Healthcare of Ontario Pension Plan Trust Fund purchased a new position in Kinetik Holdings Inc. (NASDAQ:KNTK - Free Report) during the third quarter, according to the company in its most recent Form 13F filing with the SEC. The firm purchased 41,700 shares of the company's stock, valued at approximately $1,887,000.

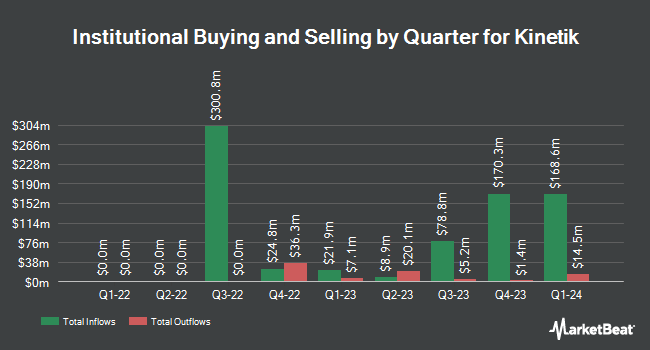

Several other institutional investors and hedge funds have also recently bought and sold shares of KNTK. Price T Rowe Associates Inc. MD acquired a new stake in Kinetik during the 1st quarter valued at $414,000. Janus Henderson Group PLC raised its position in Kinetik by 257.1% during the first quarter. Janus Henderson Group PLC now owns 26,642 shares of the company's stock valued at $1,062,000 after buying an additional 19,181 shares during the period. California State Teachers Retirement System lifted its stake in Kinetik by 38.0% in the 1st quarter. California State Teachers Retirement System now owns 35,742 shares of the company's stock worth $1,425,000 after acquiring an additional 9,846 shares in the last quarter. Harbor Capital Advisors Inc. boosted its position in Kinetik by 270.0% during the 2nd quarter. Harbor Capital Advisors Inc. now owns 3,841 shares of the company's stock worth $159,000 after acquiring an additional 2,803 shares during the period. Finally, Gilman Hill Asset Management LLC purchased a new position in Kinetik during the 2nd quarter valued at about $1,555,000. Institutional investors and hedge funds own 21.11% of the company's stock.

Analysts Set New Price Targets

Several research firms recently commented on KNTK. Barclays raised their price target on shares of Kinetik from $43.00 to $47.00 and gave the stock an "equal weight" rating in a report on Monday, October 14th. Royal Bank of Canada boosted their price target on shares of Kinetik from $46.00 to $52.00 and gave the company an "outperform" rating in a report on Wednesday, October 16th. Finally, Mizuho increased their price objective on Kinetik from $47.00 to $55.00 and gave the stock an "outperform" rating in a report on Thursday, October 24th. Three equities research analysts have rated the stock with a hold rating and four have given a buy rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $45.71.

View Our Latest Report on KNTK

Kinetik Price Performance

Shares of KNTK stock traded down $1.84 on Monday, hitting $57.18. The company's stock had a trading volume of 565,977 shares, compared to its average volume of 515,714. The stock has a market capitalization of $9.01 billion, a price-to-earnings ratio of 21.78, a P/E/G ratio of 2.74 and a beta of 2.91. Kinetik Holdings Inc. has a fifty-two week low of $31.73 and a fifty-two week high of $62.55. The firm's fifty day moving average price is $52.05 and its 200-day moving average price is $45.58.

Kinetik (NASDAQ:KNTK - Get Free Report) last released its quarterly earnings results on Wednesday, November 6th. The company reported $0.35 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.45 by ($0.10). Kinetik had a negative return on equity of 39.48% and a net margin of 30.25%. The company had revenue of $396.40 million for the quarter, compared to the consensus estimate of $331.21 million. During the same quarter last year, the company posted $0.21 EPS. The business's revenue was up 20.0% compared to the same quarter last year. Analysts predict that Kinetik Holdings Inc. will post 1.46 EPS for the current fiscal year.

Kinetik Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Thursday, November 7th. Stockholders of record on Monday, October 28th were given a $0.78 dividend. This is a positive change from Kinetik's previous quarterly dividend of $0.75. The ex-dividend date was Monday, October 28th. This represents a $3.12 dividend on an annualized basis and a dividend yield of 5.46%. Kinetik's dividend payout ratio (DPR) is currently 115.13%.

About Kinetik

(

Free Report)

Kinetik Holdings Inc operates as a midstream company in the Texas Delaware Basin. The company operates through two segments, Midstream Logistics and Pipeline Transportation. It provides gathering, transportation, compression, processing, stabilization, treating, storage, and transportation services for companies that produce natural gas, natural gas liquids, and crude oil; and water gathering and disposal services.

See Also

Before you consider Kinetik, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kinetik wasn't on the list.

While Kinetik currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.