP now owns 192,907 shares of the construction company's stock worth $33,057,000 after purchasing an additional 44,559 shares during the period. 95.14% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity at M/I Homes

In other news, CFO Phillip G. Creek sold 20,000 shares of the firm's stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $160.00, for a total transaction of $3,200,000.00. Following the completion of the transaction, the chief financial officer now directly owns 18,545 shares of the company's stock, valued at $2,967,200. This trade represents a 51.89 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. 3.70% of the stock is owned by company insiders.

Analyst Upgrades and Downgrades

A number of analysts have weighed in on the company. Wedbush raised M/I Homes from a "neutral" rating to an "outperform" rating and boosted their price target for the stock from $155.00 to $185.00 in a research report on Monday, November 4th. StockNews.com lowered M/I Homes from a "strong-buy" rating to a "buy" rating in a report on Thursday, October 31st.

Get Our Latest Stock Analysis on M/I Homes

M/I Homes Price Performance

NYSE:MHO traded up $1.83 during mid-day trading on Monday, hitting $166.86. The company's stock had a trading volume of 258,072 shares, compared to its average volume of 274,299. The company has a current ratio of 6.81, a quick ratio of 1.60 and a debt-to-equity ratio of 0.33. The company has a market capitalization of $4.63 billion, a price-to-earnings ratio of 8.93 and a beta of 2.24. M/I Homes, Inc. has a fifty-two week low of $108.10 and a fifty-two week high of $176.18. The stock has a fifty day moving average of $162.43 and a 200-day moving average of $148.34.

M/I Homes Profile

(

Free Report)

M/I Homes, Inc, together with its subsidiaries, engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee. The company operates through Northern Homebuilding, Southern Homebuilding, and Financial Services segments.

Further Reading

Before you consider M/I Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and M/I Homes wasn't on the list.

While M/I Homes currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.