Healthcare of Ontario Pension Plan Trust Fund bought a new position in Smartsheet Inc (NYSE:SMAR - Free Report) during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm bought 29,966 shares of the company's stock, valued at approximately $1,659,000.

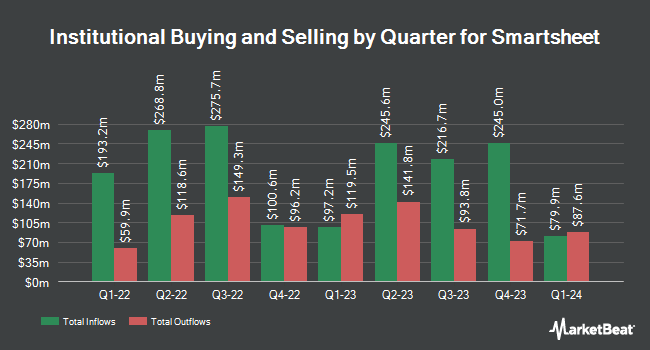

Several other institutional investors have also recently bought and sold shares of SMAR. AQR Capital Management LLC grew its position in shares of Smartsheet by 188.0% in the second quarter. AQR Capital Management LLC now owns 1,349,639 shares of the company's stock valued at $58,844,000 after purchasing an additional 881,004 shares during the last quarter. Citigroup Inc. boosted its stake in Smartsheet by 2,767.1% during the 3rd quarter. Citigroup Inc. now owns 823,501 shares of the company's stock valued at $45,589,000 after purchasing an additional 794,779 shares during the period. Engaged Capital LLC acquired a new stake in Smartsheet in the 2nd quarter valued at approximately $29,600,000. Marshall Wace LLP increased its position in Smartsheet by 40.9% in the 2nd quarter. Marshall Wace LLP now owns 1,835,994 shares of the company's stock worth $80,931,000 after buying an additional 533,278 shares during the period. Finally, Alpine Associates Management Inc. acquired a new position in shares of Smartsheet during the third quarter worth approximately $28,029,000. Institutional investors own 90.01% of the company's stock.

Analyst Ratings Changes

Several equities research analysts have recently issued reports on SMAR shares. Needham & Company LLC restated a "hold" rating and issued a $57.00 price objective on shares of Smartsheet in a research note on Tuesday, September 24th. Royal Bank of Canada restated a "sector perform" rating and set a $56.50 price objective on shares of Smartsheet in a report on Thursday, October 24th. Truist Financial reaffirmed a "hold" rating and set a $56.50 price objective (down previously from $60.00) on shares of Smartsheet in a research report on Wednesday, September 25th. UBS Group reissued a "neutral" rating and set a $56.50 target price (down from $61.00) on shares of Smartsheet in a research report on Thursday, September 26th. Finally, Canaccord Genuity Group reaffirmed a "hold" rating and issued a $56.50 price target (down previously from $60.00) on shares of Smartsheet in a report on Wednesday, September 25th. One research analyst has rated the stock with a sell rating, seventeen have issued a hold rating and two have assigned a buy rating to the company's stock. Based on data from MarketBeat, the company has a consensus rating of "Hold" and an average price target of $55.82.

Check Out Our Latest Stock Report on Smartsheet

Insider Transactions at Smartsheet

In other news, insider Jolene Lau Marshall sold 3,571 shares of the company's stock in a transaction on Friday, September 13th. The stock was sold at an average price of $50.59, for a total transaction of $180,656.89. Following the transaction, the insider now owns 13,529 shares of the company's stock, valued at $684,432.11. This represents a 20.88 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, COO Stephen Robert Branstetter sold 1,847 shares of Smartsheet stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $53.00, for a total value of $97,891.00. Following the completion of the sale, the chief operating officer now owns 64,215 shares of the company's stock, valued at approximately $3,403,395. The trade was a 2.80 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 42,194 shares of company stock worth $2,248,098. Corporate insiders own 4.52% of the company's stock.

Smartsheet Stock Up 0.2 %

SMAR traded up $0.13 during trading on Monday, hitting $56.08. The company's stock had a trading volume of 2,392,805 shares, compared to its average volume of 2,202,603. The stock has a market capitalization of $7.79 billion, a price-to-earnings ratio of -180.90 and a beta of 0.74. The firm's 50 day moving average price is $55.88 and its two-hundred day moving average price is $49.23. Smartsheet Inc has a 12 month low of $35.52 and a 12 month high of $56.55.

Smartsheet (NYSE:SMAR - Get Free Report) last released its quarterly earnings results on Thursday, September 5th. The company reported $0.44 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.29 by $0.15. Smartsheet had a negative return on equity of 4.29% and a negative net margin of 4.07%. The business had revenue of $276.41 million during the quarter, compared to analysts' expectations of $274.23 million. During the same period in the previous year, the business posted ($0.23) earnings per share. The firm's revenue for the quarter was up 17.3% compared to the same quarter last year. On average, sell-side analysts forecast that Smartsheet Inc will post -0.05 earnings per share for the current year.

Smartsheet announced that its board has approved a share repurchase program on Thursday, September 5th that allows the company to buyback $150.00 million in shares. This buyback authorization allows the company to reacquire up to 2.1% of its shares through open market purchases. Shares buyback programs are often a sign that the company's board believes its shares are undervalued.

Smartsheet Company Profile

(

Free Report)

Smartsheet, Inc engages in managing and automating collaborative work. Its platform provides solutions that eliminate the obstacles to capturing information, including a familiar and intuitive spreadsheet interface as well as easily customizable forms. The company was founded by W. Eric Browne, Maria Colacurcio, John D.

Further Reading

Before you consider Smartsheet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Smartsheet wasn't on the list.

While Smartsheet currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.