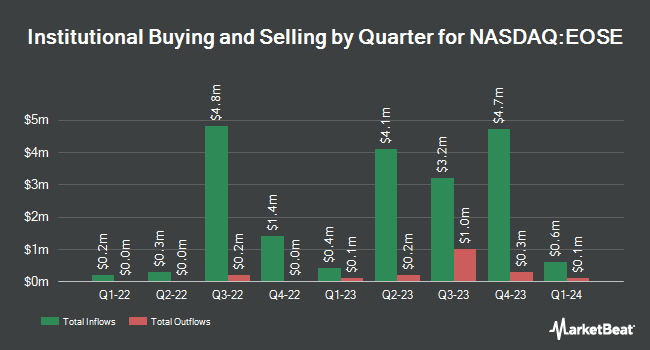

Healthcare of Ontario Pension Plan Trust Fund acquired a new stake in shares of Eos Energy Enterprises, Inc. (NASDAQ:EOSE - Free Report) during the 3rd quarter, according to its most recent 13F filing with the SEC. The firm acquired 249,409 shares of the company's stock, valued at approximately $741,000. Healthcare of Ontario Pension Plan Trust Fund owned 0.12% of Eos Energy Enterprises at the end of the most recent reporting period.

A number of other large investors also recently modified their holdings of EOSE. Vanguard Group Inc. boosted its position in shares of Eos Energy Enterprises by 6.6% during the first quarter. Vanguard Group Inc. now owns 9,375,916 shares of the company's stock worth $9,657,000 after acquiring an additional 580,022 shares during the last quarter. Millennium Management LLC boosted its holdings in shares of Eos Energy Enterprises by 5,744.5% during the 2nd quarter. Millennium Management LLC now owns 3,164,017 shares of the company's stock valued at $4,018,000 after purchasing an additional 3,109,880 shares during the last quarter. NewEdge Advisors LLC increased its holdings in shares of Eos Energy Enterprises by 30.2% in the second quarter. NewEdge Advisors LLC now owns 2,588,823 shares of the company's stock worth $3,288,000 after purchasing an additional 600,143 shares during the last quarter. &PARTNERS lifted its position in shares of Eos Energy Enterprises by 27.4% in the second quarter. &PARTNERS now owns 411,900 shares of the company's stock worth $523,000 after buying an additional 88,650 shares in the last quarter. Finally, B. Riley Wealth Advisors Inc. boosted its stake in Eos Energy Enterprises by 940.6% during the first quarter. B. Riley Wealth Advisors Inc. now owns 275,765 shares of the company's stock valued at $284,000 after buying an additional 249,265 shares during the last quarter. Hedge funds and other institutional investors own 54.87% of the company's stock.

Eos Energy Enterprises Price Performance

Shares of EOSE traded up $0.04 during midday trading on Tuesday, hitting $2.93. The stock had a trading volume of 15,909,120 shares, compared to its average volume of 6,803,304. Eos Energy Enterprises, Inc. has a 1 year low of $0.61 and a 1 year high of $3.66. The stock's 50 day moving average is $2.87 and its 200 day moving average is $2.08. The firm has a market cap of $638.48 million, a PE ratio of -1.32 and a beta of 2.32.

Insiders Place Their Bets

In other news, Director Jeffrey S. Bornstein sold 30,000 shares of the company's stock in a transaction dated Thursday, September 12th. The shares were sold at an average price of $2.62, for a total value of $78,600.00. Following the transaction, the director now directly owns 84,929 shares in the company, valued at approximately $222,513.98. This represents a 26.10 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. 3.80% of the stock is owned by insiders.

Analyst Ratings Changes

EOSE has been the subject of a number of recent research reports. Roth Mkm cut their target price on shares of Eos Energy Enterprises from $4.50 to $4.00 and set a "buy" rating for the company in a report on Thursday, November 7th. Stifel Nicolaus restated a "buy" rating and issued a $6.00 target price on shares of Eos Energy Enterprises in a report on Wednesday, August 21st. Two equities research analysts have rated the stock with a hold rating and five have given a buy rating to the company's stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $3.90.

View Our Latest Research Report on EOSE

About Eos Energy Enterprises

(

Free Report)

Eos Energy Enterprises, Inc designs, manufactures, and markets zinc-based energy storage solutions for utility-scale, microgrid, and commercial and industrial (C&I) applications in the United States. The company offers Znyth technology battery energy storage system (BESS), which provides the operating flexibility to manage increased grid complexity and price volatility.

Featured Stories

Before you consider Eos Energy Enterprises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eos Energy Enterprises wasn't on the list.

While Eos Energy Enterprises currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.