Healthcare of Ontario Pension Plan Trust Fund purchased a new stake in Warby Parker Inc. (NYSE:WRBY - Free Report) during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The fund purchased 178,700 shares of the company's stock, valued at approximately $2,918,000. Healthcare of Ontario Pension Plan Trust Fund owned about 0.18% of Warby Parker at the end of the most recent quarter.

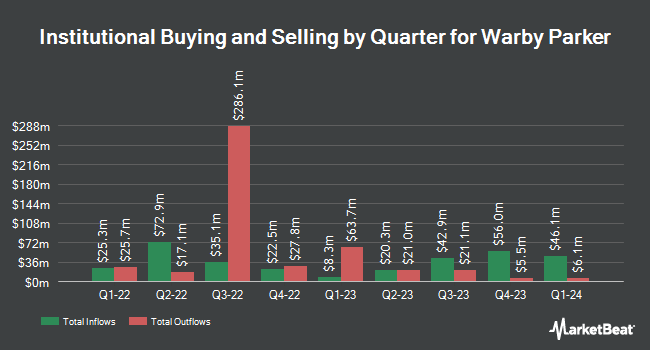

Several other institutional investors and hedge funds have also bought and sold shares of the stock. Vanguard Group Inc. grew its position in shares of Warby Parker by 2.6% in the 1st quarter. Vanguard Group Inc. now owns 8,677,106 shares of the company's stock valued at $118,095,000 after acquiring an additional 219,120 shares during the period. Advisors Asset Management Inc. grew its holdings in Warby Parker by 79.9% during the first quarter. Advisors Asset Management Inc. now owns 5,125 shares of the company's stock worth $70,000 after purchasing an additional 2,276 shares during the period. SG Americas Securities LLC increased its position in Warby Parker by 610.3% during the second quarter. SG Americas Securities LLC now owns 91,598 shares of the company's stock worth $1,471,000 after buying an additional 78,702 shares during the last quarter. LVW Advisors LLC bought a new stake in Warby Parker in the second quarter valued at approximately $201,000. Finally, Vaughan Nelson Investment Management L.P. lifted its position in shares of Warby Parker by 113.3% in the second quarter. Vaughan Nelson Investment Management L.P. now owns 2,477,410 shares of the company's stock valued at $39,787,000 after buying an additional 1,315,672 shares during the last quarter. Institutional investors own 93.24% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts recently weighed in on the company. BTIG Research increased their price target on Warby Parker from $18.00 to $20.00 and gave the company a "buy" rating in a research note on Friday, November 1st. The Goldman Sachs Group raised shares of Warby Parker from a "neutral" rating to a "buy" rating and increased their price objective for the company from $15.00 to $18.00 in a research report on Monday, October 21st. Deutsche Bank Aktiengesellschaft upgraded shares of Warby Parker from a "neutral" rating to a "buy" rating and raised their target price for the stock from $15.00 to $18.00 in a research note on Monday, October 21st. William Blair raised shares of Warby Parker from a "market perform" rating to an "outperform" rating in a report on Thursday, November 7th. Finally, Robert W. Baird raised their price objective on shares of Warby Parker from $18.00 to $23.00 and gave the stock an "outperform" rating in a research report on Friday, November 8th. Four analysts have rated the stock with a hold rating and eight have assigned a buy rating to the stock. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $18.82.

View Our Latest Analysis on Warby Parker

Warby Parker Price Performance

NYSE:WRBY traded down $0.36 during trading hours on Friday, reaching $22.54. 914,794 shares of the company were exchanged, compared to its average volume of 1,816,621. The business has a 50 day moving average of $18.40 and a 200 day moving average of $16.54. Warby Parker Inc. has a 1-year low of $10.28 and a 1-year high of $24.60. The company has a market capitalization of $2.29 billion, a P/E ratio of -83.48 and a beta of 1.80.

Insider Activity

In other Warby Parker news, CFO Steven Clive Miller sold 6,763 shares of the business's stock in a transaction that occurred on Wednesday, September 11th. The shares were sold at an average price of $13.90, for a total transaction of $94,005.70. Following the completion of the transaction, the chief financial officer now directly owns 177,488 shares in the company, valued at $2,467,083.20. The trade was a 3.67 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, CEO Neil Harris Blumenthal sold 50,000 shares of the firm's stock in a transaction on Monday, September 9th. The shares were sold at an average price of $13.89, for a total value of $694,500.00. Following the completion of the sale, the chief executive officer now directly owns 12,177 shares in the company, valued at approximately $169,138.53. This represents a 80.42 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders sold 99,178 shares of company stock worth $1,339,901. 26.55% of the stock is currently owned by company insiders.

Warby Parker Company Profile

(

Free Report)

Warby Parker Inc provides eyewear products in the United States and Canada. The company offers eyeglasses, sunglasses, light-responsive lenses, blue-light-filtering lenses, non-prescription lenses, and contact lenses. It also provides accessories, such as cases, lenses kit with anti-fog spray, pouches, and anti-fog lens spray through its retail stores, website, and mobile apps.

Featured Articles

Before you consider Warby Parker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Warby Parker wasn't on the list.

While Warby Parker currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.