Healthcare of Ontario Pension Plan Trust Fund decreased its holdings in shares of Take-Two Interactive Software, Inc. (NASDAQ:TTWO - Free Report) by 27.2% in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The firm owned 11,447 shares of the company's stock after selling 4,287 shares during the period. Healthcare of Ontario Pension Plan Trust Fund's holdings in Take-Two Interactive Software were worth $1,760,000 at the end of the most recent quarter.

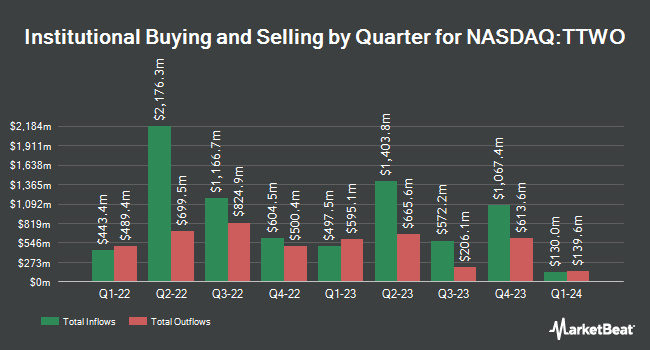

A number of other hedge funds and other institutional investors have also recently made changes to their positions in the stock. Swiss National Bank raised its holdings in Take-Two Interactive Software by 2.7% during the third quarter. Swiss National Bank now owns 493,508 shares of the company's stock worth $75,857,000 after purchasing an additional 13,200 shares in the last quarter. CIBC Asset Management Inc increased its position in Take-Two Interactive Software by 9.1% during the 3rd quarter. CIBC Asset Management Inc now owns 53,345 shares of the company's stock worth $8,200,000 after purchasing an additional 4,456 shares during the period. Sumitomo Mitsui Trust Group Inc. raised its stake in shares of Take-Two Interactive Software by 2.8% during the 3rd quarter. Sumitomo Mitsui Trust Group Inc. now owns 402,889 shares of the company's stock worth $61,928,000 after buying an additional 10,837 shares in the last quarter. WCM Investment Management LLC lifted its holdings in shares of Take-Two Interactive Software by 28.6% in the 3rd quarter. WCM Investment Management LLC now owns 12,895 shares of the company's stock valued at $1,974,000 after buying an additional 2,867 shares during the period. Finally, Harvest Fund Management Co. Ltd boosted its stake in shares of Take-Two Interactive Software by 55.8% in the third quarter. Harvest Fund Management Co. Ltd now owns 8,082 shares of the company's stock valued at $1,242,000 after buying an additional 2,896 shares in the last quarter. Hedge funds and other institutional investors own 95.46% of the company's stock.

Analyst Upgrades and Downgrades

TTWO has been the topic of a number of recent analyst reports. TD Cowen upped their price target on shares of Take-Two Interactive Software from $176.00 to $211.00 and gave the stock a "buy" rating in a research note on Friday, November 22nd. Wedbush reiterated an "outperform" rating and set a $190.00 price target on shares of Take-Two Interactive Software in a research report on Thursday, November 7th. UBS Group upped their price target on Take-Two Interactive Software from $156.00 to $175.00 and gave the stock a "neutral" rating in a report on Thursday, November 7th. Robert W. Baird lifted their price objective on Take-Two Interactive Software from $172.00 to $181.00 and gave the stock an "outperform" rating in a report on Thursday, November 7th. Finally, Bank of America reiterated a "buy" rating and issued a $185.00 price target on shares of Take-Two Interactive Software in a research report on Wednesday, August 21st. Two equities research analysts have rated the stock with a hold rating, eighteen have given a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $191.75.

Check Out Our Latest Analysis on Take-Two Interactive Software

Insider Buying and Selling

In other Take-Two Interactive Software news, Director Laverne Evans Srinivasan sold 2,000 shares of the company's stock in a transaction that occurred on Friday, November 8th. The stock was sold at an average price of $179.17, for a total value of $358,340.00. Following the completion of the sale, the director now directly owns 9,692 shares in the company, valued at $1,736,515.64. This represents a 17.11 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Company insiders own 1.45% of the company's stock.

Take-Two Interactive Software Stock Performance

TTWO traded down $0.43 during trading hours on Monday, hitting $187.95. 1,257,257 shares of the stock were exchanged, compared to its average volume of 1,601,417. The stock has a market cap of $33.01 billion, a price-to-earnings ratio of -8.88, a price-to-earnings-growth ratio of 5.68 and a beta of 0.85. The stock has a 50-day simple moving average of $165.66 and a 200-day simple moving average of $158.00. Take-Two Interactive Software, Inc. has a 12 month low of $135.24 and a 12 month high of $190.43. The company has a debt-to-equity ratio of 0.53, a current ratio of 0.85 and a quick ratio of 0.85.

Take-Two Interactive Software Profile

(

Free Report)

Take-Two Interactive Software, Inc develops, publishes, and markets interactive entertainment solutions for consumers worldwide. It develops and publishes action/adventure products under the Grand Theft Auto, LA Noire, Max Payne, Midnight Club, and Red Dead Redemption names, as well as other franchises.

See Also

Before you consider Take-Two Interactive Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Take-Two Interactive Software wasn't on the list.

While Take-Two Interactive Software currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.